Definition – Standard Mileage Rate

Standard Mileage Rate is a preset per mile rate set by IRS that a taxpayer can claim as a deduction on his/her tax return for using his/her vehicle for business, charity, medical or moving purposes. For any of the four purposes, you can take standard mileage rate in lieu of actual expenses incurred when calculating deductible automobile expenses.

A taxpayer can claim deduction either by actual expenses incurred or standard mileage rate. Usually, Standard Mileage Rate is preferred as it is easy to calculate and often provide greater deductions.

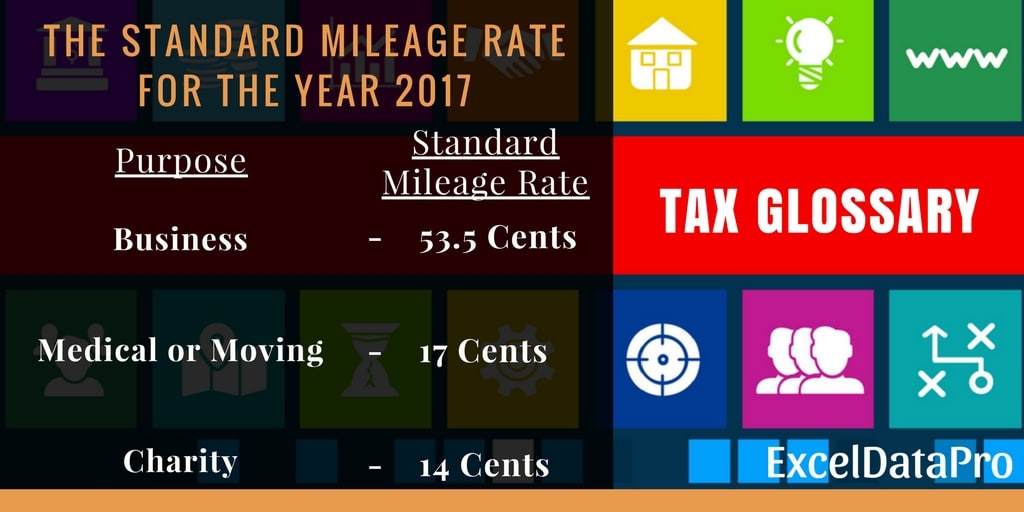

The Standard Mileage Rate for the Year 2017

As compared to 2016, the rates have substantially decreased. But again in 2018 IRS ha give an increase of few cents on the mileage rate.

There are many factors that are used to compute the mileage rate including the fuel prices. The IRS can change the rates even mid-year if the prices are volatile at a considerable amount.

How To Calculate the deduction according to the Standard Mileage Rate?

The formula to calculate the deduction amount is Number of miles driven multiplied by the present rate divided by 100.

Miles Driven X Mileage Rate / 100

For example, you have driven 500 miles for business, 100 miles for medical and 200 miles for charity.

Business: 500 X 53.5 cents / 100 = $ 267.5

Medical: 100 X 17 cents / 100 = $ 17

Charity: 200 X 14 cents / 100 = $ 28

Thus your total deduction amount will be 267.5 + 17 + 28 = 312.50

The IRS considers average gas prices, depreciation and wear and tear for finalising Standard Mileage Rate. Fuel prices paly a major role in it.

Supporting Documents Required for the Mileage Claim

IRS will not just believe what we say or write. They will need proofs for the same. In simple words, you need to manage a mileage log.

For this purpose, you need to do the following:

- You need to record the beginning odometer reading.

- Your vehicle mileage.

- Dates on which the business trips took place.

- Note the places you drove for business.

- Purpose of your business trip.

To know the history of mileage rates since 1997 click on the link below:

History of Standard Mileage Rates

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

Now MAC operating system users can download the above templates in Apple’s Numbers Application also from the link below:

Federal Income Tax Apple Numbers Templates

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply