Definition – Home Office Deduction

Home Office Deduction is a provision of Internal Revenue Code (IRC), which allows those taxpayers who use their home or a part of their property for business use to claim a deduction in their income tax return.

Here, the term “home” means a house, apartment, condominium, mobile home, boat, or similar property which consists of basic living accommodations.

In addition to the above, it also includes additional structures on your the property like an unattached garage, studio, barn, or greenhouse.

It doesn’t include any part of your property that is exclusively used as a hotel, motel, inn, or similar establishment.

Requirements to Claim the Home Office Deduction

There are 2 requirements for your home to qualify as a deduction:

- Regular and exclusive use.

- Principal place of your business.

Regular and exclusive use means that you must be using the part of your home regularly and exclusively for business activities.

Principal place of your business means that You must declare that you use your home as your principal place of business.

You can also claim the deduction proportionately, if you conduct business outside the home and use the home for business meetings, seeing patients etc. These deductions are based on the percentage of the home used for business.

Deduction Limit

According to IRS Publication 587:

- If your gross income from the business use of your home equals or exceeds your total business expenses (including depreciation), you can deduct all your business expenses related to the use of your home.

- If your gross income from the business use of your home is less than your total business expenses, your deduction for certain expenses for the business use of your home is limited.

Methods of Claiming Home Office Expense Deduction

1. Regular Method

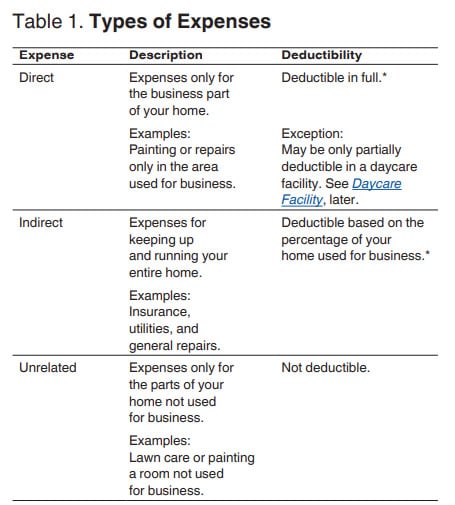

Regular method is required for tax years 2012 and prior. Under the regular method, you must determine the actual expenses. These expenses include mortgage interest, insurance, utilities, repairs, and depreciation.

Types of expenses allowed under regular method are as below:

Simplified Method

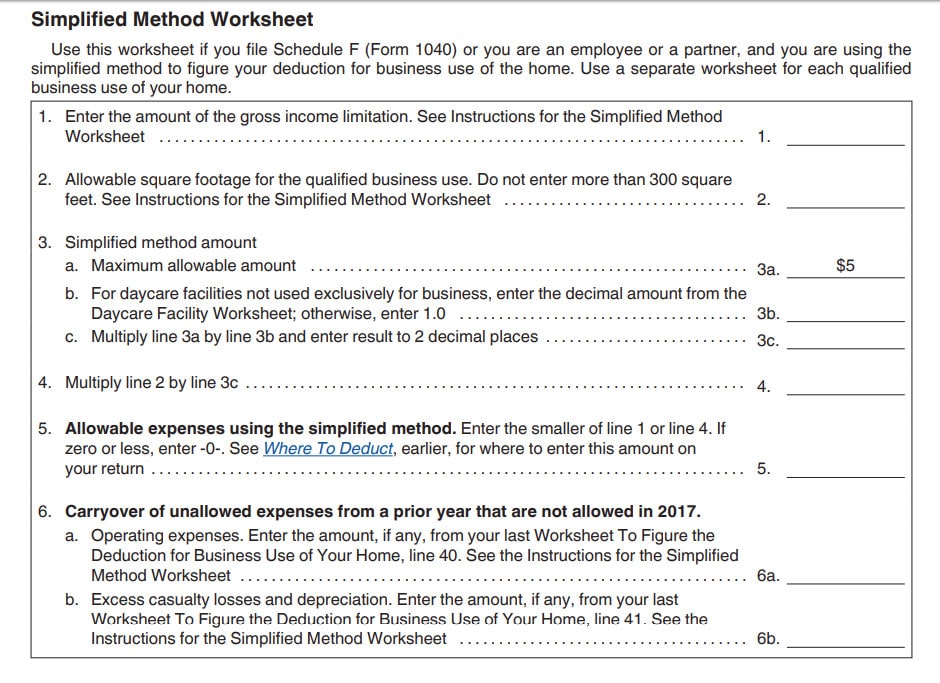

The simplified method is used for tax years on or after 2013. Under simplified method, the qualified taxpayer needs to multiply a prescribed rate by the allowable square footage of the office.

Per square foot rate for 2017 is $ 5 per. Maximum allowed square feet limit is 300 square feet. To calculate your home office expenses using the simplified method, use the below worksheet provided by IRS.

Rules for claiming home office expenses by employees and daycare facilities are different. For more information on this please read/download Publication 587.

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant before you plan for Home Office Deduction.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply