UK VAT Dual Currency Invoice is a ready-to-use excel template that helps you to issue a VAT compliant invoice in two different currencies.

A dual currency invoice is prepared when the goods or services supplied are from a foreign location or in foreign currency. It is mandatory by law to mention the tax amount in sterling with the applied exchange rate.

Table of Contents

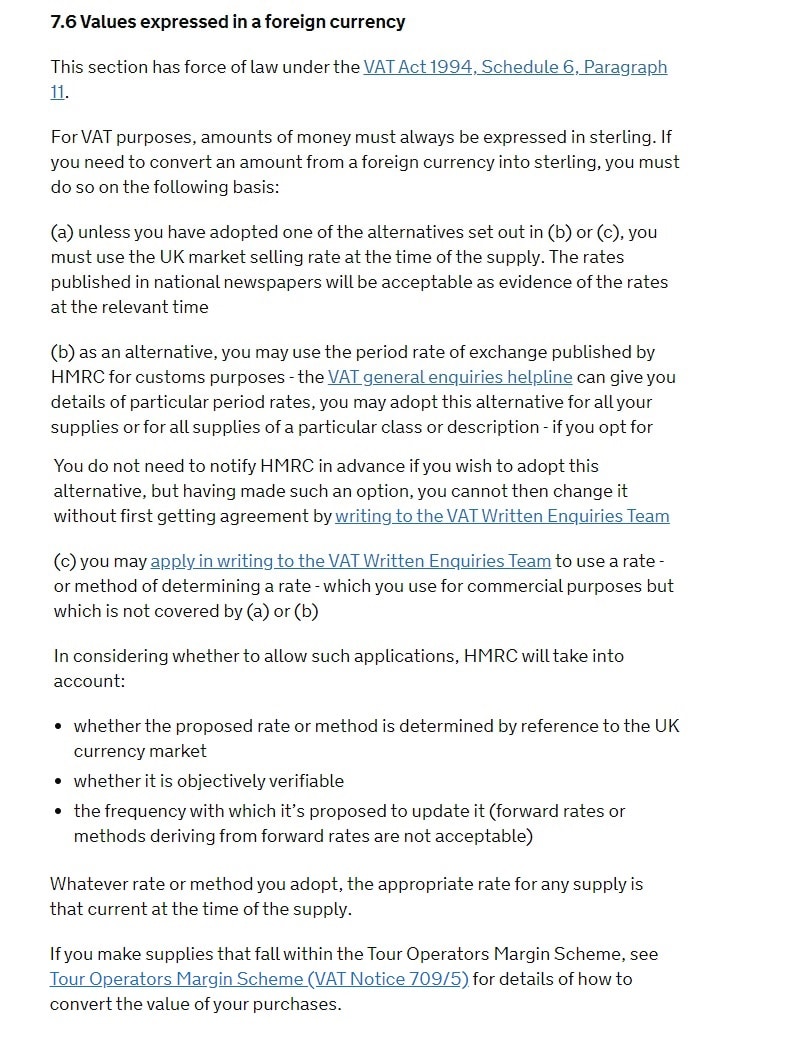

Guidelines for Dual Currency Invoice

According to Point 7.6 of VAT Guide Notice 700, “For VAT purposes, amounts of money must always be expressed in sterling.” See image below:

Source: www.gov.uk

UK VAT Dual Currency Invoice Excel Template

We have created the UK VAT Dual Currency Invoice excel template with predefined formulas that will help you to issue the invoice with 2 currencies. One is Sterling Pound and another currency whichever is applicable.

Click here to download UK VAT Dual Currency Invoice Excel Template.

In addition to that, you can also download other UK VAT Templates like UK VAT Sales Register UK VAT Debit Note, UK VAT Credit Note, UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UK VAT Invoice Template With Discount, and many more from our website.

Let us discuss the contents of the template in detail.

Contents of UK VAT Dual Currency Invoice Template

This Invoice template consists of 2 worksheets: UK VAT Dual Currency Invoice Template and Customer Database Sheet.

Customer Database Sheet

The customer sheet contains customer details of customers like company name, address, contact details, and VAT numbers, etc. The user needs to enter the name only once on the sheet.

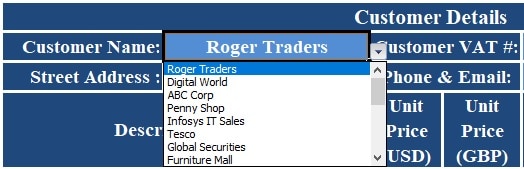

The customer sheet has been linked to the customer details section of the invoice template using data validation and VLOOKUP. Customer information can be fetched on the invoice with the help fo the dropdown list.

UK VAT Dual Currency Invoice Template

The template consists of 4 sections: Supplier Details, Customer Details, Product Details, and Other Details

Supplier Details (Your Company Details)

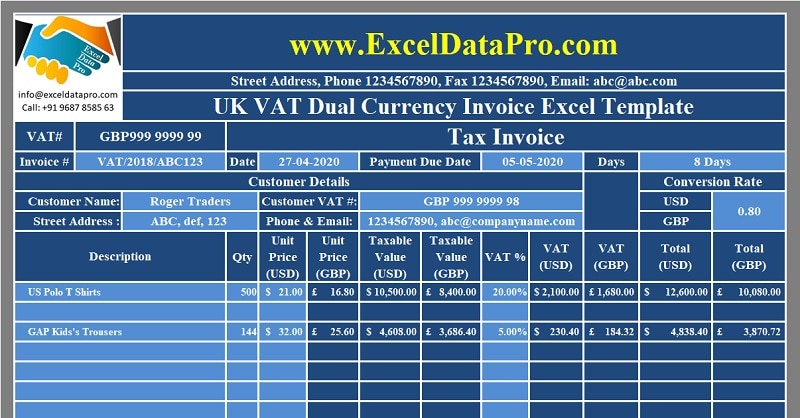

This section consists of your company name, address, logo, VAT registration number, and Invoice heading.

Customer Details

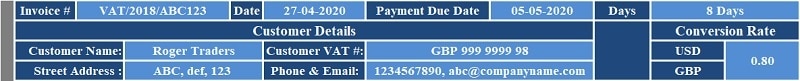

The customer detail section consists of the Invoice number, date of issue, payment due date, and the number of days between the issue date and the payment date.

You don’t need to type customer details in this section. It is pre-programmed using data validation and Vlookup function. Just select the customer name from the dropdown list and it will automatically fetch all customer details such as an address, VAT number, and contact details.

As the invoice is in two different currencies, insert the currency conversion rate in this cell. In this template, we have taken USD as other currency and thus given the conversion rate for the same. If you use any other currency, mention the currency’s alphabetical code and respective conversion rate.

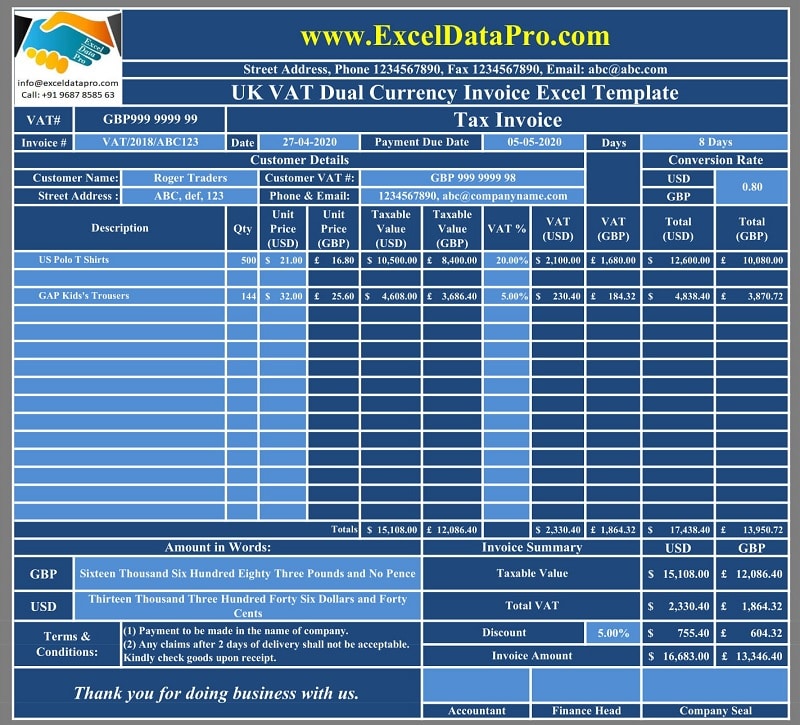

Product Details

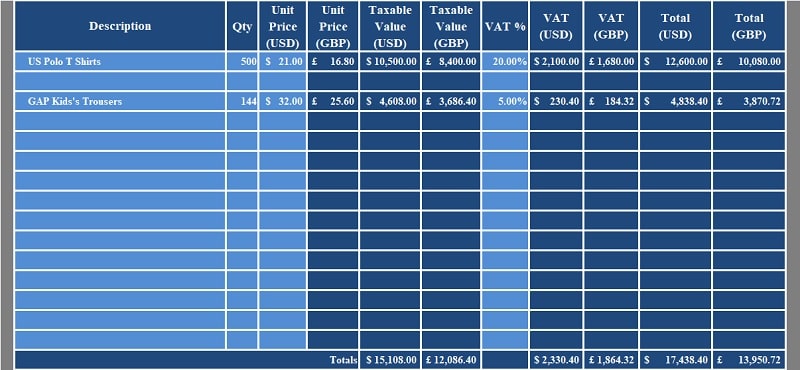

This section consists of the following columns:

Description of Products

Quantity

Unit Price (USD)

Unit Price (GBP)

Taxable Value (USD)

Taxable Value (GBP)

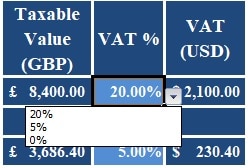

Percentage of VAT

VAT Amount (USD)

VAT Amount (GBP)

Line Total (USD)

Line Total (GBP)

Column Totals

Each of the above columns calculates the GBP amount based on the conversion rate. Select the VAT percentage from the dropdown list.

Other Details

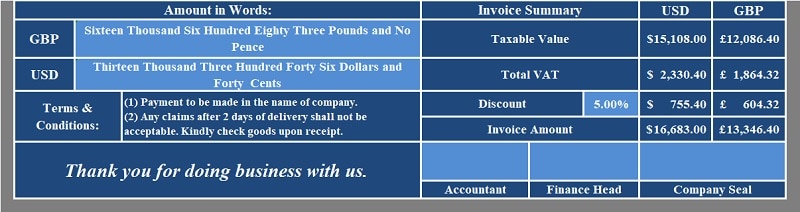

Invoice Summary contains the totals of each column of the product details section in both USD and GBP. Additionally, it consists of a discount section. Insert the percentage if it is applicable. The template will automatically calculate the discount amount.

Lastly, it consists of the Invoice Amount. The amount is calculated using the below formula:

Invoice Amount (GBP) = Taxable Value (GBP) + Total VAT Amount (GBP) – Discounts (GBP)

Invoice Amount (USD) = Taxable Value (USD) + Total VAT Amount (USD) – Discounts (USD)

Furthermore, it consists of “Amount in words” for both the currencies(GBP and USD). This cell auto-populates using SpellNumber Function.

In addition to that, it consists of Terms & Conditions along with the space for company seal and authorized signatories. On the extreme left, it consists of the business greeting.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.