EBIT – Definition

EBIT stands for Earnings Before Interest and Taxes. It is the net income of a company before paying the income taxes as well as interest expenses.

It is also referred to as operating earnings, operating profit, and profit before interest and taxes. Earings Before Interest & Taxes is the profitability measurement which is used to calculate the operating profits for a company.

It is a very useful metric used by Investors and creditors of a company. They use it know how successful the core operations of the company are and also the cost of the capital structure.

If an investor is thinking of buying a firm out, the existing capital structure is less important than the company’s earning potential.

This provides an insight to the investors to understand a company’s financial health and the ability to pay the external debt obligations.

Formula To Calculate EBIT?

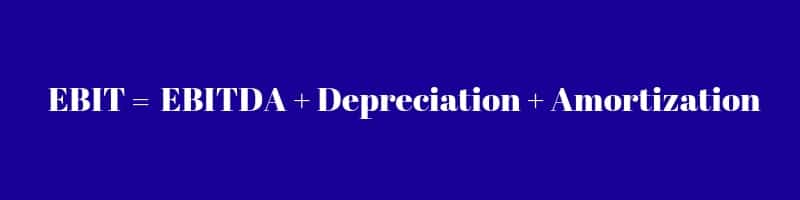

Earnings before interest and taxes is an indicator of a company’s profitability. It can be calculated in different ways. You can use these 3 formulas to calculate Earnings Before Interest & Taxes:

OR

OR

Example for EBIT Calculation

Let us understand it with simple examples.

Example 1

Below Given are the important figures extracted from Company A’s financial statements:

- Revenue/Sales: Rs. 15,00,000/-

- Cost Of Production: Rs. 6,30,475/-

- Opening Stock: Rs. 4,04,525/-

- Closing Stock: Rs: 2,60,000/-

- Operating Expenses: 2,00,000/-

Applying the first formula:

Revenue – COGS – Operating Expenses

where

COGS = Total Cost of Production + Opening Stock – Closing Stock :

= 15,00,000 – (6,30,475 + 4,04,525 – 2,60,000) – 2,00,000

= 15,00,000 – 7,75,000 – 2,00,000

= 5,25,000

Example 2

- Revenue/Sales: Rs. 15,00,000/-

- Cost Of Goods Sold: Rs. 7,75,000/-

- Gross Profit: Rs. 7,25,000/-

- Operating Expenses: 2,00,00

- Income Taxes: Rs: 35,000/-

- Interest Expenses: Rs. 1,25,000/-

- Net Income: Rs. 3,65,000/-

Changing the scenarios, if we have the net income and other expenditures of the company we can calculate EBIT using the second formula Net Income + Interest + Income Taxes, the calcualtions will be as follows:

= 3,65,000 + 1,25,000 + 35,000

= 5,25,000/-

Example 3

- Net Income: Rs. 3,65,000/-

- Depriciation: Rs. 85,500 /-

- EBITDA: Rs. 4,40,000/-

- Income Taxes: Rs. 35,000/-

- Interest Expenses: Rs. 1,25,000/-

Now Applying the third formula EBITDA + Depreciation + Amortization:

= 4,40,000 + 85000 + 0

= 5,25,000/-

Thus, it is very easy to calculate EBIT using these formulas.

Click on the link below to download ready-to-use excel template to calculate EBIT per FTE:

In addition to the above, you can also download Excel templates in other categories like HR and Payroll, Financial Analysis, Financial Statements, etc

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries or suggestions please share in the comment section below. I will be more than happy to assist you.

Leave a Reply