UK VAT Payable Calculator Excel Template is a ready-to-use excel template that helps you easily calculate your tax liability payable to HRCM.

Additionally, you can calculate input vat as well as output vat separately. This template can be helpful to small and medium-sized businesses.

Table of Contents

What is VAT Payable?

VAT payable is the VAT liability to be paid by the businesses registered under VAT in the UK. When we make sales we collect VAT on it. We issue Credit Notes and Debit Notes against invoices that we need to adjust while calculating VAT payable.

Furthermore, we are entitled to recoverable VAT input tax on purchases that we make for providing a taxable supply. This VAT input reduces our tax liability and hence is deducted from the total output tax.

Furthermore, as per VAT Notice 735 of the UK VAT Law, you have to pay VAT under reverse charge under some conditions.

Formula To Calculate UK VAT Payable

VAT Output Tax – VAT Input Tax = VAT Payable

Where:

Input VAT = VAT on Purchases + VAT allowable (acquisitions) – Input Tax Adjustment + Bad debt relief – VAT Debit Notes

And

Output VAT = VAT on Sales + VAT due (acquisitions) – Output Tax Adjustments + Annual adjustment (retail/apportionment scheme) – VAT Credit Notes

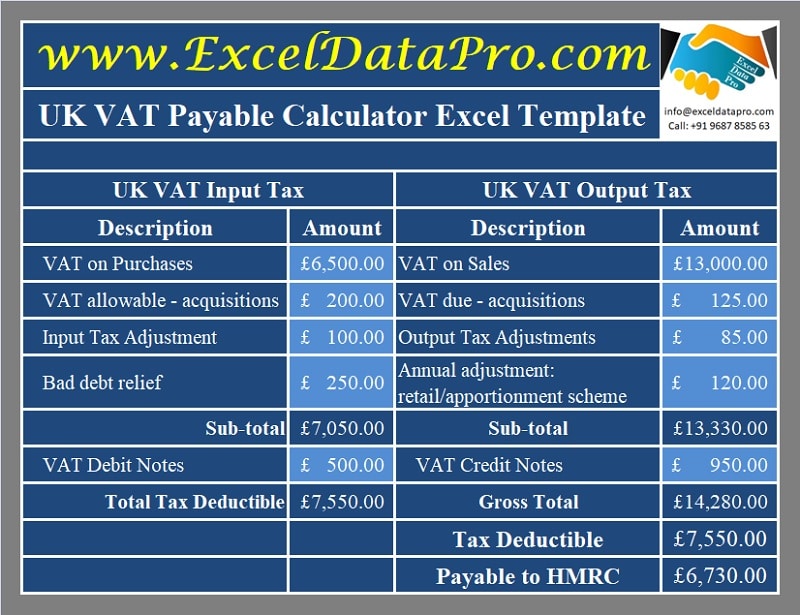

UK VAT Payable Calculator Excel Template

We have created a simple and easy UK VAT Payable Calculator Excel Template with predefined formulas. Just enter a few details and it will automatically calculate your VAT liability.

Click here to download UK VAT Payable Calculator Excel Template.

In addition to that, you can also download other UK VAT Templates like UK VAT Debit Note, UK VAT Credit Note, UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UK VAT Invoice Template With Discount, and many more from our website.

Contents of UK VAT Payable Calculator

This template consists of the following sections: Heading, Input VAT, and OutPut VAT.

Heading Section

The heading section consists of the company name, log and sheet heading. Insert your logo and name of your company to customize it as per your needs.

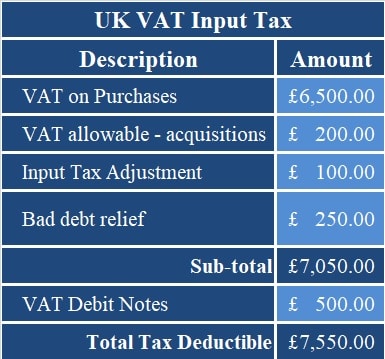

Input VAT Section

Input VAT section consists of the following:

VAT on Purchases

VAT allowable – acquisitions

Input Tax Adjustment

Bad debt relief

VAT Debit Notes

Insert the above detail and the template automatically calculates the Subtotal amount.

Subtotal = VAT on Purchases + VAT allowable (acquisitions) – Input Tax Adjustment + Bad debt relief

Total Tax Deductible = Subtotal – Vat Debit Notes

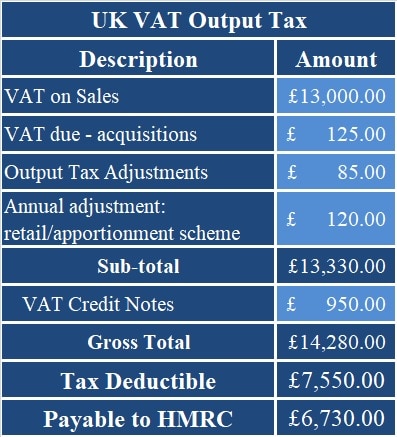

Output VAT Section

Output VAT consists of the following:

VAT on Sales

VAT due (acquisitions)

Output Tax Adjustments

Annual adjustment (retail/apportionment scheme)

VAT Credit Notes

In this section:

Subtotal = VAT on Sales + VAT due (acquisitions) – Output Tax Adjustments + Annual adjustment (retail/apportionment scheme)

AND

Gross Total = Subtotal – VAT Credit Notes

AND

VAT Payable To HMRC = Total Output Tax – Total Input Tax

This template can be useful to small and medium-sized businesses like wholesalers, semi-wholesale and trading, etc.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.