UK VAT Invoice is a ready-to-use excel template that helps you to issue a VAT compliance invoice to your clients for taxable goods and services with auto calculations.

VAT was introduced earlier as consumption tax and later on termed as Value Added Tax. Currently, there are 3 different VAT rates in the UK – 20%, 5%, and 0%.

To know more about the UK VAT you can visit the official website of the Ministry of Finance – UK www.gov.uk.

Table of Contents

Guidelines For UK VAT Invoice

|

Invoice information |

Full invoice |

| Unique invoice number that follows on from the last invoice |

Yes |

| Your business name and address |

Yes |

| Your VAT number |

Yes |

| Date |

Yes |

| The tax point (or ‘time of supply’) if this is different from the invoice date |

Yes |

| Customer’s name or trading name, and address |

Yes |

| Description of the goods or services |

Yes |

| Total amount excluding VAT |

Yes |

| The total amount of VAT |

Yes |

| Price per item, excluding VAT |

Yes |

| Quantity of each type of item |

Yes |

| Rate of any discount per item |

Yes |

| Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items |

Yes |

| The total amount including VAT |

No |

Source: www.gov.uk

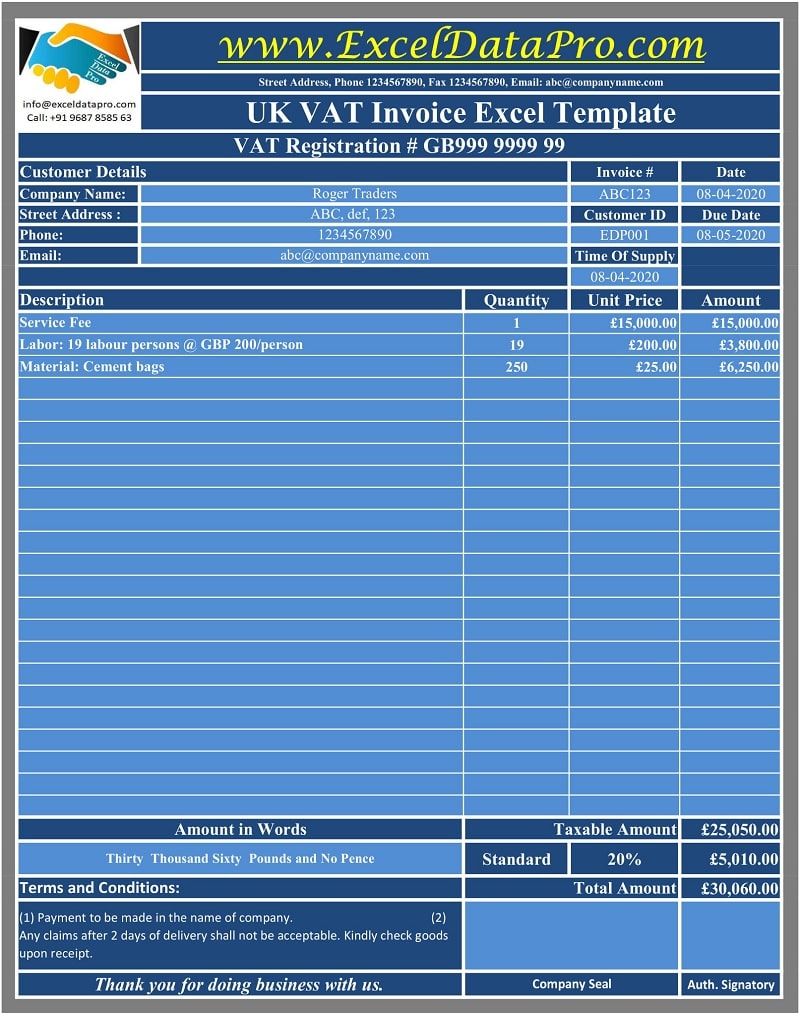

UK VAT Invoice Excel Template

We have created a UK VAT Invoice excel template with predefined formulas and formatting as per the above guidelines. You can easily issue the invoice to your customers with the help of this template.

Click here to Download UK VAT Invoice Excel Template As Per UK Government Guidelines.

You can also download other VAT templates like UAE VAT Multiple Tax Invoice, UAE VAT Dual Currency Invoice, and UAE VAT Payable Calculator.

Content of UK VAT Invoice Excel Template

This template consists of 2 worksheets; UK VAT Invoice Template and Customer Database sheet.

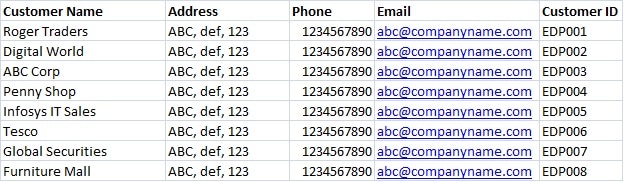

Customer Database Sheet

The database sheet contains a list of your customers. These customers are those whom we issue the invoices for the goods supplied or services rendered regularly.

UK VAT Invoice Template

The UK VAT Invoice contains the Performa of the invoice as per the guidelines. It consists of 4 sections.

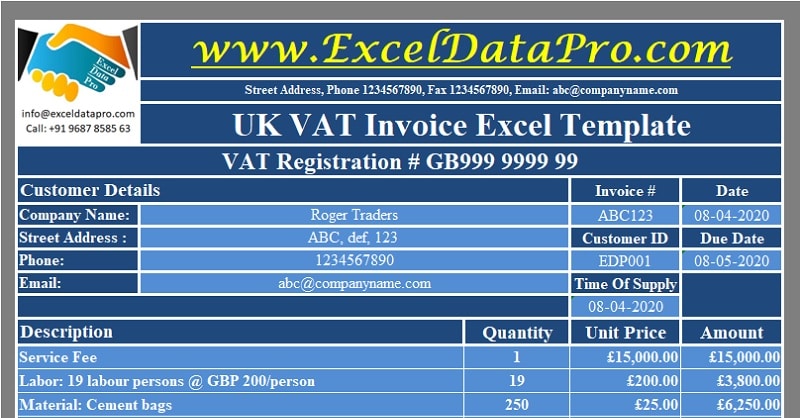

Header Section

The header section consists of your company’s logo, name, VAT Registration Number and the heading of the invoice.

Customer Details

The customer details section consists of the client’s details as below:

Company Name

Street Address

Phone

Email

Invoice

Date

Customer ID

Due Date

Time Of Supply

This section is connected with data validation and the VLOOKUP function to the database sheet. Thus, when you select the name of the customer it automatically updates the Address, phone, email, and customer id. Before making any invoice update the customer database sheet.

In addition to that, on the right-hand side, you need to enter the invoice number, invoice date, due date of payment and time of supply or tax point.

In case of a credit invoice, the due date is set to 30 days from the date of the invoice. If your invoice is cash then leave it blank.

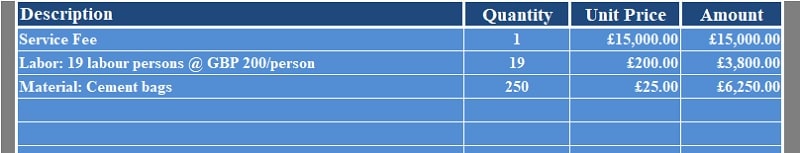

Product Details

The product details section consists of the following columns:

Description: Insert description of goods or services to your client.

Quantity: Quantity of the product.

Unit Price: Price per product.

Amount: This column shows the total amount of supply per item using Quantity multiplied by Unit Price. The final total of this column us the taxable amount.

Other Details

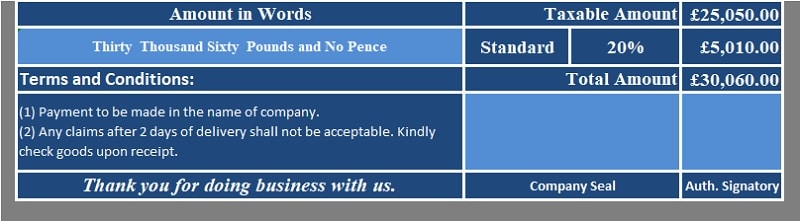

Other details section consists of the following:

Amount in words: No need to insert anything here. It will automatically convert the amount in words using Spell Number GBP.

Terms & Conditions: Insert your invoice terms and conditions.

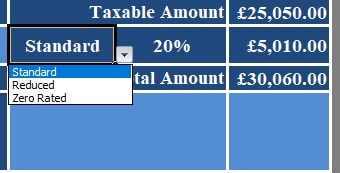

VAT computation: Select the type of VAT from the dropdown list. If you select Standard, the cell next to it will display 20% and if you select Reduced then it will display 5%. When Zero-rated is selected the cell will display 0%. The VAT amount is calculated on the basis of percentage.

Taxable Amount X VAT % = VAT Amount

VAT Amount + Taxable Amount = Final Invoice Amount

Company seal: A blank space is given for the company seal. After printing the invoice you can stamp here.

Signature: A blank space is given for the authorized signatory. After printing the invoice the authorized personnel can sign the invoice here.

Thank You Note: Insert a thank you note of your choice here.

That’s it and your UK VAT Invoice is ready to print. This template can be helpful to small and medium scale business people to issue VAT compliance invoices to their clients.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply