Table of Contents

NPV – Definition

NPV stands for Net Present Value. Net Present Value is the difference between the present value of cash inflows outflows over a period of time.

Generally, businesses use NPV for investment planning. It helps to check the profitability of a project or investment. A positive Net Present Value indicates profitability and a negative NPV indicates a loss.

A positive value indicates that the earnings will exceed the anticipated costs and is a profitable investment. Whereas an investment with a negative NPV indicates that the investment will result in a loss based on the cash inflow and outflow.

When cash inflows and outflows vary, you cannot rely on a simple interest rate. Hence, XIRR is used for that purpose to get the actual rate of return based on cash inflows and outflows.

Formula To Calculate NPV

To calculate Net Present Value you need to subtract the cost of investment along with cash outflows if any from cash inflows from investment. Please make sure all the cash inflows are converted to present value.

Example – Net Present Value

Let us understand it with an example.

Company ABC plans to buy heavy machinery for production.

Cost of Purchase: $ 500,000

Cash Inflows:

Year 1: $150,000

Year 3: $125,000

Year 4: $100,000

Year 5: $75,000

Year 6: $65,000

Total Cash Flow = $ 515,000

Thus, NPV = $ 515,000 – $ 500,000 = $ 15,000. The NPV is positive. It means the cash inflow is greater then the investment made and so the invesment is feasible.

If the difference between the present value of the sum of all cash flows would be a negative value, then it means the inflows are lower then the investment made. Thus, investment with negative Net Present Value is not feasible.

How To Calculate Net Present Value in Excel?

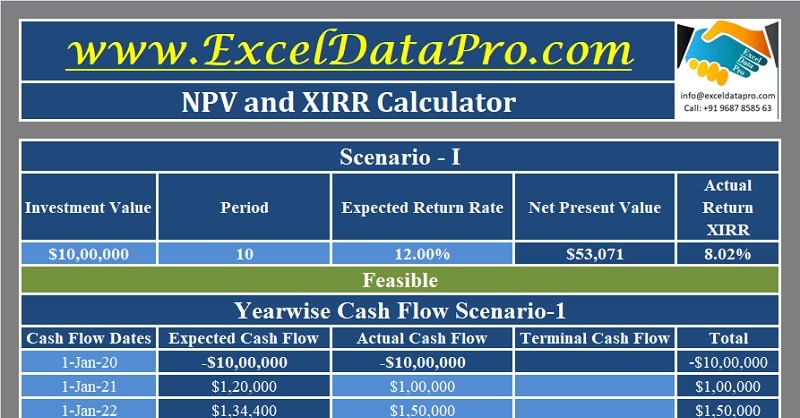

You can calculate the Net Present Value using NPV and XNPV function in excel. In addition to that, we have created a simple and easy NPV and XIRR Calculator Excel Template with predefined formulas. Enter a few details and the template automatically calculates the NPV and XIRR for you.

Additionally, you can compare two different projects/investments based on a given time and provided projected cash flows. Furthermore, the template also compares the data and provides a feasibility report with charts.

Advantages Of Net Present Value

- The Net Present Value analyzes the profitability of a particular project taking the time value of money into consideration.

- It is a comprehensive tool that concludes the feasibility of investment by evaluating inflows, outflows, and risk involved.

Disadvantages of Net Present Value

- Net Present Value calculates the value assuming a rate of return. If the rate of return is assumed higher, then the NPV can be negative.

- It is a projection based method and hence doesn’t consider any unexpected expenditures involved at the beginning or at the end of the project.

Thus. NPV can be helpful to investors looking to buy or invest in businesses, stock traders, and also individual investors.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply