US Federal Fiscal Calendar 2019-20 With Notes Excel template is made with 3 variations and available in images, downloadable/printable pdf, and excel.

Note: Australia Bangladesh, Egypt, Nepal, New Zealand, and Pakistan have the same fiscal year as the US. Thus, these templates can be used for all these countries also.

You can enter the date and the respective fiscal event in the Notes section. Events can include GST-Returns submission dates, Personal IT-Returns, Corporate IT-Returns, Audit Submissions, etc.

These templates are 100% free to download and use. Just download the template and start using it.

This calendar template is very useful to small and medium business owners, accountants, accounting professionals like CPA, CMA, CA, CFO, CS, etc for keeping in line with their fiscal events.

What is a Fiscal Year?

A 12-month period for which government institutions and businesses prepare their annual reports for the purpose taxes like Income Tax, Goods & Services Tax (GST), Value Added Tax (VAT) and other government taxes is called a fiscal year.

In the US, the fiscal year starts from 1st July to 30th June next year. Different countries have different fiscal calendars.

Furthermore, the following countries also have the same fiscal year; Australia Bangladesh, Egypt, Nepal, New Zealand, and Pakistan. A minor change in dates will be there in these countries.

Let us discuss the contents of the template in detail.

US Federal Fiscal Calendar 2019-20 With Notes Excel Template

We have created a simple and ready-to-use US Federal Fiscal Calendar 2019-20 with Notes excel template with 3 color schemes. It also consists of downloadable pdfs and images along with the excel template.

Click here to download US Federal Fiscal Calendar With Notes Excel Template

Furthermore, you can also download our 100 Years Calendar from the link below:

100 Years Excel Calendar Template

Contents of US Federal Fiscal Calendar 2019-20 With Notes

The template includes 3 different sheets for the US Federal Fiscal Calendar 2019-20 with Notes;

- Colored

- Black & White

- Ink Saver.

Each sheet consists of a Notes section beside the calendar. Notes section consists of 2 columns; Date and Description.

You can add the date on which any fiscal event is coming up and the name of the respective event in the description section.

These dates and events will be fiscal dates on which events sales tax returns, federal income tax returns, Corporate Federal Income tax return submission dates, assessment dates, corporate return submission dates, etc.

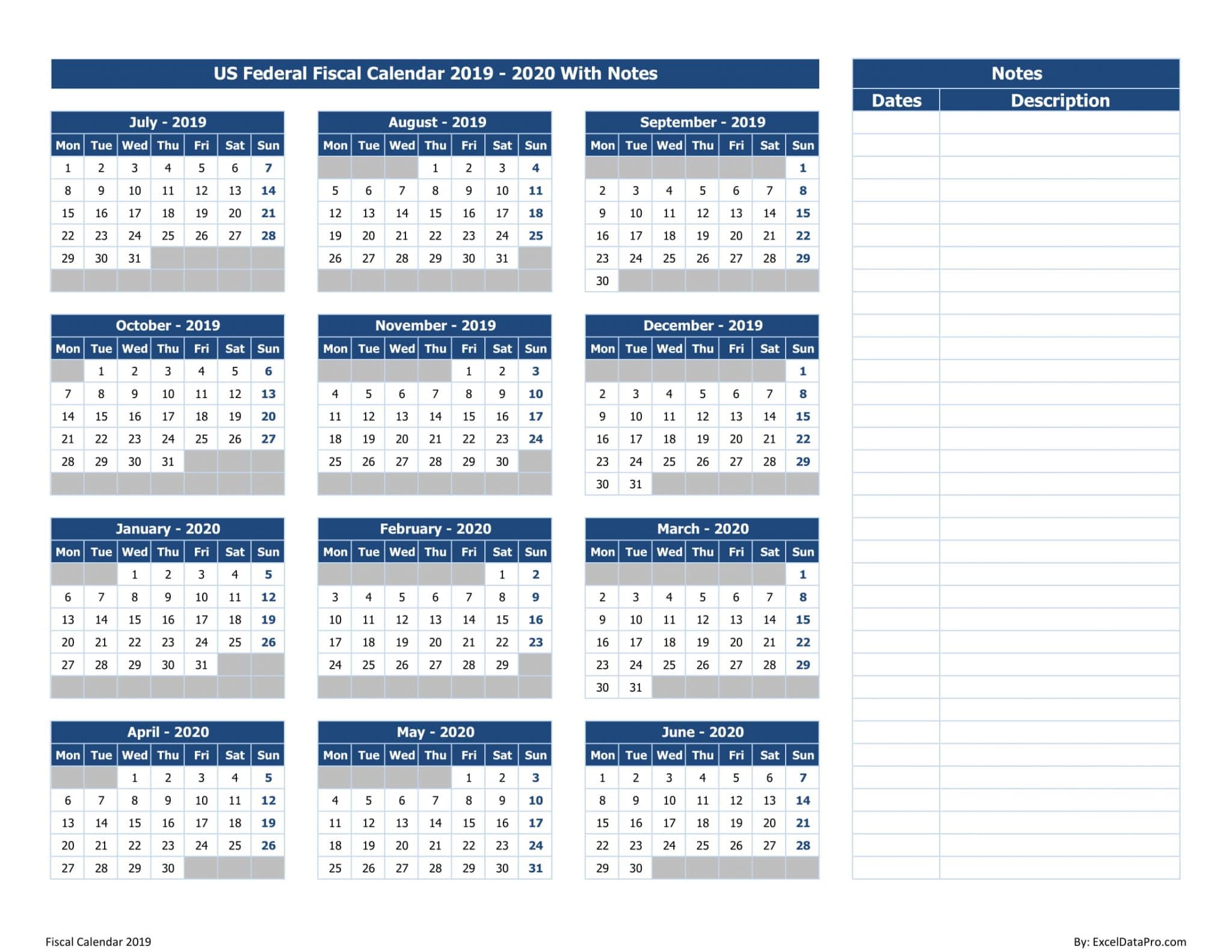

Colored – US Federal Fiscal Calendar 2019-20 With Notes

With the week starting on Monday, the colored variation is a simple fiscal calendar. 12 Months Calendar from 1 July 2019 to 30th June 2020.

Blue is considered as a professional color. The print area is already set and you can directly take the print.

You can customize the colors according to your needs. To do so follow the steps below: Go to Home Tab, in Font tab select the Font Color or Fill Color and choose your desired color.

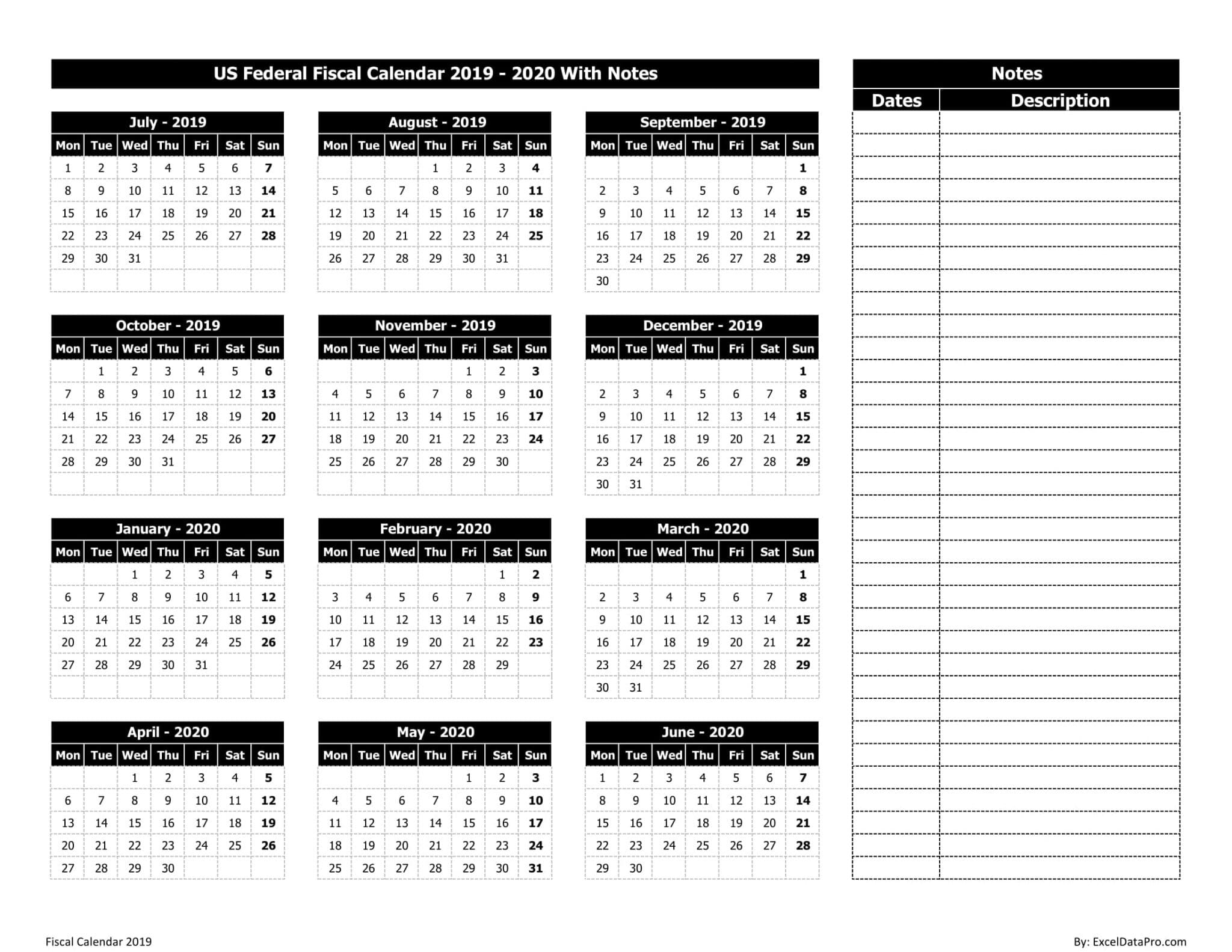

Black & White – US Federal Fiscal Calendar 2019-20 With Notes

Black & White is a generic color scheme that is acceptable to everyone. The prints of Black & White cost you less than as compared to colored prints.

Similar to the colored file, this file also consists of 12 months; 1st July 2019 to 30th June 2020 & the week starts on Monday.

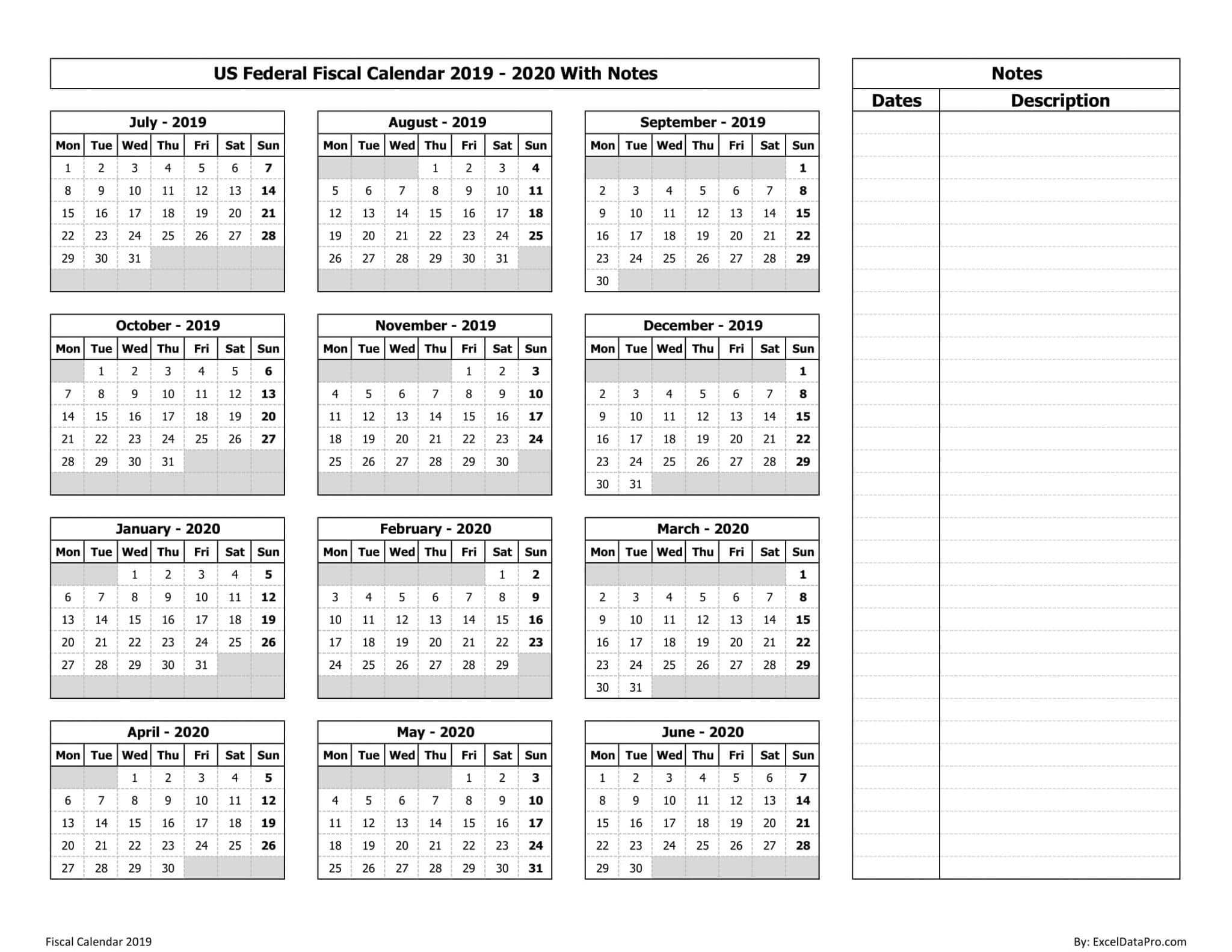

Ink Saver – US Federal Fiscal Calendar 2019-20 With Notes

Finally, in the third sheet, the calendar is made in the Ink Saver color scheme. It is an economic option of printing. It saves unnecessary usage of ink and thus saves money. As it has the least colors and more copies can be printed.

Similar to the colored and black & white color scheme, it consists of the same 12 months that is July 2019 to June 2020.

Download Printable Calendar PDFs and Images of Calendar 2019 by clicking the button below:

We thank our readers for liking, sharing and following us on various social media platforms.

If you have any queries or suggestions, please share in the comment section below. We will be more than happy to assist you.

Leave a Reply