GST has been rolled out from 1st July. As it is the initial stage, many queries are arising about the number of monthly GST Returns to be filed.

We have received this question around 15 times via emails as well as on calls in past 3 days. Thus, we decided to put clear the air in this context and publish an article answer this question.

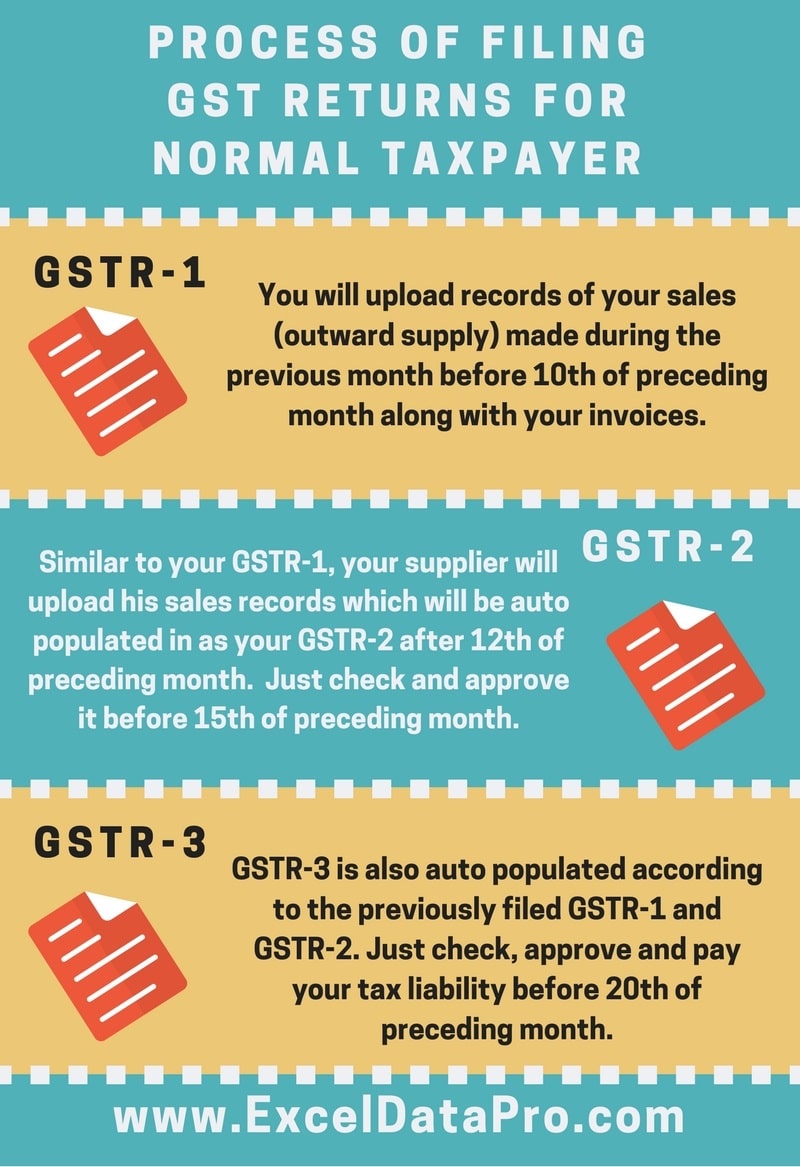

According to the GST Law, there are 3 returns to be filed by a normal taxpayer. Out of these three returns, only 1 return will be manually entered; that is GSTR-1. GSTR-2 and GSTR-3 will be auto populated.

Number of Monthly GST Returns

To simplify it, let us first understand the purpose of the all 3 returns, GSTR-1, GSTR-2 and GSTR-3.

GSTR-1: GSTR-1 consists of the details of outward supplies of taxable goods and/or services made during the month. The purpose of GSTR-1 is to provide the sales records to the government.

Download our ready to use GST Invoice Excel Template.

All the registered suppliers will file this return. The due date to file GSTR-1 is 10th of the preceding month.

Thus, you have 10 complete days to file your GSTR-1 after the completion of the month.

GSTR-2: GSTR-2 is auto populated with the details of inward supplies of taxable goods and/or services made by you during the month.

Your supplier who will file his GSTR-1 and it will be reflected in your GSTR-2 after 11th of every month.

You don’t need to file this return. You will just check and approve those entries. If there are any rectifications you can file GSTR-2A for that.

You will get the Input Tax Credit (ITC) only if your supplier files his returns.

Thus, compliance of filing returns will be interlinked. Now the government won’t force businesses to file their returns. You will force your supplier to get your Input Tax Credit.

GSTR-3: Similar to GSTR-2, GSTR-3 will be auto-populated on the basis of GSTR-1 and GSTR-2 that have been already filed.

GSTR-3 is the monthly return which consists of the details of both, outward and inward supplies already filed GSTR-1 and GSTR-2. GSTR-3 is to be filed before 20th of the preceding month.

In addition to this, the normal taxpayer will file an annual return; that is GSTR-9 which will also be auto-populated according to the monthly GSTR-3 filed every month.

Conclusion

If we calculate 3 monthly returns and 1 yearly return, it sums up to 37 returns. This big number sounds cumbersome and compliance-heavy.

As explained above, a normal taxpayer will file just 1 return and the other two are taken care of with little efforts of the assessee.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply