FTA has published Cabinet Decision No. 56 on Medications and Medical Equipment Subject To Tax At Zero Rate. This decision describes that under what conditions Medications and Medical Equipment will be subject to tax at zero rates.

To download the pdf copy of the decision on Medications and Medical Equipments from the FTA server click below:

To download the pdf copy of the decision on Medications and Medical Equipment from our server click below:

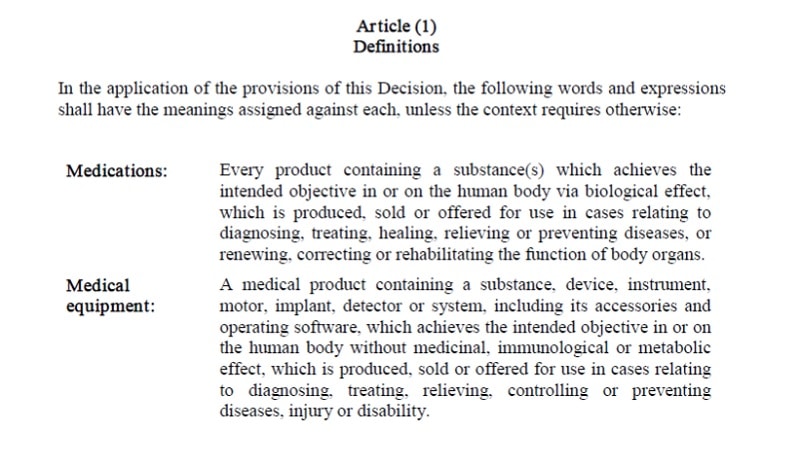

Let us first understand the definition of Medications and Medical Equipment as provided in the Cabinet decision.

Cabinet Decision No. 56 also describes the definition of the Medications as well as the Medical Equipment to be considered for the interpretation of this cabinet decision.

Medications

Article (1) of subject decision states that:

” Every product containing a substance(s) which achieves the intended objective in or on the human body via biological effect, which is produced, sold or offered for use in cases relating to diagnosing, treating, healing, relieving or preventing diseases, or renewing, correcting or rehabilitating the function of body organs.”

In other words, singular component or a mixture of multiple components intended and used for curing diseases is called medication. It can be by the means of diagnosing, treating, healing, rehabilitation etc of the patients.

Medical Equipment

Article (1) again states that

“A medical product containing a substance, device, instrument, motor, implant, detector or system, including its accessories and operating software, which achieves the intended objective in or on the human body without medicinal, immunological or metabolic effect, which is produced, sold or offered for use in cases relating to diagnosing, treating, relieving, controlling or preventing diseases, injury or disability.”

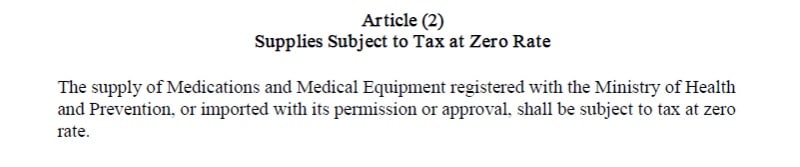

Medications and Medical Equipment Subject To Zero Rate

The Article (2) of the subject article states that ” The supply of Medications and Medical Equipment registered with the Ministry of Health and Prevention, or imported with its permission or approval, shall be subject to tax at zero rates.”

See image below:

There are two things which we need to understand here:

1. The Medications and Medical Equipment that are registered with Ministry of Health and Prevention are subject to zero rates.

OR

2. Medications and Medical Equipment for which prior permission or approval is taken from Ministry at the time of import are subject to zero rates.

If they aren’t any of the above they are subject to the normal 5% tax.

You can download UAE centric excel templates like Arabic VAT Invoice Template, GCC VAT Invoice Template With Discount and UAE VAT Payable Calculator from our website.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply