Arabic VAT Invoice Template is an excel template in the Arabic language that can be used for all 6 countries under GCC VAT Agreement.

We received multiple requests from our readers to provide the Arabic version of our VAT Invoice Template which was earlier created in English.

2017 is about to end and only a few days to the launch of VAT implementation in UAE and Saudi for now. Other GCC countries who have signed the agreement will implement VAT in near future.

Businesses whose turnover is above the threshold have to mandatorily register for VAT and other businesses can also register voluntarily.

We have created a ready to use VAT Invoice Template in Excel. The user just needs to select his country and can start issuing VAT compliance invoices to their customers.

This template can be useful to accounting professionals, clerks, trading companies etc.

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

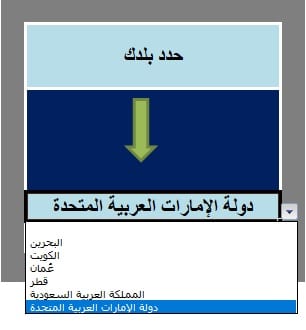

Before proceeding to the template contents, you need to select your country from the box given beside the template. See image for reference:

A dropdown list has been created using data validation tool for all 6 VAT implementing GCC countries. When you select your country the currencies will automatically change to the respective currency.

Let us discuss the contents of the template in detail.

Content of Arabic VAT Invoice Template

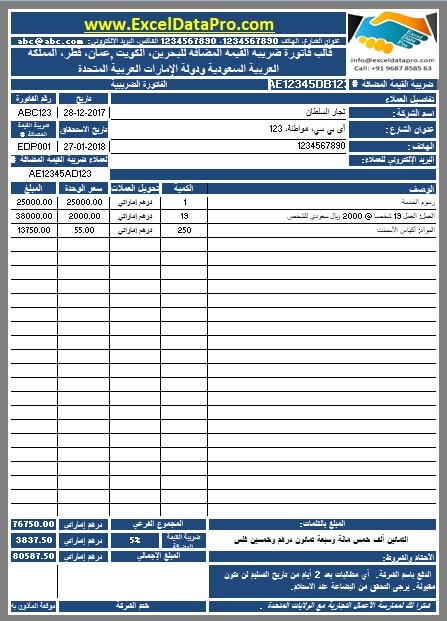

Similar to the English version of VAT Invoice Template, this template also contains 2 worksheets.

- Arabic VAT Invoice Template.

- Database Sheet.

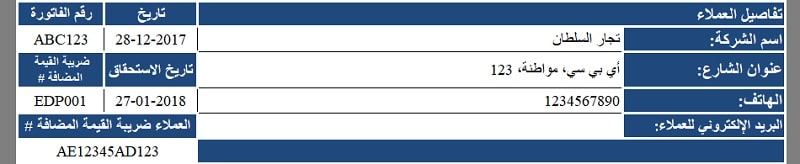

The Database sheet consists of details of your customers like customer name, customer address, customer phone numbers and customer email address.

The sheet has been programmed with VLOOKUP function to display the customer details of the selected customer. Enter your customer details that you need to reflect on the invoice.

See image for reference:

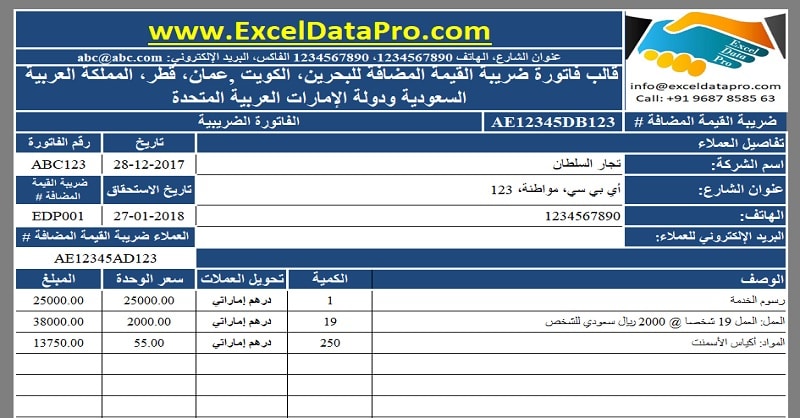

Arabic VAT invoice is designed from right to left. Arabic VAT invoice template consists of 4 sections as in the English version.

- Supplier Details

- Customer Details

- Product Details

- Calculation and Other Details

1. Supplier Details

Supplier details section is the header section. This section contains your company name on top of the invoice heading. Then your address, Invoice type, your VAT number along with your logo on right.

2. Customer Details

This section consists of customer details. It contains predefined formulas using the VLOOKUP Function.

A dropdown list for the customer has been created. When you select the customer name from the list it will automatically update all other details except the email address. Email to be entered manually.

3. Product Details

Product details consist the details of goods or services sold like product description, quantity, rate, and totals.

Subtotal for the amount column has been given below and displays the total invoice amount before tax.

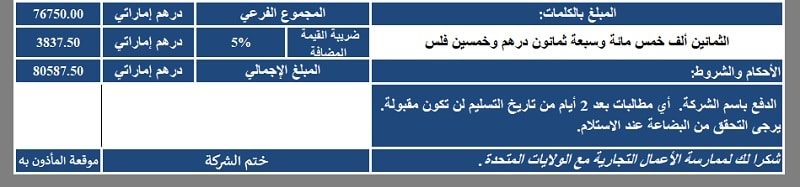

4. Calculations and Other Details

This section consists of 5% VAT computation on the subtotal amount of the invoice.

In addition to that, it also consists of the “Amount In Words”, terms & conditions, space for company seal. space for the authorized signatory and business greetings.

Edit the Terms & Conditions as per your requirement. The ” Amount in Words section is to be entered manually.

Use this ready to use invoice template by entering your company credentials. Start issuing VAT compliance invoice to your clients.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.