Definition – SIMPLE IRA Plan

According to IRS, SIMPLE IRA plan stands for Savings Incentive Match Plan for Employees. SIMPLE IRA plan allows employees and employers to contribute to traditional IRAs set up for employees. It is ideally suited for a start-up retirement savings plan for small employers not currently sponsoring a retirement plan.

SIMPLE is a kind of retirement plan that can only be established by employers. Even self-employed individuals can enroll for SIMPLE IRA.

The employer is entitled to claim a tax deduction for the contributions made to the SIMPLE IRA. The employer makes either matching or non-elective contributions to each eligible employee’s SIMPLE IRA and employees may make salary deferral contributions.

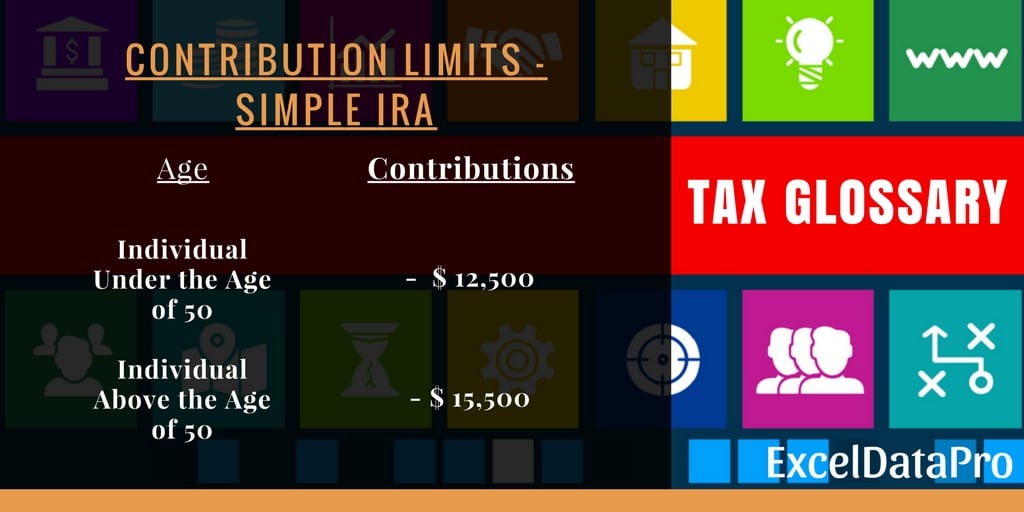

SIMPLE IRA – Contribution Limits for the year 2017

The limits for contributing to SIMPLE IRA plans are lower than other types of retirement plans that are provided by the employers like Section 402(g), 401(k), 401(a), and 403(b) plans.

The limits have substantially increased since the start. Currently, for the year 2017, the contribution limits to SIMPLE are $ 12,500 for the individuals under the age of 50 and $ 15,500 for individuals above the age of 50.

The tabular representation of the limits is given below:

Rules for SIMPLE IRA Plan

- An eligible employer can only establish a SIMPLE IRA. The definition of an eligible employer is that his company doesn’t consist of more than 100 employees. If an eligible employer starts SIMPLE IRA when he was having less than 100 employees, such employer can continue to be “eligible” for two years after crossing the 100 employees limit.

- It is not mandatory for employees to make regular contributions to the SIMPLE retirement account.

- The SIMPLE retirement plan requires a minimum contribution from the employer. The employer can match the contributions of employees dollar for dollar up to 3% of the employee’s compensation. Otherwise, the employer can choose to contribute a flat 2% of compensation for each employee with at least $5,000 in compensation for the contributing year irrespective of employee contribution.

- The SIMPLE plan can be funded with either an IRA or a 401(k). There is almost no benefit to funding it with a 401(k) as there are lower contribution limits of SIMPLE.

- You cannot rollover a SIMPLE IRA to a Traditional IRA without waiting period of two years from the date the employee first participated in the plan.

For more information on the topic, you can see Publication 560 on Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans)

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

Now MAC operating system users can download the above templates in Apple’s Numbers Application also from the link below:

Federal Income Tax Apple Numbers Templates

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply