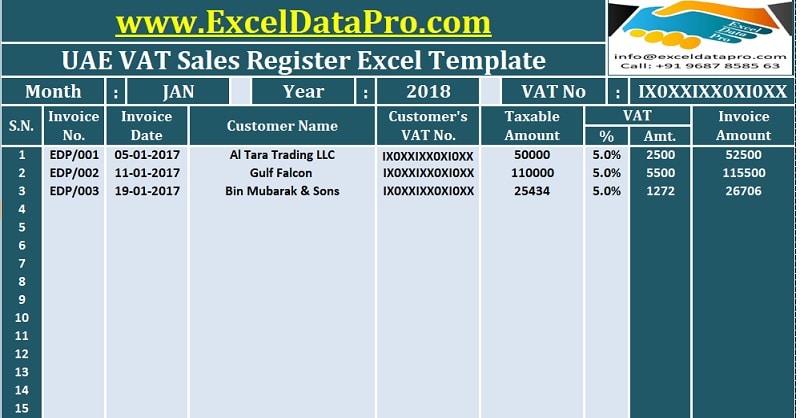

UAE VAT Sales Register is a document that maintains the records of your sales during a specific period along with details of Output VAT collected on those sales. Earlier, we maintained records of sales, but those records were without VAT calculations. UAE is all set to implement VAT from Jan 2018 and businesses have been […]

How To Calculate UAE VAT Payable to FTA?

Article 53 of Federal Decree-Law No. (8) of 2017 on Value Added Tax, describes the method to Calculate UAE VAT Payable to FTA(Federal Tax Authority). The above article means, Your the Output Tax less of Recoverable Input Tax is equal to Tax Payable. Hence, the formula to Calculate UAE VAT payable is as below: Output […]

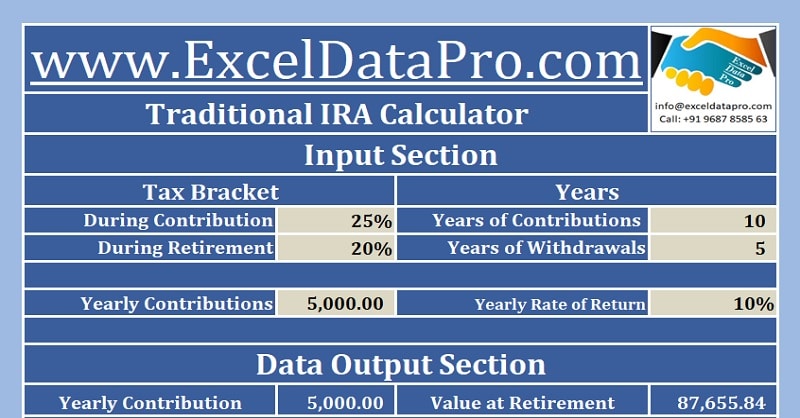

Download Traditional IRA Calculator Excel Template

In this article, we will discuss the Traditional IRA Calculator which will be helpful to you to decide the amount of savings you need to invest for your retirement goals. IRA stands for Individual Retirement Account. A Traditional IRA is a type individual retirement account. Investing in traditional IRA helps you grow your earnings tax-deferred. In […]

Understanding UAE VAT Recoverable Input Tax

VAT is all set to be implemented in UAE from Jan 2018. Article 54 to Article 56 of UAE VAT Law describes the conditions and eligibility of claiming UAE VAT Recoverable Input Tax. Article (54) – UAE VAT Recoverable Input Tax Source: www.mof.gov.ae In simple terms, a registered person is liable to recover input tax […]

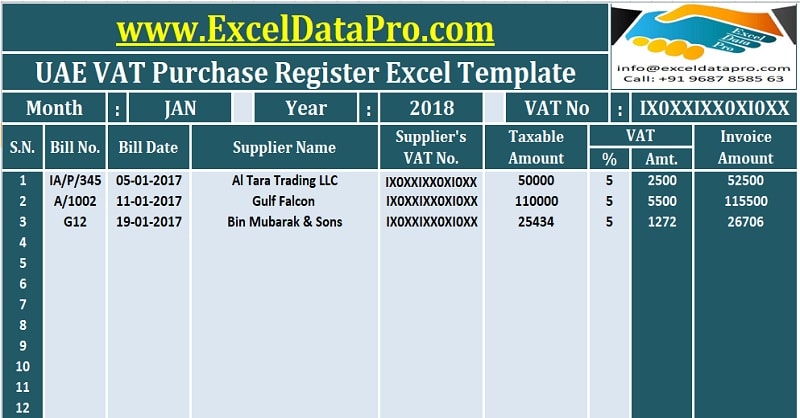

Download UAE VAT Purchase Register Excel Template

We have created an excel template for UAE VAT Purchase Register to maintain your purchase records and help you to easily calculate your input tax. This template is helpful to all traders, wholesalers, retailers, industrial units, etc.