It is mandatory for businesses to link their VAT number or TRN with Dubai Customs that are indulged in import and export goods. (TRN stands for Tax Registration Number).

VAT has been implemented in UAE since 1st Jan. In this article, we will discuss the documentation required and steps to link your VAT number or TRN with Dubai Customs.

Things Required To Link VAT number or TRN With Dubai Customs

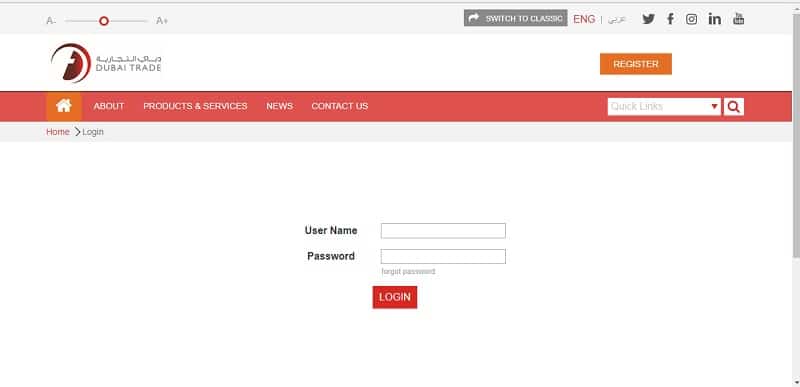

- Login credentials for Dubaitrade.ae. You might have received the login password when you have been earlier registered with Dubai Customs.

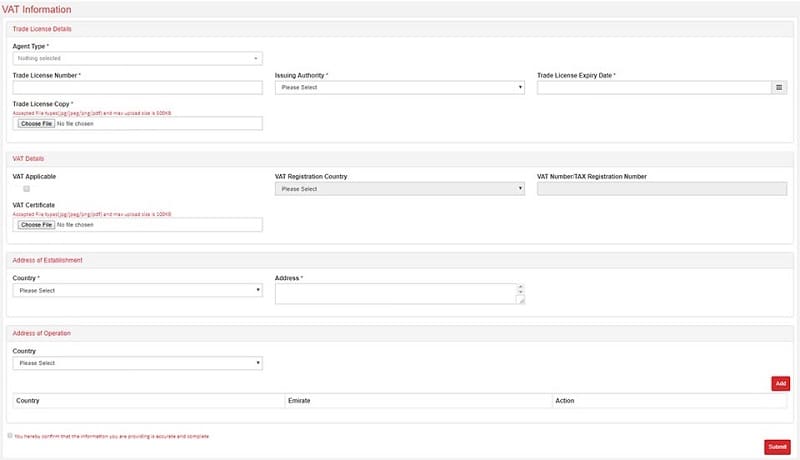

- Scan/PDF copy of the Trade License. It should be kept in mind that the trade license must be valid.

- Scan/PDF copy of VAT Certificate. In case you don’t have the certificate, log in to FTA website with your id password and take a screenshot of your VAT Dashboard.

- Address details of the Establishment card.

As soon as you get the above things ready, follow the steps given below to link TRN to customs.

Steps to Link VAT number or TRN With Dubai Customs

- Open www.dubaitrade.ae or click here to go to the website.

- Log in with your credentials.

- Click on User Management

- Select “DP World VAT Profile”

- Fill out the required VAT information on the displayed page.

- Click Submit.

Once you have completed the process wait for the confirmation message from Dubai Customs. Upon confirmation, you have linked your TRN with Dubai Customs.

You can download UAE centric excel templates like Arabic VAT Invoice Template, GCC VAT Invoice Template With Discount and UAE VAT Payable Calculator from our website.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.