Section 179 Deduction – Definition

Section 179 deduction is the immediate expense deduction available to business owners on the purchase of business equipment during the tax year instead of depreciating or capitalizing it over the life of the equipment.

In simple terms, deducting the cost of certain types of property on income taxes as an expense, instead of capitalizing or depreciating the cost of the property over multiple years is called Section 179 deduction.

The Section 179 Deduction is a provision to encourage businesses to purchase the required equipment and help them stay competitive by writing off the full amount on their taxes for the current year.

Eligibility Criteria for Qualifying Property under Section 179 Deduction

Surely, there are some eligibility criteria for the property under section 179.

- The property should be in taxpayer’s name or must have the legal rights over it.

- It should be tangible, depreciable and personal property.

- Purchased and put to use in the same year.

- Acquired from a non-related party.

Properties that qualify for the Section 179 Deduction

- Heavy Machinery purchased for business use.

- Tangible personal property used for business purpose.

- Vehicle used for business purpose in excess of 6,000 lbs

- Computers used for business purpose.

- Computer Software (off the self) used for business.

- Office Furniture

- Office Equipment

- Property used for partially for business and personal use. (a proportionate amount according to the use of it will be deductible).

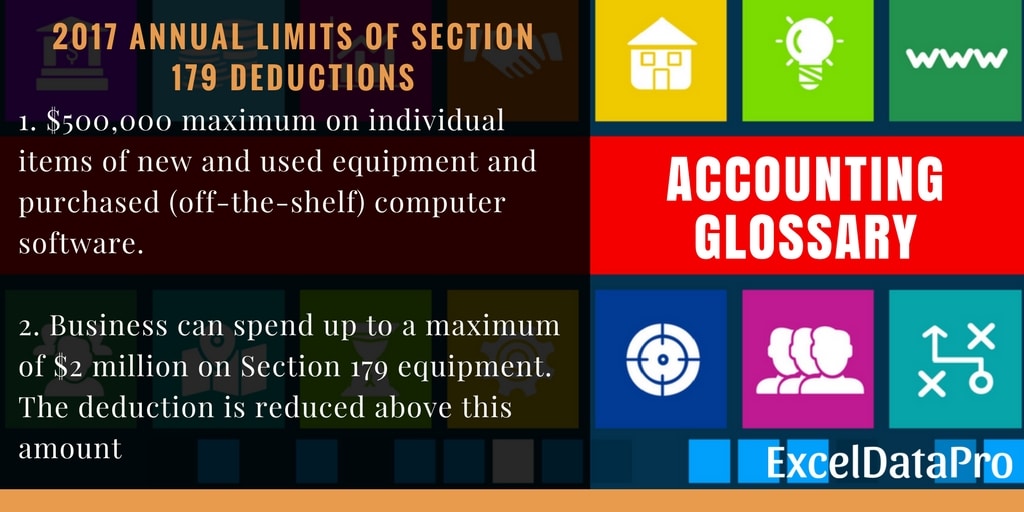

2017 Annual Limits of Section 179 deductions

In addition to the above, subject to IRC 179 (b) (3):

“The amount allowed as a deduction under subsection (a) for any taxable year (determined after the application of paragraphs (1) and (2) ) shall not exceed the aggregate amount of taxable income of the taxpayer for such taxable year which is derived from the active conduct by the taxpayer of any trade or business during such taxable year.”

For example, if the taxpayer’s net business income from is $ 235,000 in the tax year, then the taxpayer’s Section 179 deduction amount cannot exceed $ 235,000.

For more information on this section 179 click on the link below:

Thus, Section 179 deductions can save a huge amount of money for small and medium businesses. These amounts can be used for further enhancement of business.

Disclaimer: Interpretation of the above topics is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant before going for section 179 deductions.

We have created some useful templates in excel to help simplify the process of calculating your federal income tax like Simple Tax Estimator, Itemized Deductions Calculator, 401k Calculator and Child Tax Credit Calculator etc.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply