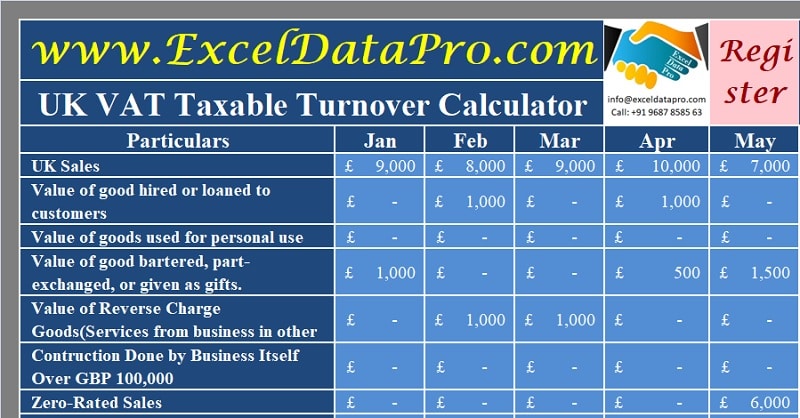

To simplify the process, we have created a simple and easy UK VAT Taxable Turnover Calculator to calculate taxable turnover for registration purposes in just a few minutes. Enter respective sales for each month and the template will automatically calculate the total turnover during the past 12 months.

Step By Step Guide TO UK VAT Registration Process

Every business has to register for VAT with HM Revenue and Customs if their VAT taxable turnover is above the given threshold and depending on the scheme selected. Upon registration, HMRC provides you with a VAT registration certificate. The VAT registration certificate displays your VAT number and the date of the first VAT return and payment.

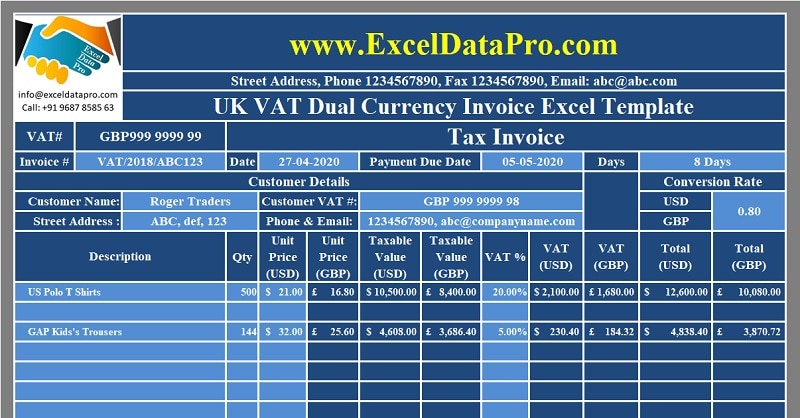

Download UK VAT Dual Currency Invoice Excel Template

We have created the UK VAT Dual Currency Invoice excel template with predefined formulas that will help you to issue the invoice with 2 currencies. One is Sterling Pound and another currency whichever is applicable. A dual currency invoice is prepared when the goods or services supplied are from a foreign location or in foreign currency. It is mandatory by law to mention the tax amount in sterling with the applied exchange rate.

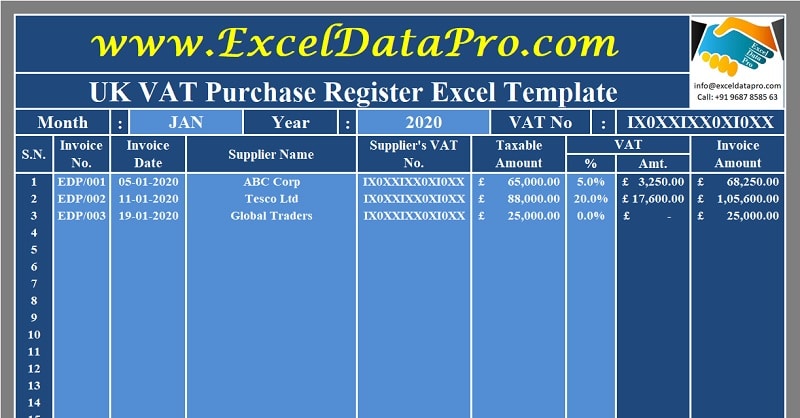

Download UK VAT Purchase Register Excel Template

We have created a simple and easy UK VAT Purchase Register Excel Template with predefined formulas and formating. You can easily record your VAT purchases as well as purchase return transactions in it. This template auto-calculates the VAT amount for the given taxable value.

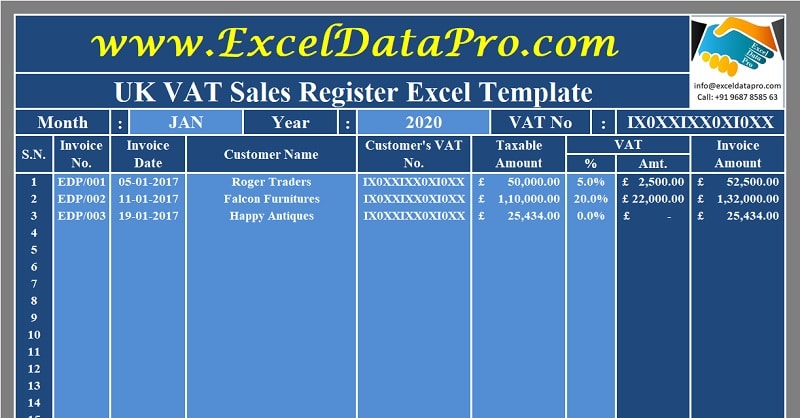

Download UK VAT Sales Register Excel Template

We have created a simple and easy UK VAT Sales Register Excel Template with predefined formulas and formating. You can easily record your VAT sales as well as sales return transactions in it. This template auto-calculates the VAT amount for the given taxable value.