GCC VAT Invoice Template With Discount is an excel template for tax invoice for businesses who give discounts to their customers.

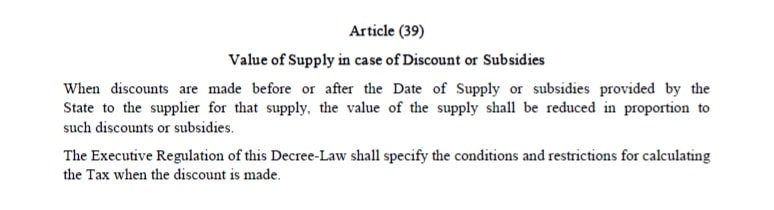

According to Article 39 of Federal Decree Law No. 8, the value of supply will be reduced by any discounts or subsidies offered.

Article 39 – Value of Supply in Case of Discounts, Subsidies, and Vouchers

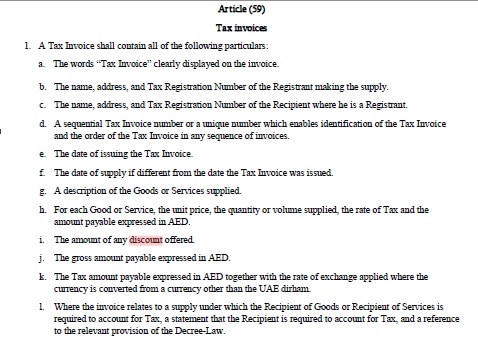

Article 59 of Cabinet Decision number 52 – Executive Regulation, point number (1) describes the contents of tax invoice. As per the ruling, the discounts are offered are to be deducted after adding the tax amount.

Article 59 – Tax Invoices

Taking into consideration the above rulings, we have created an excel template for GCC VAT Invoice With Discounts with predefined formulas.

This template can be helpful to all cashiers, account assistants, accountants and finance professionals. Just change the basic details in the header section and start using the template.

Click here to Download GCC VAT Invoice Template With Discount

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

As this template is for all 6 GCC Countries, you need to select the country from the drop-down menu given in the blue box beside the invoice format.

As you select the desired country, the currencies in all place will automatically change. See image below:

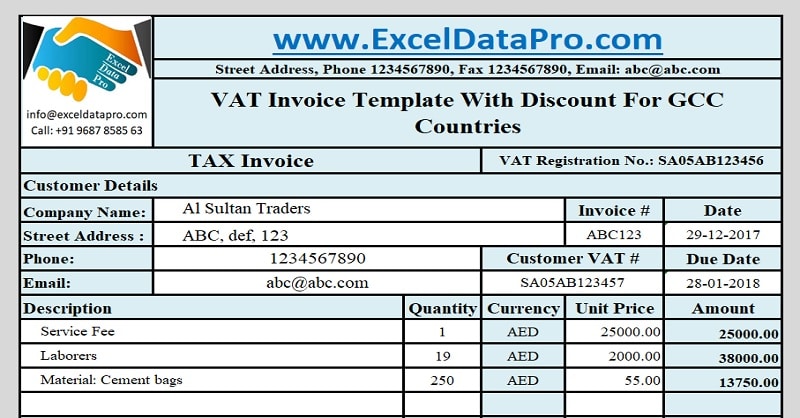

Let us discuss the contents of VAT Invoice Template in detail now.

Content of GCC VAT Invoice Template With Discount

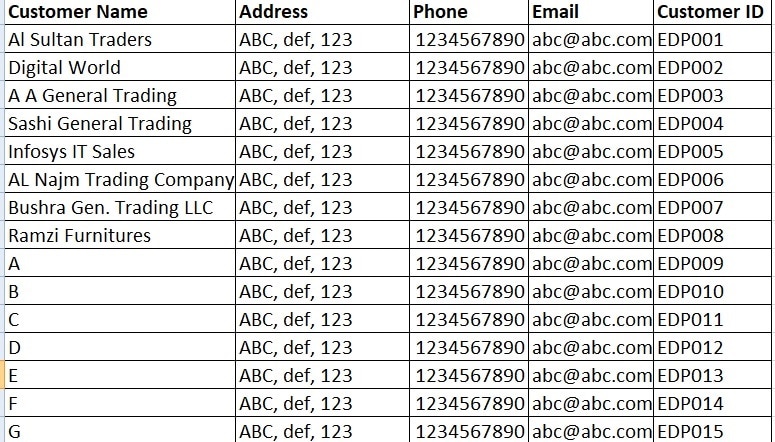

This template workbook consists of two worksheets. one is the GCC VAT Invoice Template and second is the customer database sheet.

The customer database sheet contains the details of the customer to be used in customer details section of the invoice.

Using data validation and VLOOKUP Function, this sheet is connected to the GCC VAT Invoice Template with Discount.

The invoice template has 4 parts:

- Supplier’s Details

- Customer’s/Buyer’s Details

- Goods or Services Details

- Tax Calculations and Other Details.

1. Supplier’s Details

Supplier’s details mean your company details. Enter your company name, logo, address etc in this section.

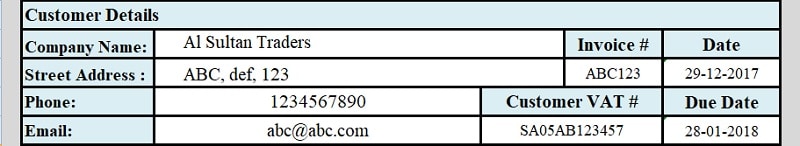

2. Customer’s/Buyer’s Details

This section contains details of customer like his company name, address, contact details and VAT number.

In the first line under customer section comes the customer name. This cell is programmed with data validation tool. Select the name you want from the drop-down list.

When you select the customer name, it will automatically update other customer details like address, contact information and his VAT number as you have entered in customer database sheet.

You just need to update the Customer Database sheet only once.

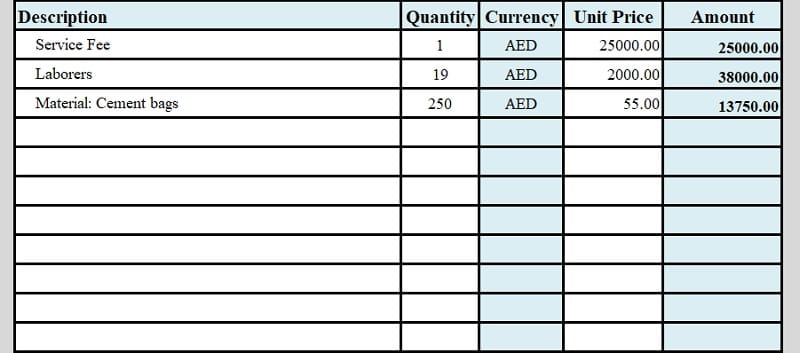

3. Goods or Services Details

In Goods and services details, you need to enter the goods sold to customers or services provided.

It contains 4 columns; quantity, currency, the rate per unit and the line total amount. The amount column automatically the line total.

Quantity X Rate = Line Total.

At the end, the subtotal of the invoice items has been made, which is used to calculate the tax amount.

4. Tax Calculations and Other Details

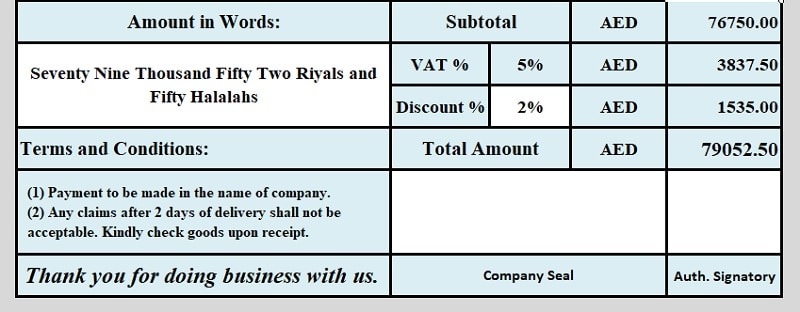

VAT Tax calculation is calculated at a flat rate of 5 % as per the ruling. Then comes the discount amount column. Enter the percentage of discount you are offering or you can directly enter the amount.

Final Invoice Total is calculated according to the below formula:

Subtotal + 5% VAT – Discounts = Total Amount.

In addition to that, the “Amount in words”, Terms & Conditions, Company seal and signature section are also there in this section.

That’s it, your GCC VAT compliant invoice is ready. Start using this ready to use and easy template.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.