UAE VAT Sales Register is a document that maintains the records of your sales during a specific period along with details of Output VAT collected on those sales.

Earlier, we maintained records of sales, but those records were without VAT calculations.

UAE is all set to implement VAT from Jan 2018 and businesses have been instructed to get VAT ready.

The VAT collected by you n sales of goods or services is called Output Tax.

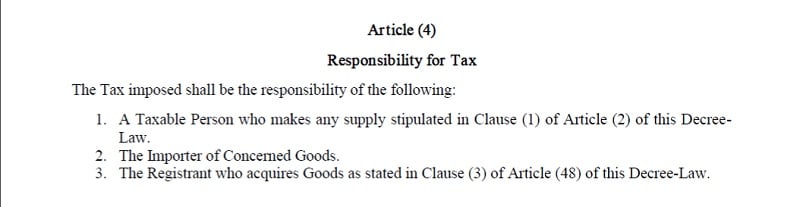

According to Article 4 of Federal Decree-Law No. (8) of 2017 on Value Added Tax, It is the responsibility of the taxable person to collect VAT whenever a taxable supply takes place.

See imager below:

You can download the pdf copy of Federal Decree-Law No. (8) of 2017 on Value Added Tax from the link below:

Federal Decree-Law No. (8) of 2017 on Value Added Tax

The VAT paid on purchases of raw material intended to be used in the making of the taxable supply is called UAE VAT Recoverable Input Tax.

When you purchase goods you can maintain your purchase records in our UAE VAT Purchase Register.

Whenever you make any sales, you are entitled to collect the VAT on the goods or services you supply.

At the end of the tax period, you pay the difference between the output VAT collected and recoverable Input VAT paid.

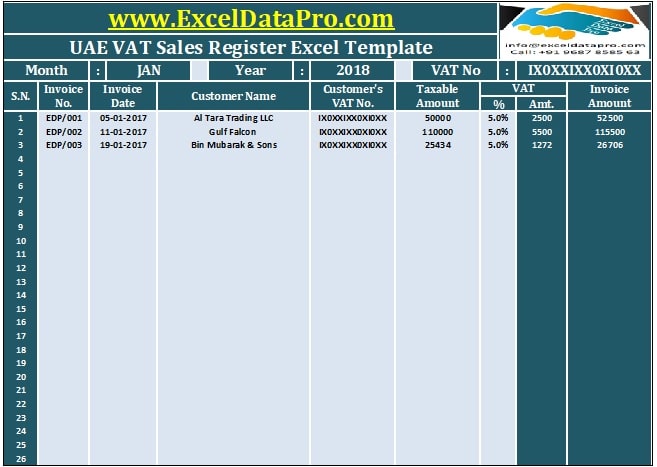

We have created the UAE VAT Sales Register Excel Template to maintain your sales records and help you to easily calculate your output tax.

This template is helpful to all traders, wholesalers, retailers, industrial units, etc.

Click here to Download UAE VAT Sales Register Excel Template.

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note, and UAE VAT Credit Note, etc.

Let us discuss the creation of this template in detail.

Contents of UAE VAT Sales Register

The UAE VAT Sales Register template consists of 2 sections:

- Header Section

- Sales Details Section

Header Section

Usually, the header section consists of your company name, template heading.

Apart from that, it consists of Month, Year, and your VAT registration number.

Sales Details Section

This section consists of multiple subheadings:

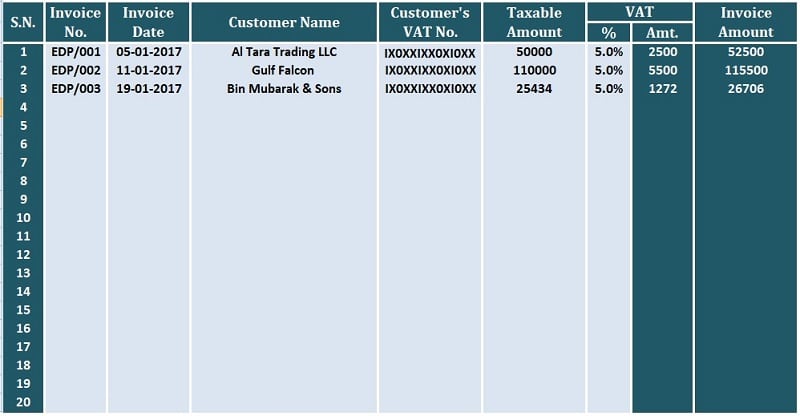

Sr.No.: A serial number is a sequence to know the number of sales made during a particular period.

Invoice No: You need to enter the Invoice number of the issued against the supply made to your customer.

With the help of a unified numbering of the invoice, it becomes easier for you to identify missing invoices, etc.

Invoice Date: Date on which the sale was made and invoice was issued.

Customer Name: You need to enter the name of the company to which the supply has been made.

Customer’s VAT No.: If your customer is a registered person, enter their VAT registration number. If the customer is an unregistered user, leave it blank.

Taxable Amount: Amount on which the applicable 5% VAT will be calculated. In other words, the sales price on which the 5% VAT is calculated.

VAT % and Amount: Just enter the applicable tax percentage tax of VAT and it will automatically calculate the amount.

VAT percentage in UAE is a flat rate of 5%. Thus, enter 5% in each cell.

Invoice Amount: Invoice amount = Taxable Amount + VAT Amount.

Lastly, the total of each column is made at the end of the column.

There is a provision to enter up to 100 invoices in this template.

If you have more than 100 invoices, you can insert additional rows as per your requirement.

To maintain records for a longer time, either make a copy of this sheet and you can use it for other tax periods.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.