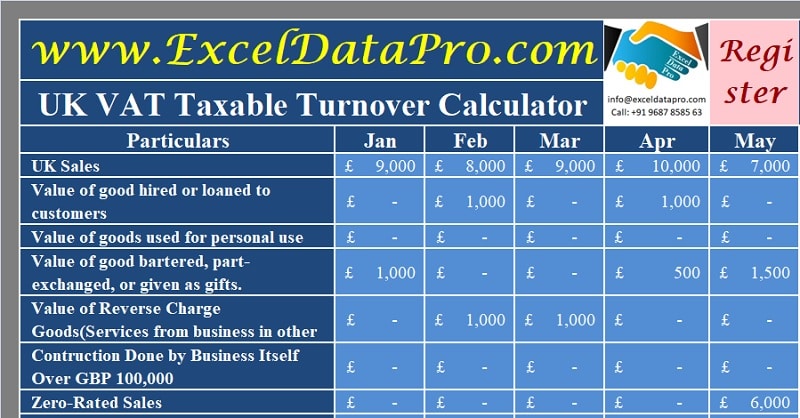

UK VAT Taxable Turnover Calculator is a ready-to-use excel template to calculate the value of goods sold during the past 12 months for registration purposes.

Insert month-wise sales and the template will automatically calculate the amount for you. If the amount is above the threshold limit £ 85,000, it will display “Register” on the top otherwise it will display “Not Eligible”.

Taxable turnover is the total value of goods or services a business sells during a particular period that is not exempt from VAT.

Every business must register with HM Revenue and Customs if the total sales during the past 12 months exceed £ 85,000.

The period can be any specific 12 month period like calendar year, tax year, or any 12 months. You should check your rolling turnover regularly if you’re close to going over the threshold.

Table of Contents

What to include while calculating UK VAT Taxable Turnover?

As per the guideline given by UK VAT Registration Guide, to check whether or not your sales have exceeded the threshold in any 12 months, you need to add the total value of your sales made in the UK apart from VAT exempt sales.

It includes goods you hired or loaned to customers, business goods used for personal reasons, goods you bartered, part-exchanged or gave as gifts, etc.

It also includes services your business has received from businesses in other countries that are subject to Reverse Charge and construction of building above £ 100,000 done for own business by itself.

Sales made under zero-rated items are also included in the taxable turnover. Only VAT-exempt sales and goods or services you supply outside the UK will be excluded.

Source: www.gov.uk

UK VAT Taxable Turnover Calculator Excel Template

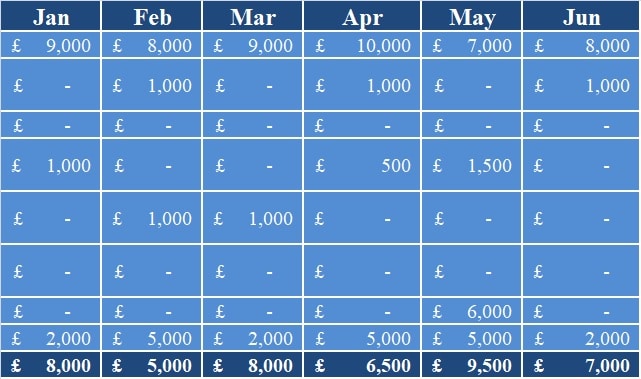

To simplify the process, we have created a simple and easy UK VAT Taxable Turnover Calculator to calculate taxable turnover for registration purposes in just a few minutes. Enter respective sales for each month and the template will automatically calculate the total turnover during the past 12 months.

Click here to download UK VAT Taxable Turnover Calculator Excel Template.

In addition to that, you can also download other UK VAT Templates like UK VAT Sales Register UK VAT Debit Note, UK VAT Credit Note, UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UK VAT Invoice Template With Discount, and many more from our website.

Let us discuss the contents of the template in detail.

Contents of UK VAT Taxable Turnover Calculator Excel Template

This template consists of 3 sections: Header Section, Type of Sales, and Monthly Sales.

Header Section

The header section consists of the heading of the template, company name, and company logo. Furthermore, it consists of the registration indicator beside the heading.

If the total taxable turnover is above the threshold limit, it will display “Register” in red and if the taxable turnover is below the threshold then it displays “Not Eligible” in Yellow.

Type of Sales

This section consists of column headings for each type of sale to be included in the taxable turnover. It consists of the following:

UK Sales

The Value of good hired or loaned to customers

Value of goods used for personal use

The Value of good bartered, part-exchanged, or given as gifts.

Value of Reverse Charge Goods(Services from business in another country)

Construction Done by Business Itself Over GBP 100,000

Zero-Rated Sales

After adding the above, deduct VAT Exempt Sales for each month respectively to derive the actual taxable turnover figure. Please make sure you include sales made inside the UK in all categories.

Monthly Sales

Insert month-wise sales applicable under each type and the template will automatically do the rest for you.

In the end, line totals and column totals for each month and each type of sales are given in the template. As soon as your sales will reach £ 85,000, it will indicate to register. Till then the indicator will display that you are not eligible for registration.

This template can be helpful to small ad medium-sized businesses looking forward to registering for UK VAT.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

hi can the vat threshold be changed ?

hi the uk threshold has changed to £90,000 can you update this please ?