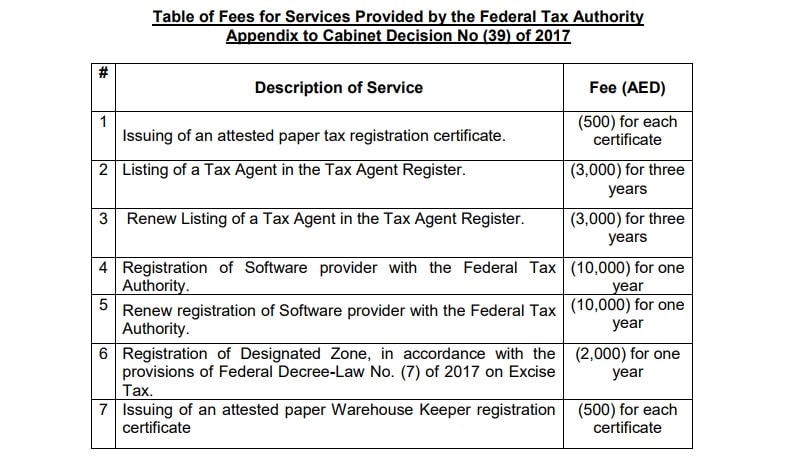

Cabinet Decision No. (39) of 2017 on fees for services provided by the Federal Tax Authority (FTA) provides the amount to be collected as fees for issuing Tax Registration Certificate.

See image below for reference:

To download the PDF copy Cabinet Decision from the FTA website click on the link below:

Cabinet Decision No. (39) of 2017

To download the same PDF copy Cabinet Decision from our server click on the link below:

Cabinet Decision No. (39) of 2017

To obtain a hard copy of the Tax Registration Certificate the FTA has given a procedure to follow.

Let us discuss it in detail.

Step-By-Step Guide To Obtain Tax Registration Certificate

1. Email to FTA Certificate Department

Send an email to certificates@tax.gov.ae with your TRN (Tax Registration Number) and a request to issue a hard copy of the tax copy in the favor of the company.

Please ensure that:

- Sender is one of the Authorized Signatories

- TRN is stated in the email

FTA will match the details and if found correct the request is will be entertained.

2. Receiving Request Number

In response to your application, FTA will provide you with a Request Number. This Request number will be used for making payments on FTA portal for the fees.

3. Making Payment of FTA fees for Certificate

As mentioned above, the fees for this service is AED 500. A payment of AED 500 should be made on the FTA portal eservices.tax.gov.ae

Log in using your email address and password.

Go to My Payments-Miscellaneous Payments section. Enter the Request Number provided by FTA into the payment form.

Payments can be easily made using an E-Dirham card or other debit or credit cards. On successful payment of the fees, you will receive a payment reference number.

4. Sending Payment Reference number to FTA

Send the Payment Reference Number in reply to the email address which provided you with the request number.

5. Receiving the Hard Copy of Tax Registration Certificate

On successful completion of the above steps and acceptance by FTA, they will print the Tax Registration Certificate and send it the applicant’s address that was provided while registration process.

You can also download UAE centric templates like Arabic VAT Invoice Template, GCC VAT Invoice Template With Discount and UAE VAT Payable Calculator from our website.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.