LTA stands for Leave Travel Allowance. It is a type of allowance given to an employee by the employer to cover his travel expenses while he/she is on leave from work.

It is also known as Leave Travel Concession (LTC). In India, Leave Travel Allowance is exempted from tax under Section 10 (5) of Income Tax Act, 1961.

Usually, Leave Travel Allowance means any travel concession received by given to the employee by his employer to cover the expenses incurred in traveling while on leave for himself and his family member.

Note: Family of the employee can include the following members

- Spouse of the Employee.

- Children of the Employee.

- Parents of the Employee.

- Wholly or mainly dependent brothers and sisters of the employee.

An employee can claim for two journeys in one block of four years that are created by the Income Tax Departments.

Currently, we are in the block year of 1st January 2014- 31st December 2017.

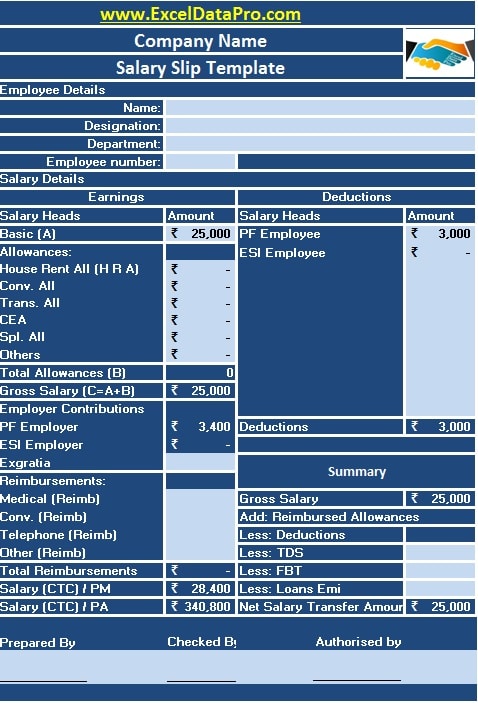

Generally, Leave Travel Allowance is not a part of the salary structure.

Thus, before claiming for Leave Travel Allowance, you need to check your pay structure with concerned departments.

It is not mandatory, but you need to produce relevant documents like tickets, bills when demanded by the employer.

Limitations of LTA

- Only domestic travels within India are covered in Leave Travel Allowance. No international travels are covered under this allowance.

- Only travel expenses are covered in this.

- Tax exemption can be claimed for only 2 children on an individual.

If LTA forms a part of your salary you can find it in your Salary Slip.

You can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply