FTA has published the list of the designated zone in UAE vide Cabinet Decision No. 59 on Designated Zones. According to Article (2) of Cabinet Decision No. 59 on Designated Zone: “The Cabinet has the authority to amend the list of Designated Zones annexed to this Decision, by addition, deletion or amendment.” To download the pdf […]

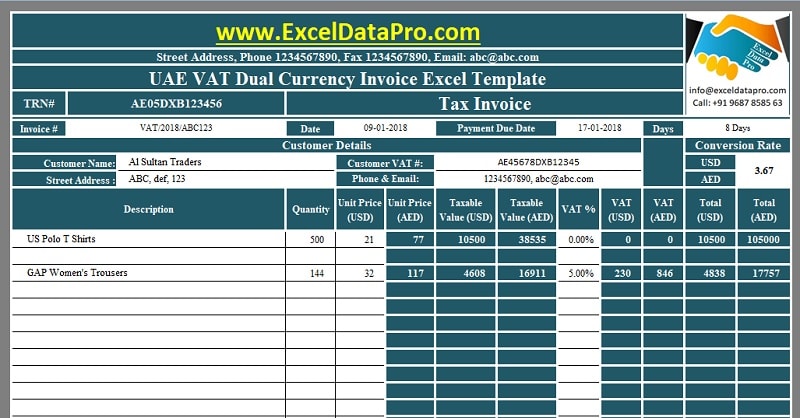

Download UAE VAT Dual Currency Invoice Excel Template

For Exports, we have created the UAE VAT Dual Currency Invoice is used when the invoice is prepared in currency other than UAE Dirham. Furthermore, it is mandatory by law to mention the tax amount in AED with the applied exchange rate.

Step-By-Step Guide To Obtain UAE VAT Tax Registration Certificate

Cabinet Decision No. (39) of 2017 on fees for services provided by the Federal Tax Authority (FTA) provides the amount to be collected as fees for issuing Tax Registration Certificate. See image below for reference: To download the PDF copy Cabinet Decision from the FTA website click on the link below: Cabinet Decision No. (39) of […]

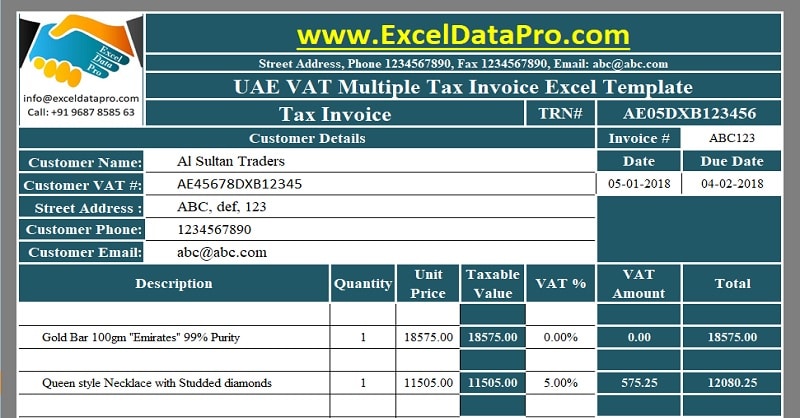

Download UAE VAT Multiple Tax Invoice Excel Template

When you supply goods with different tax rates, you will require the UAE VAT Multiple Tax Invoice. It is an invoice used for goods or services of multiple tax rates taxable(5%), nil(0%) rated or exempt all in one invoice.

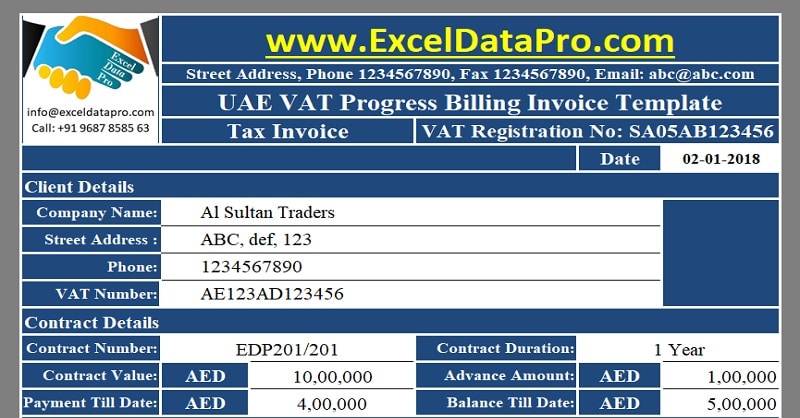

Download UAE VAT Progress Billing Invoice Excel Template

Progress Billing Invoice is a type of invoice used to obtain part payment of the total contract amount from your clients as agreed in the contract.