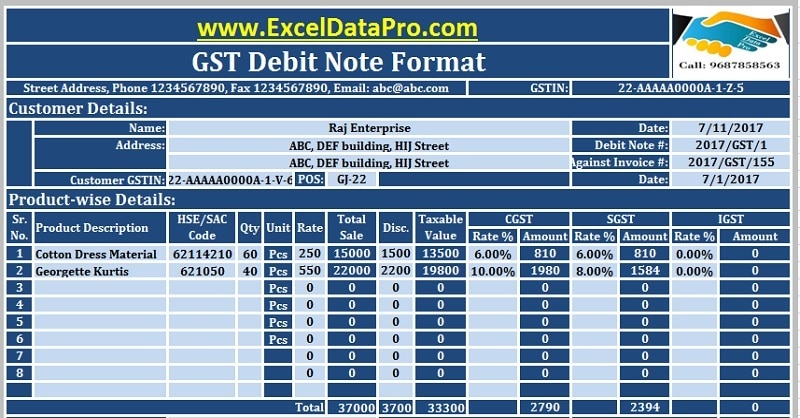

GST has bee implemented from 1st July 2017. As a registered business will now issue GST Invoice for the supply of taxable goods or services is made. A GST Debit Note whenever taxable value or tax charged in the original invoice is found less than the actual amount. In this article, we will discuss the […]

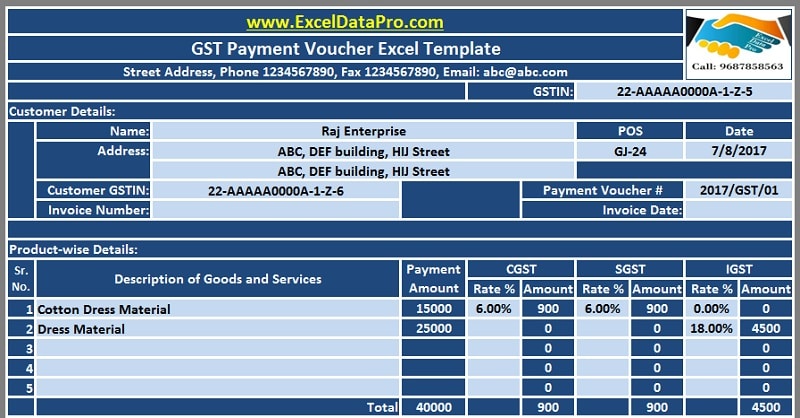

Download GST Payment Voucher Excel Template for Payments Under Reverse Charge

A recipient liable to pay tax under reverse charge is required to issue a GST Payment Voucher at the time of making payment to the supplier. Currently, people are searching for various formats like of GST compliance Tax Invoice, GST Bill format, Receipt Vouchers etc to carry on their business activities. In our previous posts, […]

The Refund Process Under GST?

Compared to the old tax regime, processes under the GST regime are easy. Though it is GST Return filing process or the Refund process. The Government has put utmost focus to make the refund process easier as compared to the previous tax regime. Delays in refund can cause the problem for the exporters and the […]

How To Claim Input Tax Credit?

After the rollout of GST since 1st of July, many queries have arisen. One such query was asked by many of our readers, which is “How to claim input tax credit under GST?” In our previous post, we discussed “Number of Returns to be filed by Regular Taxpayer under the GST Regime?“. These are our […]

How Many Monthly GST Returns Are To Be Filed By A Regular Taxpayer?

GST has been rolled out from 1st July. As it is the initial stage, many queries are arising about the number of monthly GST Returns to be filed. We have received this question around 15 times via emails as well as on calls in past 3 days. Thus, we decided to put clear the air […]