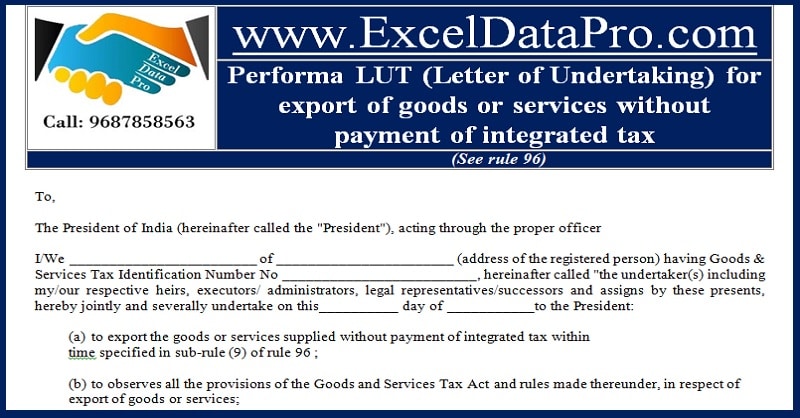

Many queries have been generated asking the Performa LUT (Letter of Undertaking) provided by Exporters to the government for exporting goods without payment of GST or providing Bond. Norms for exports under GST regime have been eased. Now exporters can export goods against LUT without paying GST or Bond. GST council announced vide Notification No. 37 […]

Major Decisions Taken in 22nd GST Council Meeting

The 22nd GST Council Meeting was held on 6th October 2017 at New Delhi. Many important decisions that GST Council took in this meeting. Recently, taxpayers were facing many problems due to system failure of GST portal as well as return filing compliance. Key points discussed in this meeting are listed below: GST Registration GST Return […]

Step By Step Guide To File LUT For Exports Without IGST

With the release of government for exports against LUT without paying GST or Bond vide Notification No. 37 /2017 – Central Tax. The IGST Act governs exports and imports of goods and services under the GST regime. Note: LUT stands for Letter of Undertaking. Previously, the eligibility for furnishing LUT was for those who have […]

Download UAE VAT Credit Note Excel Template

Every business entity has to issue a UAE VAT Credit Note, whenever the goods are returned or the invoice issued is overbilled. VAT in UAE is expected to be implemented from 1st January 2018. Businesses must be ready for the VAT billing system. A Credit note is a document issued by a supplier on a customer […]

Export Against LUT Without Payment of GST or Bond

The government announced vide Notification No. 37 /2017 – Central Tax that exporters and now export against LUT without the payment of GST or Bond. Note: LUT stands for Letter of Undertaking. Since the implementation of GST, the exporters were facing many problems in taking refunds of GST paid on their consignment and blockage of […]