A registered supplier is eligible to claim the bad debts Output VAT adjustments according to the Article (64) of UAE VAT Law. These bad debt Output VAT adjustments are subject to specific conditions. Let us discuss the adjustments of Bad Debts in detail. What are Bad Debts? Before we proceed to understand the Article (64) regarding […]

What Are Tax Exemptions?

Tax Exemptions are a form of deduction that IRS allows to every taxpayer in the federal income tax. These tax exemptions reduce your taxable income similar to the allowable deductions. Taxpayer often either don’t pay attention to these tax exemptions and tend to pay higher taxes. Knowing these exemptions will help you reduce your tax liability.

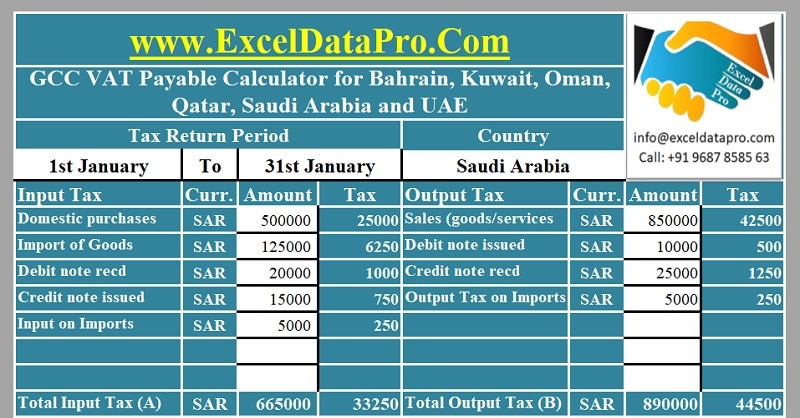

Download GCC VAT Payable Calculator For All 6 GCC Countries

GCC VAT Payable Calculator is an excel template with predefined formulas for easy computation of VAT liability. Output VAT less of Input VAT is GCC VAT Payable. UAE, Qatar and Saudi Arabia are all set to start implementing GCC VAT from Jan 2018. Bahrain, Oman, and Kuwait have also signed the agreement but implementation dates […]

What Are Itemized Deductions?

Itemized Deductions are a type of Allowable deductions in the federal income tax, in which actual expenses are considered instead of Standard Deduction.

Intra-GCC Transactions Under GCC VAT Law

Intra-GCC transactions are the transactions (sales and purchases) between member states of GCC. Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE have signed the GCC VAT Agreement. VAT is all set to be implemented in across GCC from January 2018. Exports outside the country under the GCC VAT Law are zero-rated. But what about the transaction […]