The only way to reduce federal tax liability is to lower your tax bracket. Tax percentage decreases as taxable income reduces. In this article, we will discuss 5 legal ways that help you reduce federal tax liability.

While preparing your taxes, we usually forget to maximise the benefit given by the law to us. The reason behind it is either we don’t know about them or we know but forget to do so due to time constraint (last moment filing).

You don’t need to be a tax pro or an accountant to do so. Paying a little bit of attention can help you save a lot of money in the form of tax.

Using these simple tactics, you can smart people tend to receive tax refunds or at the least minimize your Federal tax liability.

Taxes take away a large amount of our income. Thus, it will be smart trying to reduce them in every possible legal way.

5 Legal Ways To Reduce Federal Tax Liability

There are many ways to reduce your taxable income, some would be approved by IRS some not. Here we will look for 5 legal ways that are in accordance with the IRC (Internal Revenue Code).

1. Adjusting your Withholding Tax

Taxes are deducted from your paycheck. These taxes are called withholding taxes which are adjusted against your tax liability. If they are more you get a refund or pay the difference.

Usually. these refunds aren’t good as they seem. Basically, it is the settlement with the government.

You could have received that money and put it to earn for you the whole year. It could be anything, a retirement or a savings account.

It doesn’t lower your tax bill. You will pay at the time of tax filing. But you can have a pay raise and get control of your hard earned money.

An employee can adjust your withholding at any time of the year. To do so, he/she just needs to file Form W-4 and submit it to the employer.

You can use the Withholding Calculator available on IRS Website.

2. Donating Smartly to Charity

Charitable donations are eligible to be deducted from your income. You need to keep receipts of the donations that you make. Donations can be either in the form cash or items.

A smart way to do is to clear your wardrobe at regular intervals and donate the unwanted stuff to charity. If you are volunteering, you can deduct miles that you travel it.

3. Contributing to IRAs

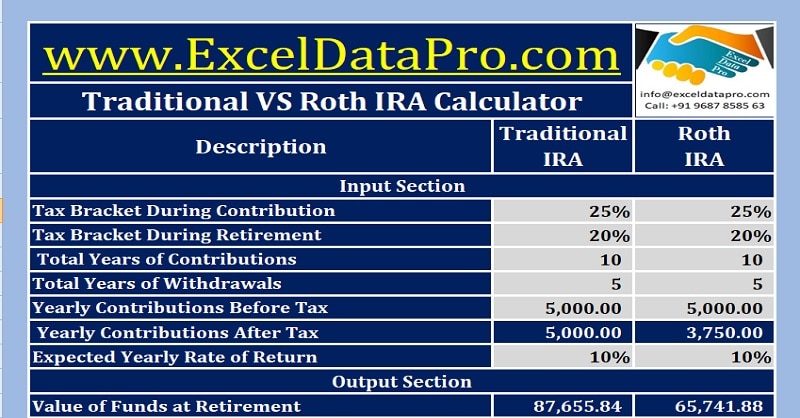

Contributing to Traditional or Roth IRAs is a good option to reduce Federal tax liability.

Contributions to Traditional IRAs will give you the advantage of decreasing your taxable income in the contributing year. Whereas the contributions to Roth IRAs are taxable during the contribution year.

In Traditional IRAs, the withdrawals are taxable during retirement, but in Roth IRAs the withdrawals during retirement years Roth IRAs are tax-free.

Usually, people prefer to go for Roth IRAs as you can withdraw the contributions tax-free and penalty-free at any time even before the age of fifty-nine and a half years.

To compare the returns between a Traditional IRA and a Roth IRA, you can use Traditional VS Roth IRA Calculator.

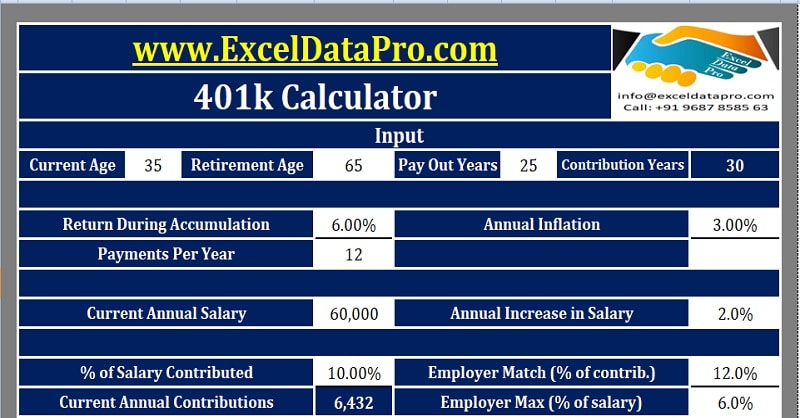

4. Contributing to 401k Plan Or Flexible Spending Account

A 401k plan is a type retirement plan that can only be sponsored by an employer. In this employees can save and invest a specific portion of their paycheck before taxes which helps to again reduce federal tax liability.

Withdrawals before the age of retirement are subject to penalties. As taxes are paid at the time of withdrawal, you can save your hard earned money going out in the form of tax.

If your employer offers such plan do not leave this opportunity. You can use our 401k Calculator to calculate the total amount of money you could save during until your retirement age.

Another option to reduce your Federal Income Tax Liability is a tax-free health flexible spending account. Contributions to such flexible spending account are not subject federal income taxes.

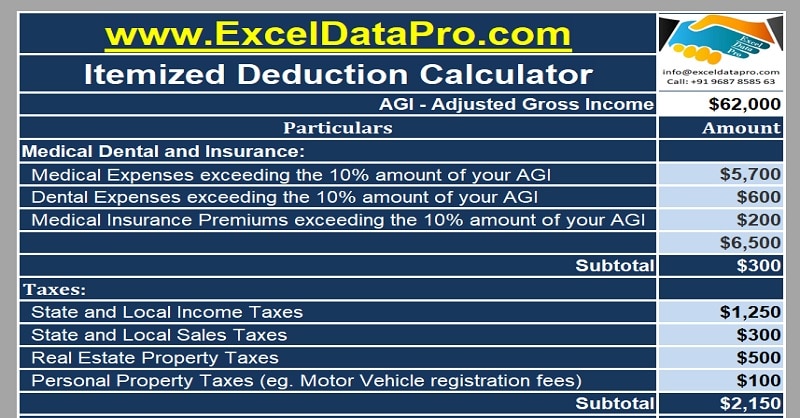

5. Itemized Deductions instead of Standard Deduction

Taxpayer usually makes a mistake choosing between standard and itemized deductions. Standard deductions are for taxpayers whose income levels are really low.

Before choosing standard or itemized deductions, you must check how much the amount of itemized deductions will be by using some of the itemized deduction calculators available on the internet.

You can also use our Itemized Deduction Calculator for this purpose.

Bonus Tips

-

- Pay your bills prior to tax date.

- Installing solar energy systems in your home can get you tax credits up to 30% of the cost of installation.

- Maximum utilization of the tax credits. For example, Child Tax Credit, Child & Dependent Care Credit, Earned Income Credit, Credit for the Elderly or the Disabled, Retirement Savings, Contribution Credit, American Opportunity Tax Credit, Lifetime Learning Credit, Nonbusiness Energy Property Credit, Residential Energy Efficient Property Credit, homebuyer Credit etc.

- Submit State Taxes early to claim them in your Federal Income Tax.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply