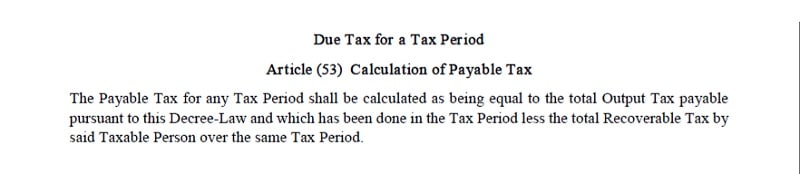

Article 53 of Federal Decree-Law No. (8) of 2017 on Value Added Tax, describes the method to Calculate UAE VAT Payable to FTA(Federal Tax Authority).

The above article means, Your the Output Tax less of Recoverable Input Tax is equal to Tax Payable.

Hence, the formula to Calculate UAE VAT payable is as below:

Output VAT – Recoverable Input VAT = VAT payable.

To know more about UAE VAT Recoverable Input Tax click on the link below:

To download the Federal Decree-Law No. (8) of 2017 on Value Added Tax click on the link below:

Federal Decree-Law No. (8) of 2017 on Value Added Tax

From Jan 2018, VAT is all set to be implemented in UAE. It is necessary for businesses to get ready for VAT compliances.

Businesses will have to maintain records, collect and pay VAT, the filing of VAT returns etc. all in accordance with the VAT Law.

Let us understand the above with the help of an example.

You purchase good from a distributor.

Distributor Price – AED 10,000.

5 % VAT Paid – AED 500.

Purchase price – AED 10,500.

Now you sell the above goods to your customers.

Your Price – AED 11500.

5 % VAT Collected – AED 575.

Your Sale Price = 12075.

How to Calculate UAE VAT Payable?

VAT collected – VAT paid = VAT Payable

AED 575 – AED 500 = AED 75

Thus AED 75 is your payable amount to FTA.

You can download UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note, UAE VAT Purchase Register and UAE VAT Credit Note etc.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.