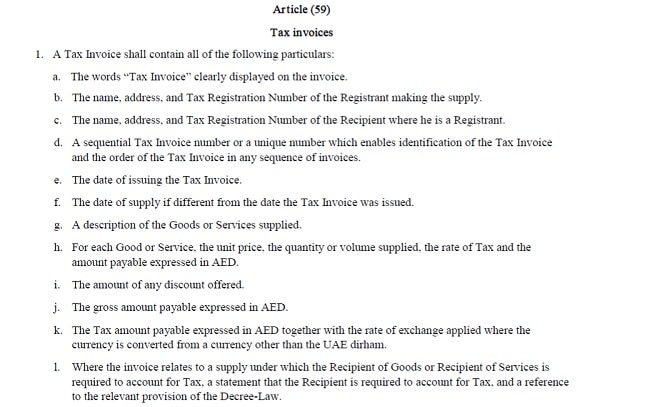

UAE VAT Dual Currency Invoice is used when the invoice is prepared in currency other than UAE Dirham. Furthermore, it is mandatory by law to mention the tax amount in AED with the applied exchange rate.

According to Article (59), Clause 1, Point “k” of Cabinet Decision No 52 of 2017 on Executive Regulations, “The Tax amount payable expressed in AED together with the rate of exchange applied where the currency is converted from a currency other than the UAE dirham.”

To download the Executive Regulations from the UAE Ministry of Finance click on the link below:

Cabinet Decision No 52 of 2017 – Executive Regulations

To download the same Executive Regulations from our website click the link below:

Cabinet Decision No 52 of 2017 – Executive Regulations

We have created the UAE VAT Dual Currency Invoice template in excel with predefined formulas that will help you to issue the invoice with 2 currencies. One is UAE Dirham and second whichever applicable.

Click here to download UAE VAT Dual Currency Invoice Excel Template.

You can also download other UAE centric templates like UAE VAT Multiple Tax Invoice, Arabic VAT Invoice Template, GCC VAT Invoice Template With Discount, and UAE VAT Payable Calculator.

Let us discuss the contents of the template in detail.

Contents of UAE VAT Dual Currency Invoice Template

This Invoice template consists of 2 worksheets:

- UAE VAT Dual Currency Invoice worksheet.

- Customer worksheet.

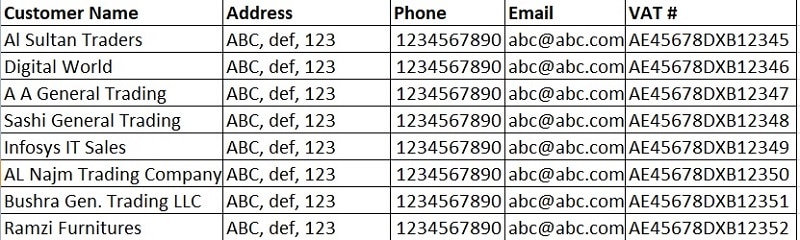

The customer sheet contains customer details of customers like company name, address, contact details, and VAT numbers, etc. The user needs to enter the name only once on the sheet.

The customer sheet has been linked to the customer details section of the invoice using data validation and VLOOKUP. Customer information can be fetched on the invoice with the help fo the dropdown list.

The template consists of 6 sections:

- Supplier Details

- Customer Details

- Conversion Details

- Sales Details

- Invoice Summary

- Other Miscellaneous Details

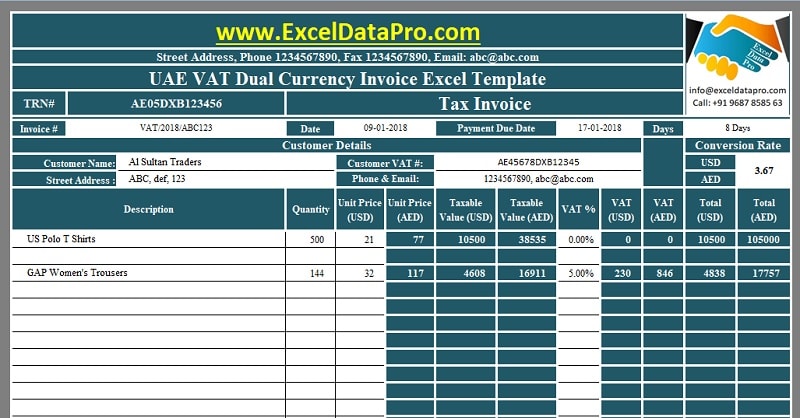

1. Supplier Details (Your Company Details)

As usual, this section consists of your company name, address, logo, TRN number, and Invoice heading.

In addition to that, it also contains Invoice number, date of issue, payment due date, and no if days between the issue date and the payment date.

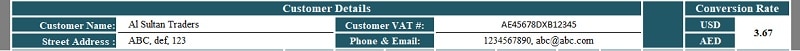

2. Customer Details

The customer details section is pre-programmed using data validation and Vlookup function. Just select the customer name from the dropdown list and it will automatically fetch all customer details.

It consists of customer name, address, VAT number, and contact details.

3. Currency Conversion Details

As the invoice is in two different currencies, the acceptable conversion rate should be mentioned in this section against the UAE Dirham.

In this template, we have taken USD as other currency and thus given the conversion rate for the same. If you use any other currency, mention the currency’s alphabetical code and respective conversion rate.

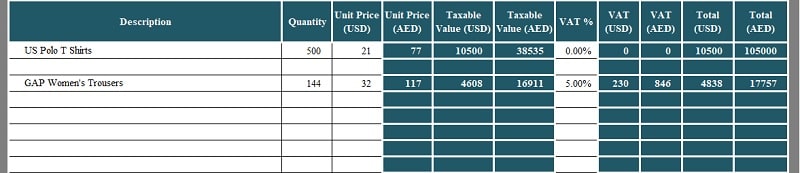

4. Sales Details

This section consists of the following columns to enter the details of the sale made:

Description of Products

Quantity

Unit Price (USD)

Unit Price (AED)

Taxable Value (USD)

Taxable Value (AED)

Percentage of VAT

VAT Amount (USD)

VAT Amount (AED)

Line Total (USD)

Line Total (AED)

Column Totals

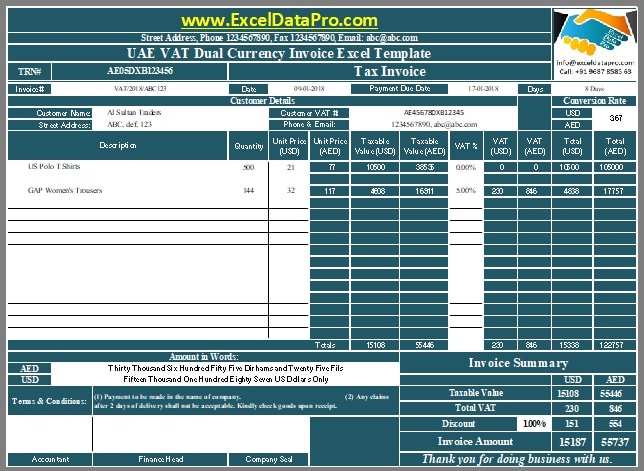

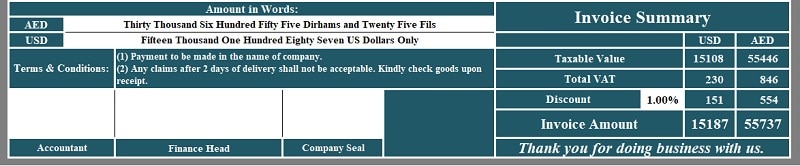

5. Invoice Summary

Invoice Summary contains the totals of each column of the product details section in both UAD and AED. Additionally, it consists of a discount if applicable.

Enter discount either directly the amount or enter the percentage of discount offered. The system will automatically calculate the discount amount.

Lastly, it consists of the Invoice Amount. The amount is calculated using the below formula:

Invoice Amount (AED) = Taxable Value (AED) + Total VAT Amount (AED) – Discounts (AED)

Invoice Amount (USD) = Taxable Value (USD) + Total VAT Amount (USD) – Discounts (USD)

6. Other Miscellaneous Details

Miscellaneous details consist of “Amount in words” for both the currencies; AED and USD, Terms & Conditions along with the space for company seal and authorized signatories.

At the extreme right of the invoice, there is a business greeting.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.