VAT is all set to be implemented in UAE from Jan 2018. Article 54 to Article 56 of UAE VAT Law describes the conditions and eligibility of claiming UAE VAT Recoverable Input Tax.

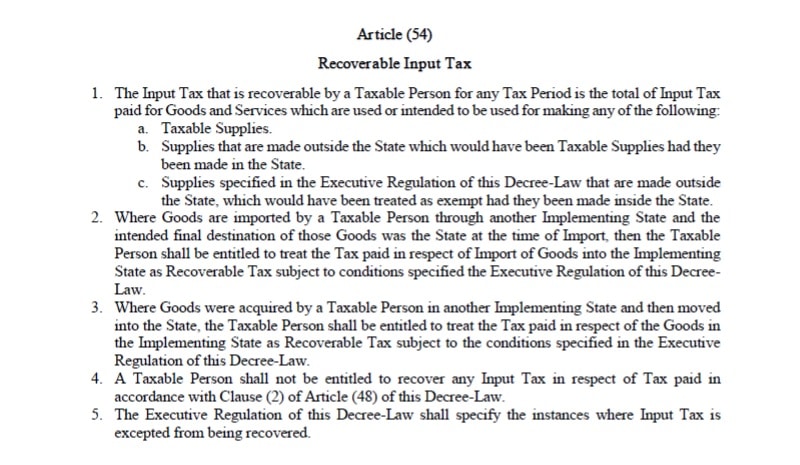

Article (54) – UAE VAT Recoverable Input Tax

Source: www.mof.gov.ae

In simple terms, a registered person is liable to recover input tax paid on the purchase of goods and services intended for the furtherance of business except for capital goods.

If there is no provision for collection of Input of VAT paid, increase in prices of good and services will be big. Thus, making the goods and services more expensive.

Case Study Supply Of Goods Without UAE VAT Recoverable Input Tax Credit

Let us take an example of a supply chain of the textile industry.

Supply from Manufacturer to Distributor

Sale Price – AED 100 , 5% VAT – AED 5, Total Price – AED 105

Supply from Distributor to Retailer

Sale Price – AED 115 , 5% VAT – AED 5.75, Total Price – AED 120.75

Supply from Retailer to Consumer

Sale Price – AED 135 , 5% VAT – AED 6.75, Total Price – AED 141.75

Hence, the price payable by the consumer includes VAT of AED 17.50 (5+5.75+6.75).

Case Study Supply Of Goods With UAE VAT Recoverable Input Tax Credit

Let us take an example of a supply chain of the textile industry.

Supply from Manufacturer to Distributor

Sale Price – AED 100 , 5% VAT – AED 5, Total Price – AED 105

The manufacturer gets the credit of VAT for raw materials used if he has paid VAT on it. In this case, we consider not VAT Paid.

Supply from Distributor to Retailer

Sale Price – AED 110 , 5% VAT – AED 5.50.

The Distributor gets Input Credit of VAT amount AED 5 paid to Manufacturer. So VAT payable is 5.50 – 5.00 = 0.5.

Hence, he can now adjust the sale price forwards the benefit of VAT Inputs to his supply chain.

Total Price – AED 115.50

Supply from Retailer to Consumer

Sale Price – AED 125 , 5% VAT – AED 6..25,

The Retailer gets Input Credit of VAT amount AED 5.50 paid to Distributor. So VAT payable is 6.25 – 5.50 = 0.75.

Total Price – AED 131.75

Hence, the price payable by the consumer includes VAT of AED 6.25 (5+0.50+0.75).

This is the benefit of UAE VAT recoverable Input.

Furthermore, every person in the supply chain is collecting the same amount of profit as earlier. This creates a win-win situation for all.

As we can see that the price difference to be paid by the consumer is less in UAE VAT Recoverable Input Tax system.

Price Without Input – Price With Input

141.75 – 131.75 = AED 10.

You can download UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.