YEARFRAC Function calculates the fraction of the year represented by the number of whole days between two dates (the start_date and the end_date). The YEARFRAC is a worksheet function.

It is used to identify the proportion of a whole year’s benefits or obligations to assign to a specific term.

In other words, YEARFRAC function returns the number of days between 2 dates as a year fraction.

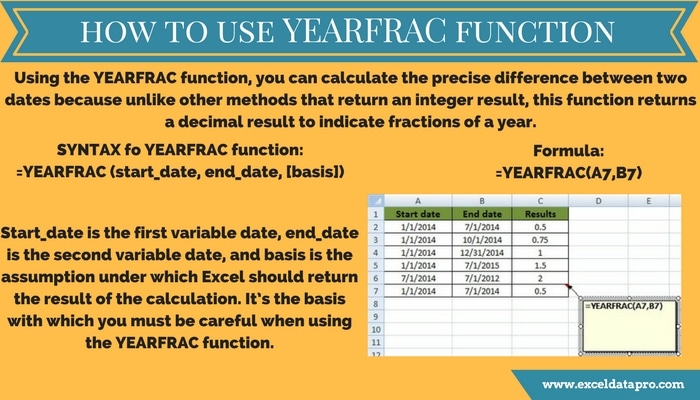

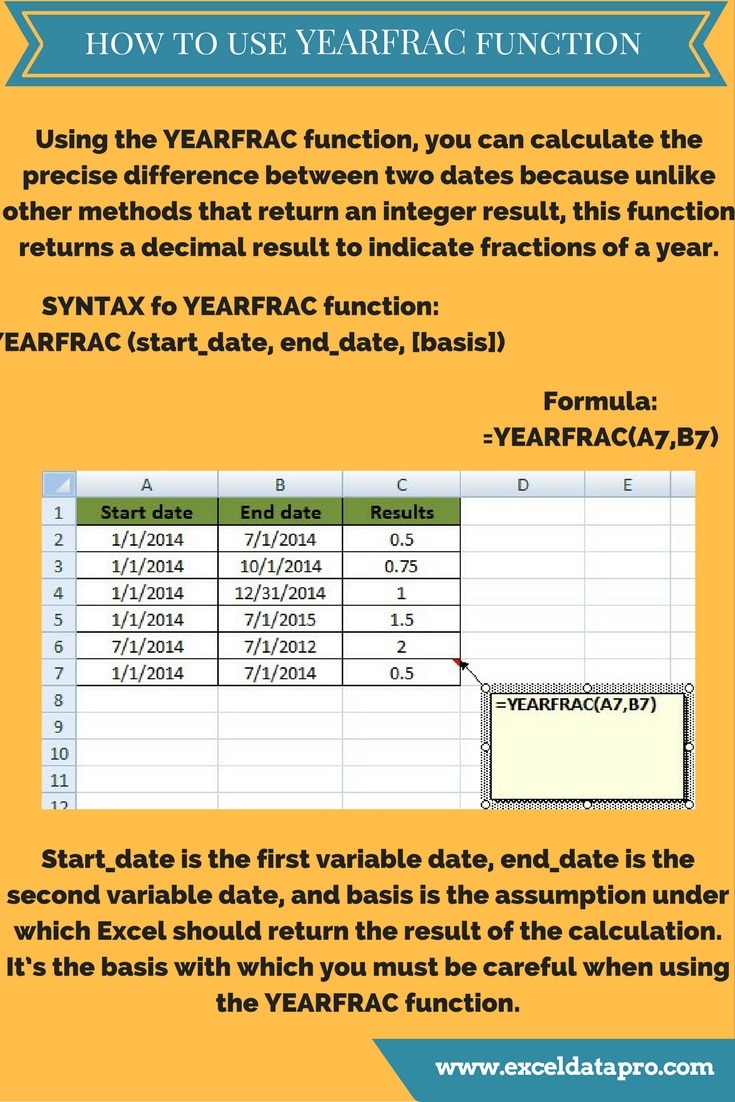

SYNTAX for YEARFRAC Function:

=YEARFRAC(start_date, end_date, [basis])

We have created the infographics for YEARFRAC Function. This is a step by step process to for learning excel functions easily.

Excel consists of many inbuilt functions which are helpful in the analytical and statistical study of number.

Simply follow the instructions in the infographics below:

Normally, when we divide no of days we get a fractional proportion for that period. Instead of doing that you just need to use the YEARFRAC function.

As shown in the above example, in Column C the YEARFRAC function calculates the fraction of the year for given dates in Column A and Column B.

In this function the Basis is optional. It is the type of day count basis that we instruct the function to use. But when you use it you need to use it very carefully.

- Basis 0: US (NASD) 30/360 – default

- Basis 1: Actual/actual

- Basis 2: Actual/360

- Basis 3: Actual/365

- Basis 4: European 30/360

You can also find downloadable accounting templates like Accounts Receivable With Aging, Accounts Payable With Aging, Salary Sheet and many other useful templates on our website.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply