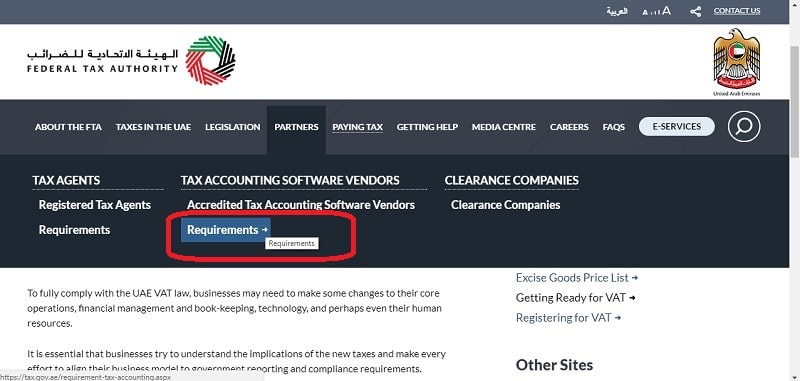

UAE VAT Return Format has been published to FTA site. You can find it in the menu under partners, below Tax Accounting Software Vendors in Requirements.

UAE VAT Return Format is on page 48 under Appendix 8 – VAT Return Format. The VAT Return Format start from page 48 and ends at page 57.

To simplify the document and avoid confusion we have cut the pdf from page 48 to page 57.

To download only the VAT Return from our server click the link below:

The work done here by FTA is really appreciable. The document is very precise and self-explanatory. It gives the description of each field to be filled in detail.

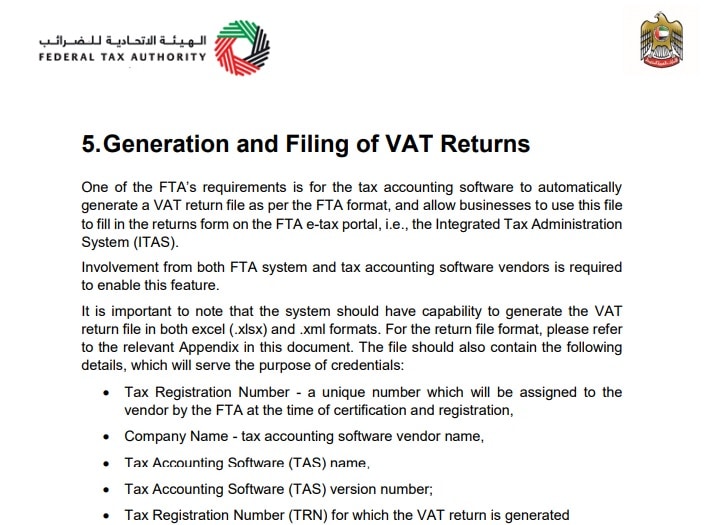

The VAT returns are required to be filed electronically on FTA portal. As prescribed by FTA, the acceptable format will be either in excel (.xlsx) and .xml format.

Reference:

If the registrant is using the software that is approved by FTA, return filing will be available in the software.

UAE VAT Return will consist of the consolidated details of total supplies. These Supplies include both purchase and sales, VAT collected on supplies, recoverable input VAT paid on purchases, and the total tax due.

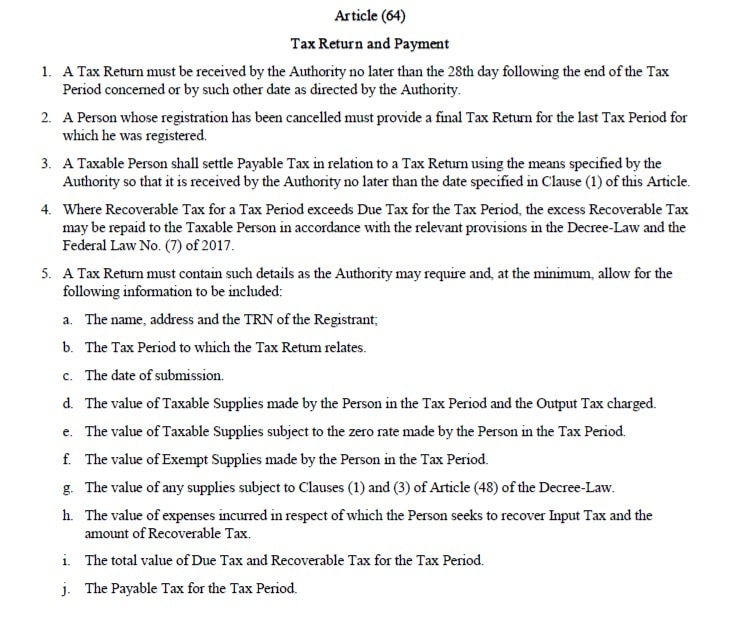

Article 64 of the Executive Regulations has prescribed the mandatory details to be given on a VAT return. See image below for reference:

Summary of Details to be filled in UAE VAT Return Format

Details of Registrant

Giving your TRN number in the VAT return is mandatory. TRN is provided by the FTA when you register for VAT. Name and address details are also to be mentioned in VAT Returns.

An accounting software which complies with UAE VAT Return Format will auto-populate them for you.

VAT Return Period

VAT Return period consists of 3 details to be furnished, that is VAT return period, Tax Year and VAT Return Reference number.

VAT on Sales and all Other Outputs

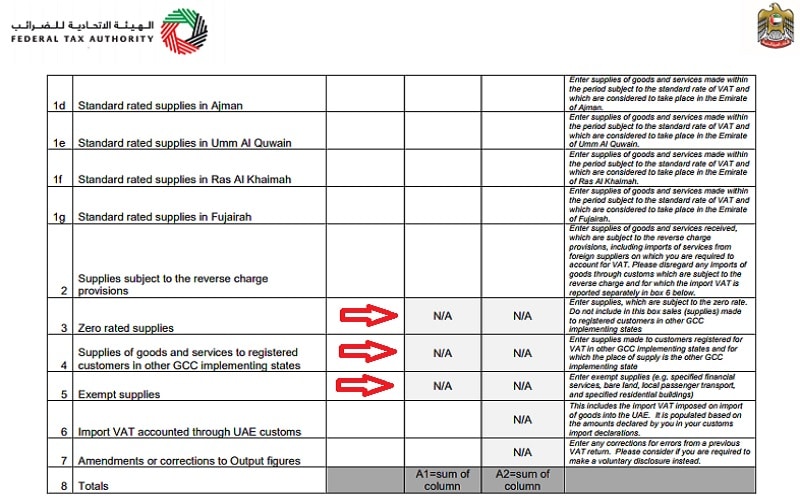

Here you will enter details of sales made during the tax period. Standard supplies related to each emirate has to be mentioned differently.

Thus, it is clear that the registrant needs to maintain the records accordingly to avoid last minute delays.

In addition to the above, supplies related to reverse charge, zero-rated supplies, supplies to registered customers in other GCC implementing states, exempt supplies. import VAT accounted through UAE customs etc are to be furnished.

It is clear from the UAE VAT Format by FTA that zero-rated supplies, exempt supplies and the supplies made to registered customers in other GCC implementing state doesn’t attract VAT.

View the screenshot below for reference:

Lastly, the totals of both the column are given below referred as A1 and A2.

VAT on Expenses and all other Inputs

VAT related to expenses (that are used for taxable supply) and all other kinds of inputs are reported in this section.

This includes Standard rated expenses, supplies subject to reverse charge and amendments if any. At the end, the totals of both the column are given below and referred as A3 and A4.

Net VAT Due

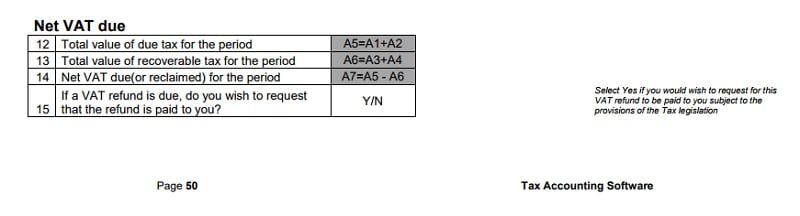

The Net amount of VAT due is calculated as below:

- The total value of due tax for the period referred here as A5, where A5 = A1 + A2.

- The total value of recoverable tax for the period referred here as A6, where A6 = A3 + A4.

- Net VAT due(or reclaimed) for the period referred here as A7, where A7 = A5 – A6.

- If the amount of output is less than the input amount, then the registrant is eligible for a refund. Thus, if the registrant willing to claim he should provide yes in this column.

In case the registrant doesn’t take the refund the balance VAt will be adjusted in preceding tax periods.

Additional Details

The above details will be applicable to all the VAT registrants. Apart from the above-mentioned details, the return format also consists of other additional details as listed below:

- Profit Margin Scheme applicability.

- Imported Goods transferred to other GCC implementing states.

- VAT paid on personal imports via Agents.

- Transportation of own goods to other GCC states.

- Recoverable VAT paid in other GCC implementing states.

- Tax Refunds for Tourists Scheme.

Declaration

At the end, the registrant signs a declaration with following details:

- Online Username (English)

- Online Username (Arabic)

- Declarant name (English)

- Declarant name (Arabic)

- Emirates Identity Card number

- Passport number (if no Emirates ID available)

- Declarant mobile country code

- Declarant mobile number

- e-mail address

- Submission Date

Disclaimer: The explanations provided here are for educational purpose and does not give any legal binding against the law. Authenticate references from the Law have been provided for the understanding.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.