A taxpayer can choose between Itemized deduction or standard deduction while filing their federal income tax return. To simplify this process we have created a ready to use Itemized Deduction Calculator Numbers Template. This template has been designed for our readers who use Mac operating system.

The purpose of this Itemized Deduction Calculator Numbers Template is to help you save money on your tax return.

You might be thinking how. Let us take two situations here:

- One is that you choose to go standard deduction and your itemized deduction must me more.

- Another is that you choose Itemized deduction and your standard deduction amount is more.

In both the above situations, the taxpayer loses money:

- When you go for standard deduction and you don’t know that your itemized deduction is more you tend to claim lower deductions. This increases your taxable income and eventually increases your tax amount.

- In the second situation, when you choose itemized deductions and are unaware that your standard deduction is amount is more. Similar to the above, your taxable income increases and so does your tax amount.

The standard deduction is a fixed amount to be claimed with no questions asked. Whereas in itemized deduction filer needs to present relevant documents as and when demanded by IRS.

To know the limits of the itemized deductions click on the link below:

Pease Limitation on Itemized Deduction

This Template can be helpful to accountants, tax professionals, individuals and couples filing jointly or separately.

Click here to download the Itemized Deduction Calculator Numbers Template

To download the same calculator in Excel click the link below:

Itemized Deduction Calculator Excel Template

In addition to the above, you can also download other Numbers Templates like Simple Tax Estimator and Section 179 Deduction Calculator

Let us discuss the contents of the template in details.

Contents of Itemized Deduction Calculator Numbers Template

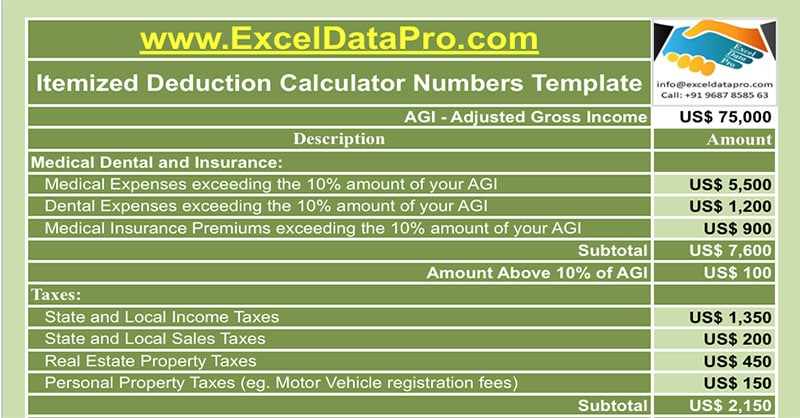

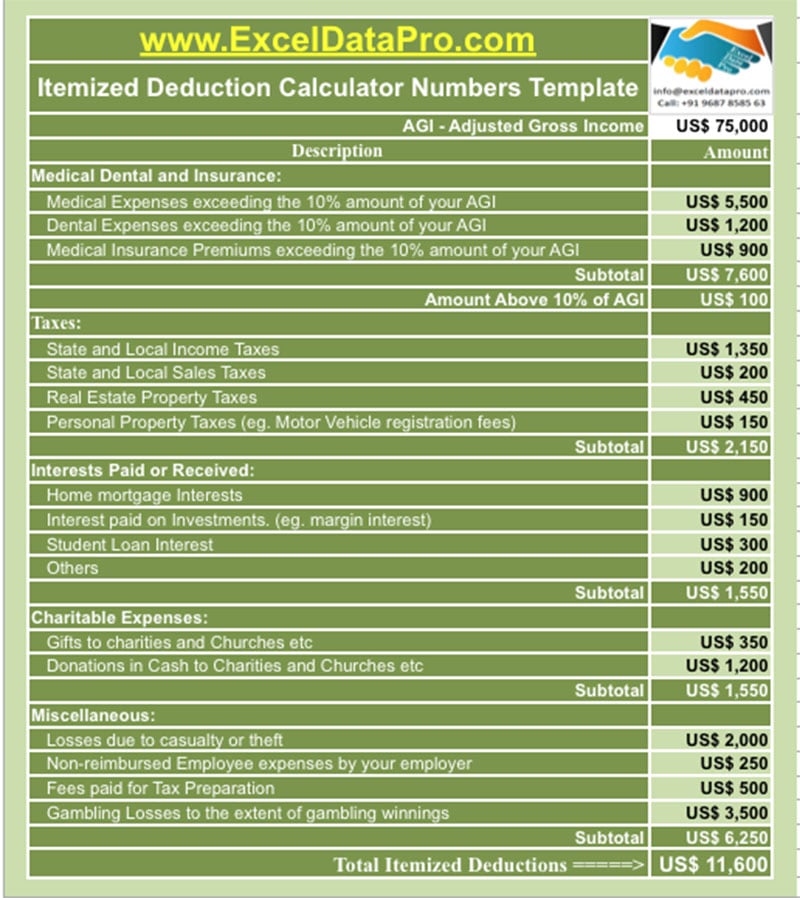

This template consists of 5 sections to be filled. By just entering the respective amount, the template will automatically calculate the subtotals as well the final total.

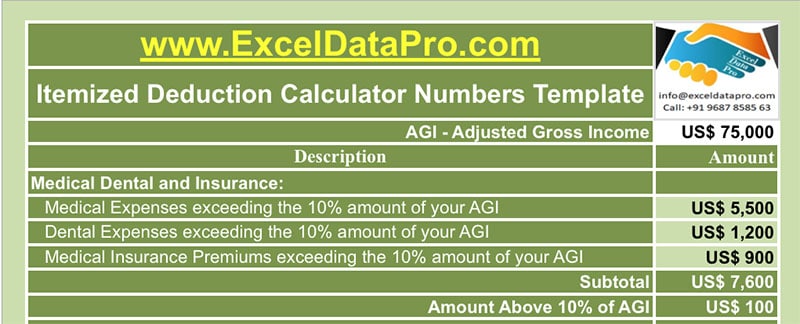

Firstly, you need to enter your Adjusted Gross Income (AGI) on the top. If you know your AGI then enter it directly or you can use our Adjusted Gross Income Calculator to know your AGI.

The five sections are as below:

- Medical, Dental and Insurance Expenses

- Expenses in the form of Taxes

- Interests Paid and Received

- Charitable Expenses

- Miscellaneous Expenses

1. Medical, Dental and Insurance Expenses

This category reposts the medical, dental and insurance premium expenses that are above 10 % of your Adjusted Gross Income(AGI).

2. Taxes

Taxes paid by the taxpayer like state income tax, state sales tax, real estate and personal property taxes etc are reported in this section.

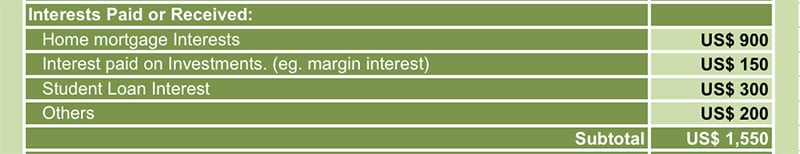

3. Interest Paid and Received

In this section, you need to enter the amounts of interests paid or received in the form of home mortgage interests, student loan interests etc.

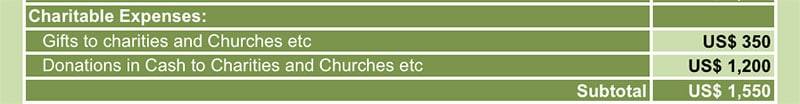

4. Charitable Expenses

Charitable expenses include the amount paid to charitable institutions in the form of Cash or in the form of gifts.

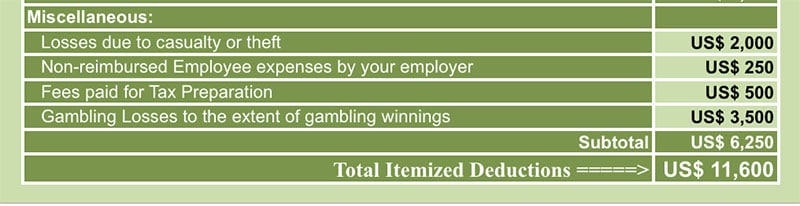

5. Miscellaneous Expenses

Here in this section, you need to enter the amounts pertaining to losses due to theft or casualties, gambling losses, tax preparation fees etc.

In the last row, the total of each section is summed up and given as Total Itemized Deduction amount.

To know more about itemized deductions download the pdf provided by IRS from the link below:

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply