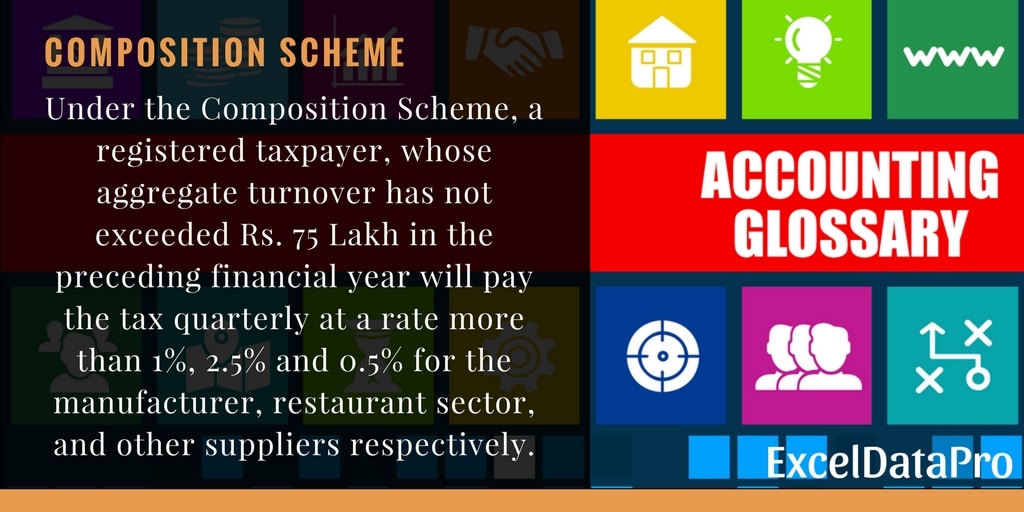

Any registered taxpayer, whose aggregate turnover has not exceeded Rs. 75 Lakh in the preceding financial year can choose to pay tax under the Composition Scheme.

With reference to the revised limit in 16th GST Council Meeting:

Under the Composition Scheme, a registered taxpayer, whose aggregate turnover has not exceeded Rs. 75 Lakh in the preceding financial year will pay the tax quarterly at a rate more than 1%, 2.5% and 0.5% for the manufacturer, restaurant sector, and other suppliers respectively.

Source: www.cbec.gov.in

Following taxable persons cannot opt for this scheme:

- Businesses indulged in supplies of goods not leviable under the Act.

- Those who are indulged in the supply of services.

- Those indulging in inter-state or export/import supply of the goods.

- Businesses making the supply of goods through E-Commerce Operators.

- Manufactures of such goods which may be notified by Government.

Benefits of Composition Scheme

Lower Compliance: Compared to the normal taxpayer, a taxpayer under this scheme is required to file one return in each quarter.

Whereas the normal taxpayer is required to file 3 returns on a monthly basis and a consolidated yearly return.

As maintenance of records under this scheme is less. Neither a tax invoice, no maintenance of books of records and last but not the least the furnishing of detailed returns.

Lesser Tax Liability: As compared to the normal taxpayer, a person taxed under Composite Scheme is liable to pay tax at a rate which is not more than 2.5% against the standard rate of 18%.

Liquidity: Due to lower tax rates high liquidity of his working capital.

Disadvantages the Composition Scheme

Business Only Intra-State: Being registered under the scheme, you are obliged to carry only intra-state transactions and cannot indulge in export/import or interstate transactions.

No Input Tax Credit: Under this scheme, you are not eligible for getting the credit of Input Tax.

Input Tax Credit cannot be claimed even if taxable purchases are made from a dealer registered under the normal scheme.

Similarly, the buyer of goods from a supplier registered under the composite scheme will not get any credit of tax paid.

No Tax Collection from Buyers: Users registered under this scheme cannot collect tax from their buyer even though the rate of composition tax is very low (0.5%,1% or 2.5%).

Such dealer cannot issue a GST Tax invoice. He can only issue a Bill of Supply.

Eventually, the burden of this excess tax will be on the dealer registered under such scheme and he is liable to pay it from his pocket.

High Penalties: If the taxpayer under such scheme is found that he is not eligible for the scheme shall be liable to pay the tax difference with a penalty.

Thus, before opting for the composition scheme, he/she much be thorough about his/her eligibility for the scheme to avoid such penalties.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

I am in composition scheme, if I purchase materials from a regular

registered dealers will I have to pay the tax.

Yes You have to pay GST.

Dear sir

As a merchant exporter while filing GSTR-1 , i wrongly ticked deemed export,so how can i rectify the same, because my suppliers registers shows the tax amount to be paid at their end

Contact GST Office for rectification.