Central Board of Excise and Customs (CBEC) on 8/8/2017 has notified vide Notification No: 21/2017-Central Tax, that the last date to file GSTR-3B return is 20th August 2017 for the month of July 2017. In simple terms, GSTR-3B is the summary of your sales and purchase made during the tax period. Dates of GSTR-1 and […]

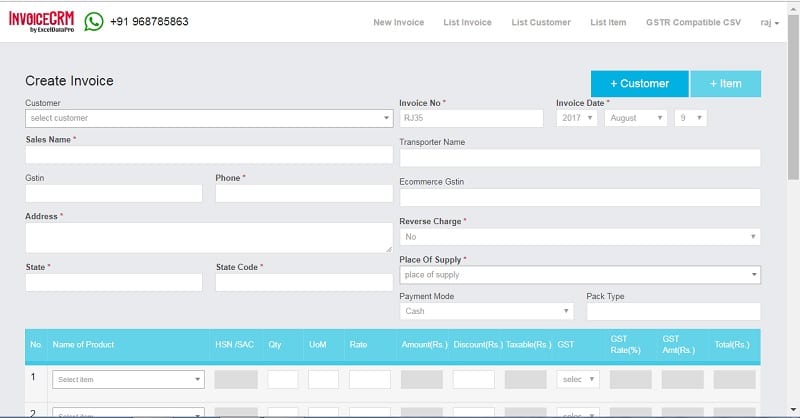

Simplified GST Invoicing and Effortless GSTR Filing

We have created InvoiceCRM, an online software for Simplified GST Invoicing and Effortless GSTR Filing. You can create your invoice in less than a minute and get your CSV file in just one click. First Look: Create your invoice anytime and anywhere. Being Indian, we usually have a tendency to try things before I buy. […]

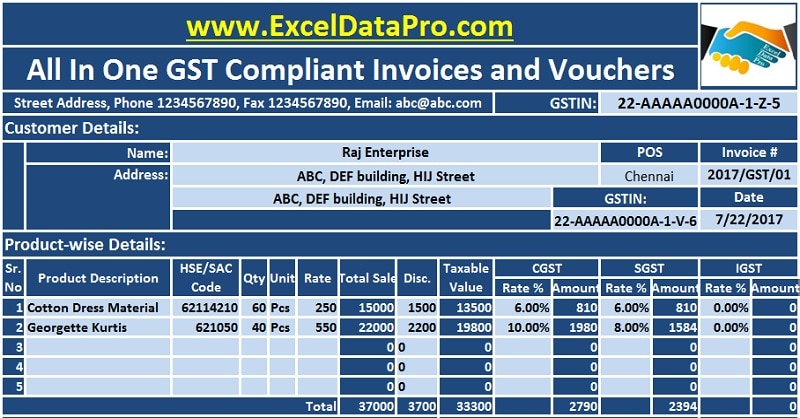

Download GST Compliant Voucher Formats In Excel

With GST into effect from 1st July 2017, taxpayers are looking for ready templates in order to carry on their activities. We have created a separate template for all types of GST Compliant Invoices and Vouchers in Excel. You can find them all on our GST Templates page under the templates category in the menu. […]

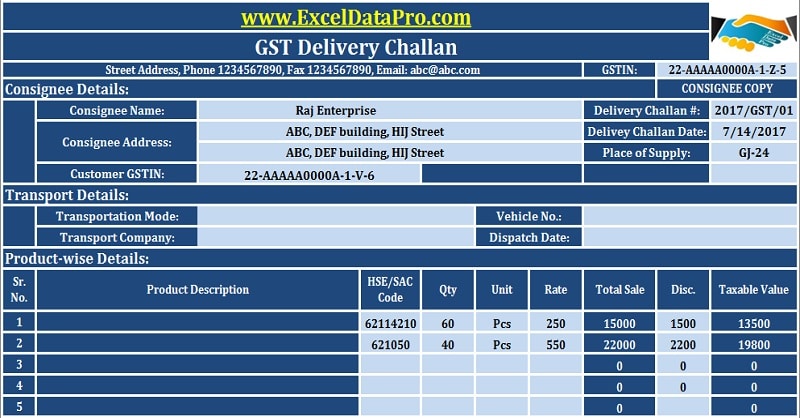

Download GST Delivery Challan Format in Excel For Transportation Of Goods Without The Tax Invoice

The consignor issues a GST Delivery Challan in lieu of GST Tax Invoice at the time of removal of goods for transportation for the purpose of job work, the supply of goods from primary office to branch etc. According to the rules provided by the government, rules for issuance of the delivery challan are as […]

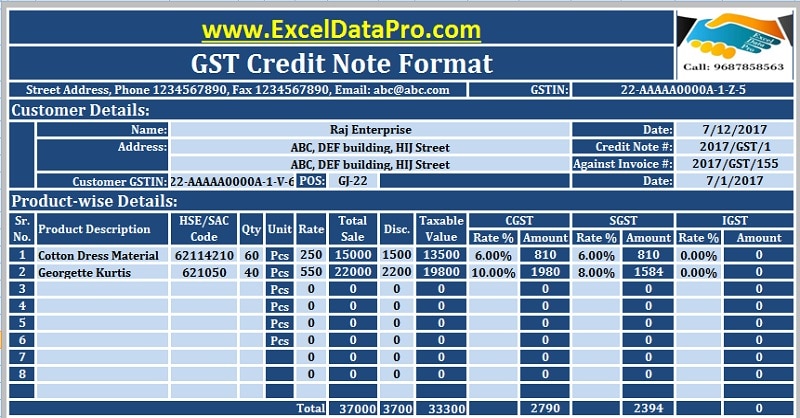

Download GST Credit Note Format In Excel Issued Against Goods Return Or Over Billing

A registered supplier needs to issue a GST Credit Note to his customer when: The taxable value or the tax charged in the original invoice exceeds the taxable value or the tax payable in accordance with such supply. In simple terms, if your previously issued invoice is over billed. The goods are returned by the […]