It is mandatory to display GSTIN on name board for all registered taxpayers according to Point No.18 of Notification No. 3 /2017 – Central Tax dated 19th June 2017. Ruling to Display GSTIN On Name Board For Dealers Registered Under Regular Scheme Point No.18 clearly states that: Every registered person shall display his certificate of registration […]

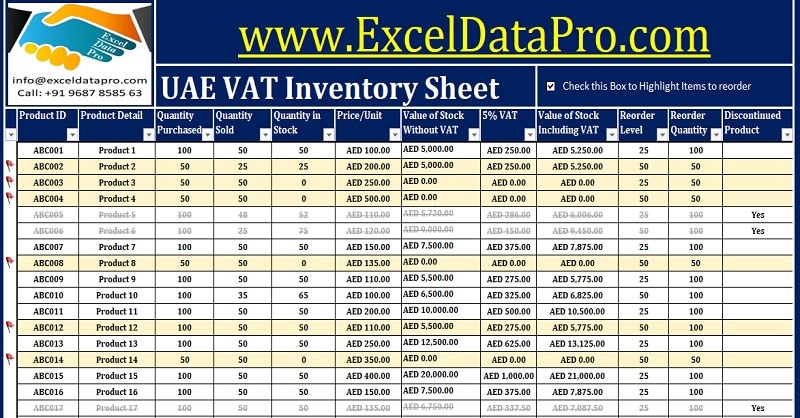

Download UAE VAT Inventory Management Excel Template

We have created an Excel Template for UAE VAT Inventory Management using excel table function and predefined formulas. With this template, you can keep an eagle’s eye on your stock inventory. Eventually, helping you increase the profitability of your business.

Step by Step Guide To File Nil GSTR-2 for Inward Supply

For Inward Supplies, a GST registered taxpayer needs to file GSTR-2. In other words, GSTR-2 is to be filed for all purchases made during the tax period. In this article, we will discuss how to file Nil GSTR-2. Nil GSTR-2 is filed when there are no purchases during the tax period. Please note that if […]

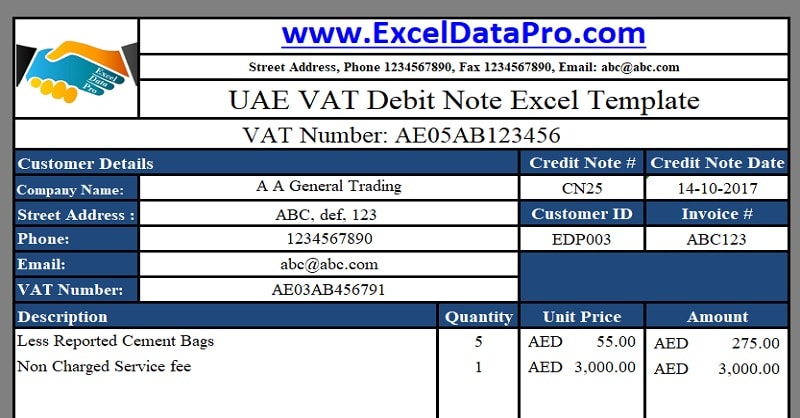

Download UAE VAT Debit Note Excel Template

Every business entity has to issue a UAE VAT Debit Note, whenever the goods delivered are less are or tax collected is less against the original issued invoice. VAT to be implemented in UAE from 1st January 2018. Businesses will have to get ready for VAT billing system. A Debit Note is a document issued […]

Understanding UAE VAT Reverse Charge Mechanism

The UAE VAT Law will be introduced and implemented across UAE on 01st January 2018 at a flat rate of 5%. Let us understand UAE VAT Reverse Charge Mechanism. Usually, the VAT liability is to be discharged by the supplier of goods/ service or both. However, in specific cases, the liability to pay tax is […]