UK VAT Credit Note is a ready-to-use excel template that helps to issue a VAT compliant credit note when the goods are returned or an invoice is overbilled.

A Credit note is a document that a supplier issues to his/her customer for a reduction in invoice or discount in the price on the original VAT invoice. Goods return or reduction in billing amount reduces your tax liability as the goods or services supplied have been reduced by that amount.

Hence, VAT on Sales – VAT Credit Notes = VAT Payable.

Table of Contents

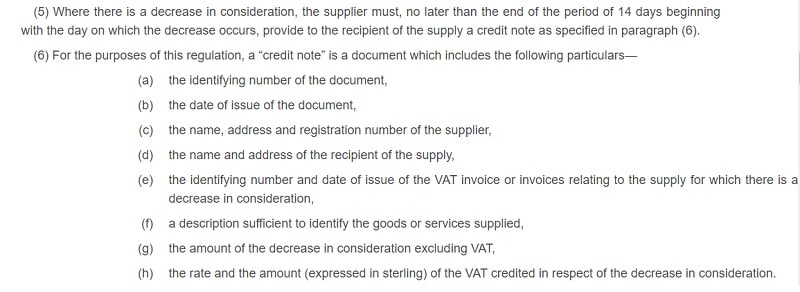

Guidelines For UK VAT Credit Note

According to the Amendment of the Value Added Tax Regulations 1995, Point 15C, describes the guidelines for a credit note:

Source: www.legislation.gov.uk

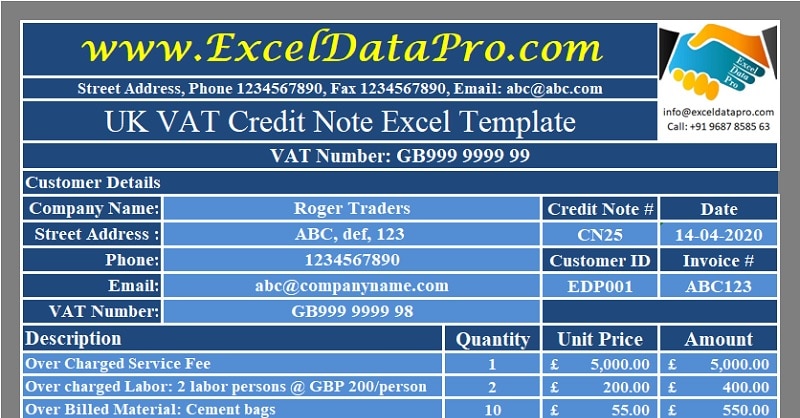

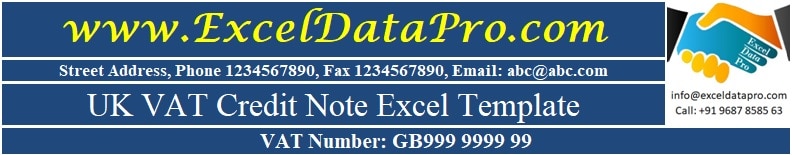

UK VAT Credit Note Excel Template

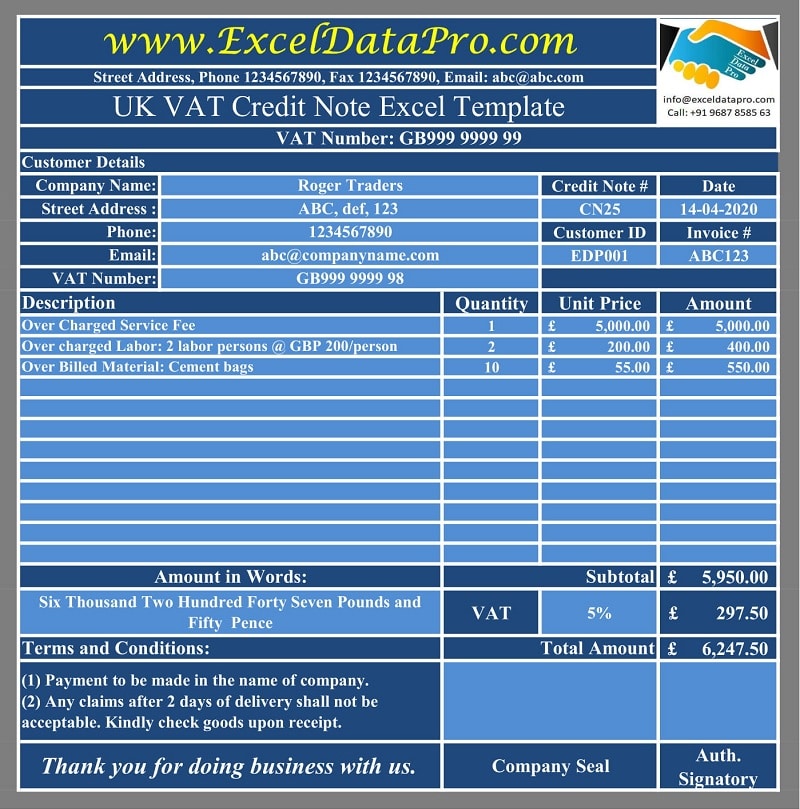

Following the above-mentioned guidelines, we have created a simple and easy UK VAT Credit Note Excel Template with predefined formulas and formating. Issue a VAT compliant credit note to your customer in just a few minutes.

Click here to download the UK VAT Credit Note Excel Template.

Additionally, you can download other UK VAT Templates like UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UK VAT Invoice Template With Discount, and many more from our website.

Let us understand the contents of the template in detail and how to use this template.

Contents of UK VAT Credit Note Excel Template

This template consists of 2 sheets: UK VAT Credit Note Template and Customer Database Sheet.

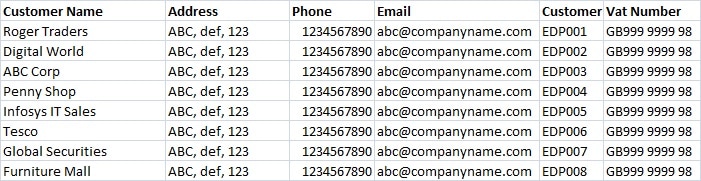

Customer Database Sheet

The customer database sheet consists of customer details like customer id, customer name, customer address, customer phone, Customer VAT number, and customer email address.

The purpose of creating this sheet to help you save time and simplify your work. You need to update the database sheet once with customer details as per your requirement.

Furthermore, a drop-down list has been created using the data validation function. When you select the customer name, the customer section fetches all the relevant details using the VLOOKUP function.

UK VAT Credit Note Template

Credit Note Template consists of the following 4 sections: Supplier Details, Customer Details, Credit Note Details, and Other Detail.

Supplier Detail

Supplier Details Section consists of company name, logo, address and VAT number.

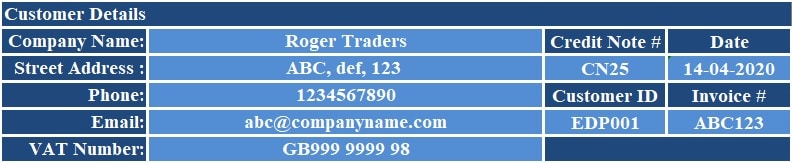

Customer Detail

Customer detail section consists of the following details:

Company Name

Street Address

Phone

Email

VAT Number

Credit Note Number

Date

Customer ID

Invoice Number

As discussed earlier, this section is interlinked with data validation and the VLOOKUP function to the database sheet. Just select the name of the customer and this section is filled.

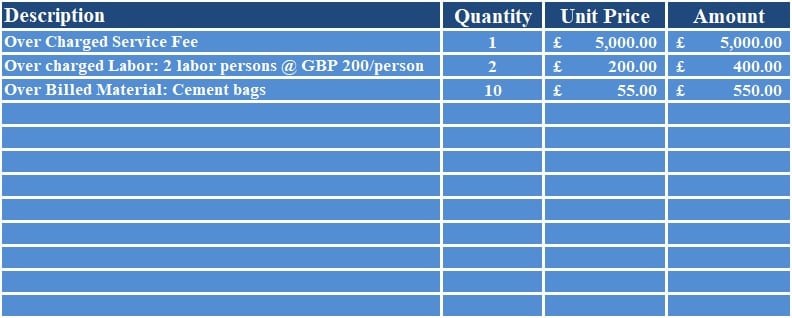

Credit Note Detail

Insert the details of goods return or overbilling. This section consists of columns like Description, Quantity, Unit Price and Amount. In the end, there is the subtotal line.

Quantity X Unit Price = Amount.

Other Details

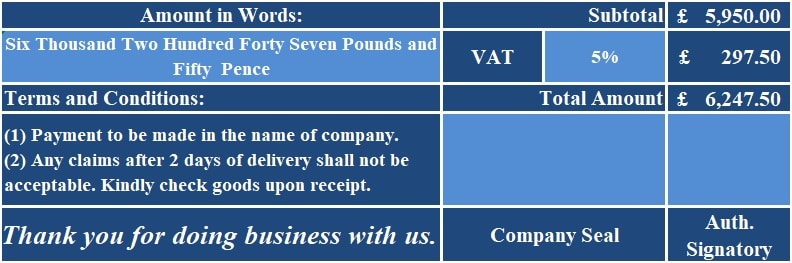

Other details section consists of the following:

Amount in words: No need to insert anything here. It will automatically convert the amount in words using Spell Number GBP.

Terms & Conditions: Insert your credit note terms and conditions.

VAT computation: Insert the VAT percentage manually. The VAT amount is calculated based on the percentage.

Taxable Amount X VAT % = VAT Amount

VAT Amount + Taxable Amount = Final Invoice Amount

Company seal: After printing the invoice you can stamp the invoice with a company seal at the given place.

Signature: Sign the invoice after printing the invoice by the authorized personnel.

Thank You Note: Insert a thank you note of your choice here.

That’s it and your VAT Compliant Credit Note is ready to print. It can be helpful to small and medium scale businesses to issue a credit note.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply