Definition – Charitable Donations Deductions

Contributions made to qualified charitable organizations in the form of cash, property or services can be claimed as deductions on your federal income tax return. Such deductions are called Charitable Donations Deductions. Contributions made to an individual are not deductible as charitable donations deductions.

You can claim up to 50% of your AGI – Adjusted Gross Income. In some cases, the limit is 20% or 30% of your AGI.

Please note that Contributions must be made to qualified charitable organizations. You must obtain a receipt for the donations made and keep a record of it. To know whether the organization you want to contribute is a qualified organization click on the link below given by IRS and follow the instructions:

EO Select Check Tool

Types of Charitable Donations Deductions

Cash donations include cash, check or any other monetary form for which you have obtained a receipt from the qualified charitable organization.

Non-cash contributions can be in the form of clothes, things, vehicles etc donated to qualified charitable organizations and the receipt must be obtained for the same.

Valuation Guidelines provided online by Salvation Army or Goodwill for common items such as clothing, small appliances, and other household goods can be of big help.

If the donated items are new then save the price tag and/or store receipt as a proof of the item’s value.

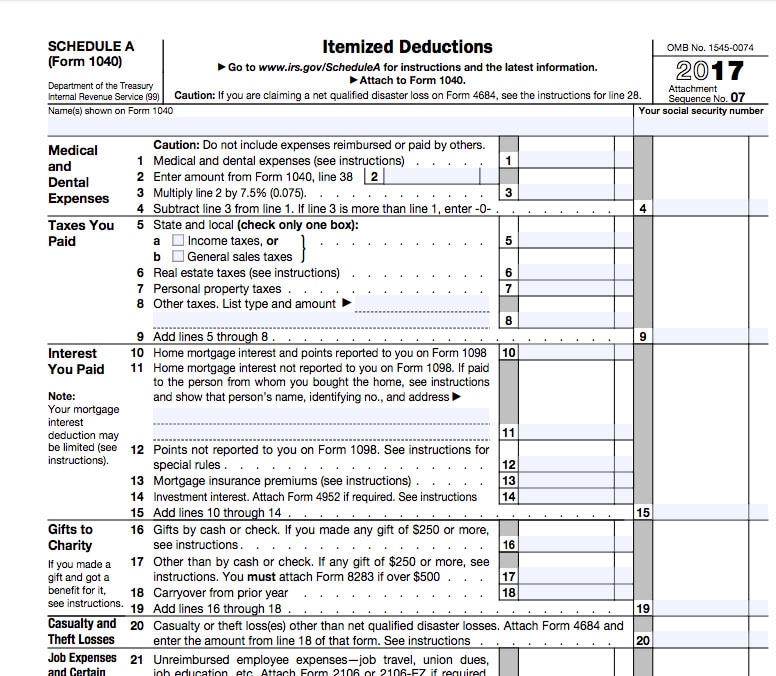

Where and How to Claim Charitable Donations Deductions on your tax return?

To claim the Charitable Donations Deductions, first of all, you need to choose to go for itemized deductions on your tax return. For Cash Charitable Contributions you need to report in F Form 1040, Schedule A of Itemized Deduction Section.

Whereas for non-cash contributions you need to file Form 8283. and attach it to your tax return if your contributions are above $ 500.

If a taxpayer claims a deduction for a noncash property worth $ 5,000 or less, he/she must fill Section A of Form 8283.

If the claim of deduction for a noncash property is worth more than $5,000, they will need a qualified appraisal of the noncash property and must fill out Section B of Form 8283.

In case, the claim of deduction noncash property is worth more than $ 500,000, the taxpayers need to attach the qualified appraisal to their return.

To know more about Charitable Contributions please refer Publication 526 (2017), Charitable Contributions

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

Now MAC operating system users can download the above templates in Apple’s Numbers Application also from the link below:

Federal Income Tax Apple Numbers Templates

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply