What is Tax Deducted at Source (TDS)

TDS stands for Tax Deducted at Source. It is income tax that a payer deducts from the payment of the payee. The payer deposits the tax that is collected to the IT Department.

The income tax collected by the payer on behalf of the payee is known as Tax Collected at Source (TCS). Whereas the tax deducted from the payee by the payer is known as Tax Deducted At Source.

The payer, though it is a company or an individual that makes the payment and deducts TDS is referred to as the deductor.

The payee. though it is a company or an individual that receives the payment is referred to as the deductee.

The deductor is responsible to deduct TDS while making payment and depositing the collected tax to the government.

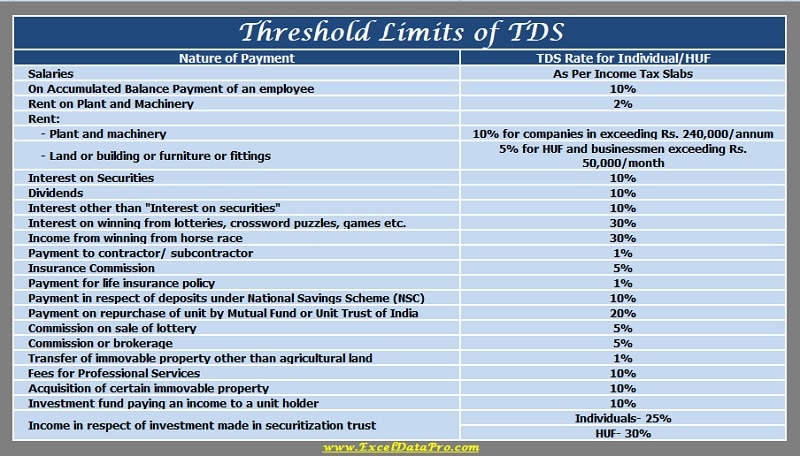

According to the IT Act, companies and individuals require to deduct tax at source while making a payment, if the payment exceeds certain threshold limits.

It is the deductor’s responsibility to deduct TDS before making the payment and deposit the same with the government.

Please note that the payee has to deduct tax irrespective of the mode of payment. Either it is cash, cheque or credit. The payee will deduct the tax against PAN Number of the deductor.

Payments Covered Under Tax Deducted at Source (TDS)

These payments include all types of payments; salaries, rents, interest payments, commission, consultation fees, professional fees, etc. The Income Tax department prescribes the rate/percentage to be deducted.

In addition to the above, dividend, transfer/sale of immovable property, interest on securities, winnings from lottery or horse race, Payment to contractor/ sub-contractor, repurchase of units of Mutual Funds and deposits under NSS

Salaried persons do not require to deduct TDS. But individuals running a business partnership, company or proprietorship require to obtain TAN and then only they can deduct TDS.

Similarly, individuals who have not obtained TAN cannot deduct TDS while making payments for rent or professional fees to professionals such as lawyers, doctors, etc.

For the deductee, the deducted TDS can be claimed in the form of a tax refund after they file their ITR.

How To Obtain TAN Number?

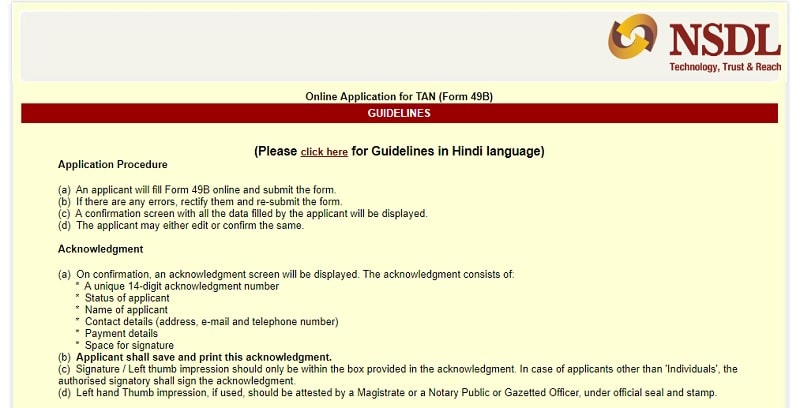

You can apply through an online application from NSDL website. Click on the link below to apply online:

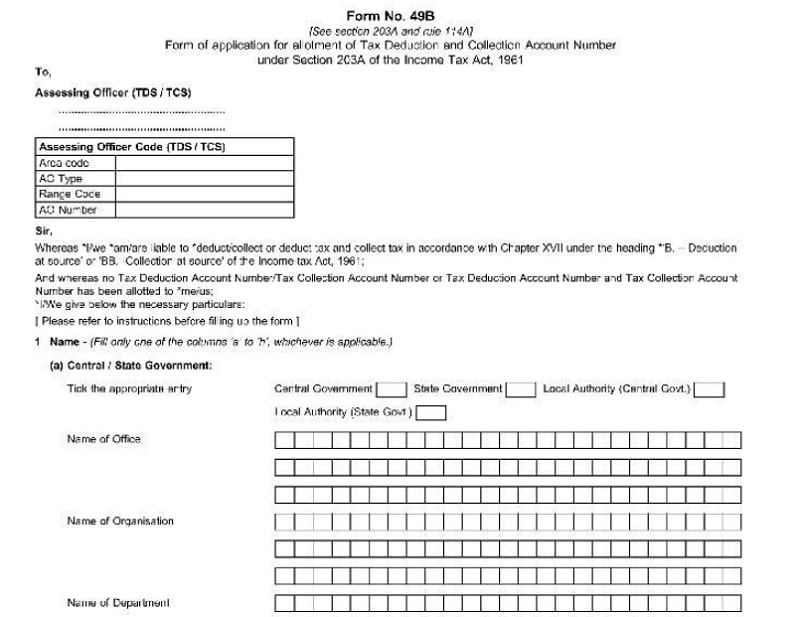

Or else you can apply by submitting physical TAN Application. You can download the TAN application from the link below:

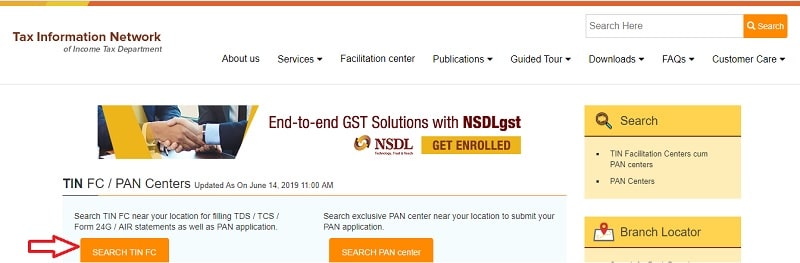

This application can be physically handed over at any TIN-Facilitation Center (TIN-FC) of NSDL.

Follow the instructions and guidelines available in the application form while filling it.

Rs. 65 is the processing fee for both the applications including GST.

For find TIN-FC in your area use the following link.

Tax Deducted at Source (TDS) Threshold Limits

How To Calculate TDS on Salary?

It is very simple to deduct TDS on salary either you are a deductor or a deductee. Follow the following steps to calculate TDS on salary:

- Calculate gross monthly income. That is basic salary + allowances+ perquisites.

- Deduct the exemptions U/S 10 of the Income Tax Act like Medical, HRA, TA, etc.

- Multiply the figure with 12. The amount derived is the total yearly income from salary.

- Add other incomes like house rent or deduct losses from paying housing loan interests,

- Deduct investments made during the tax year. Exemption of up to Rs.1.5 lakh under Section 80C is available. If it is under that you can deduct that. This consists of premiums paid for life insurance, PPF, Investments in mutual funds, repayment of home loan, ELSS funds, or Sukanya Samriddhi account.

- Currently, income up to Rs.5 lakhs is fully exempt from paying taxes. Rs.5 lakhs to Rs.10 lakhs income bracket is taxed at 20%. All income above this amount is taxed at 30%.

Let us understand the above TDS deduction with a simple example.

Example

Mr. X has a Gross Monthly Income of Rs.70,000. This includes basic pay Rs.45,000, House Rent Allowance Rs.15,000, travel allowance of Rs.700, medical allowance Rs.1,000, CEA of Rs.200 and other allowances 8,100.

He has his own house thus monthly exemption from allowances is the total of medical, travel and CEA. This sums up to (1000+700+200).

Thus, the taxable income will be gross monthly income less of allowed allowances multiplied by 12 months.

[70,000 – 1,900] X 12 = 8,17,200.

He incurred a loss of Rs.1 lakhs on house loan interest repayments during the year.

Now, his taxable income will be 8,17,200 – 1,00,000 = 7,17,200.

His investments U/S 80C are 98,000 and U/S 80D are 25,000. These investments are exempted under VI-A up to 1.5 lakhs.

Thus, his taxable income will decrease by this amount and the net taxable income will be 5,94,000.

He falls into the third slab as per FY 2019-2020. The income tax applicable to him is 20% on 94,000 along with 12,500.

12,500 + (94,000 X 20%) = 12,500 + 18,800 = 31,300 Net payable Income Tax.

Divide Net Payable Income Tax by 12 which is 2608.33. This is the minimum amount his employer will deduct per month from his salary.

What is TDS Return?

In addition to the collection of TDS, it is obligatory for a deductor to submit the TDS return and pay the collected amount to the Income Tax Department. TDS returns are to be filed quarterly.

Different types of TDS deductions have to be filed using different TDS return forms.

Form 24Q is Statement for TDS from Salaries and Form 26Q is Statement for TDS on all payments except salaries.

Form 27Q is Statement for TDS from interest, dividends, etc payable to NRI and Form 27EQ is Statement of collection of TDS at the source.

Process for filing TDS returns

It is mandatory according to section 206 to file TDS return in electronic form. The taxpayer can prepare TDS Return through the Return Preparation Utility(RPU) developed by NSDL.

Click here to download the RPU.

After generating the file through the RPU, you need to validate them with File Validation Utility (FVU). This is to ensure the accuracy of the format of the file.

Points to Keep in Mind While Filing Your TDS Return:

Form 27A consists of multiple columns to be filled properly Once it is filled you must verify it properly before submitting. This hard copy of the form will be verified with the electronically filed e-TDS.

You need to fill the amount paid and collected accurately enclosed with the respective forms.

Mention the TAN number of the organization on the TDS return. Failing to do so can result in a verification problem.

You need to mention the amount of tax paid and the mode of payment along with the challan number. Mismatch in filing can result in verification and you might need to file the return again.

The 7-digit BSR code must be entered properly for easy tallying against the actual amount of tax deposited.

Submit the physical TDS returns at TIN-FC’s managed by NSDL in your area.

Submit Online returns directly on the NSDL TIN website. Digital signature to be made for this type of filing.

On successful submission of the TDS Return, NSDL will issue a provisional token number. It is the acknowledgment of the return filed.

NSDL will issue a memo mentioning the reasons for rejections in case of rejections. Thus you need to re-file the return again.

Tax Deducted at Source (TDS) Due Dates

Leave a Reply