HRA stands for House Rent Allowance. House Rent Allowance is the amount allocated by an employer to the employee as a portion of their CTC salaries.

The employer decides the house rent allowance depending on different criteria like the city of residence and salary grade.

This allowance is regulated by the Section 10(13A) of the Income Tax Act. Only salaried individuals are entitled to house rent allowance.

Usually, house rent allowance for an employee residing in a metro city is 50% of basic salary and 40% of basic for employees residing in a non-metro city.

HRA Calculations

Metro city Resident = Basic Salary X 50%.

Non-metro city Resident = Basic Salary X 40%.

OR

Actual amount – 10 % of Salary.

Additionally, you can also claim tax deductions against house rent allowance. This claim is only available to employees living in rental accommodations.

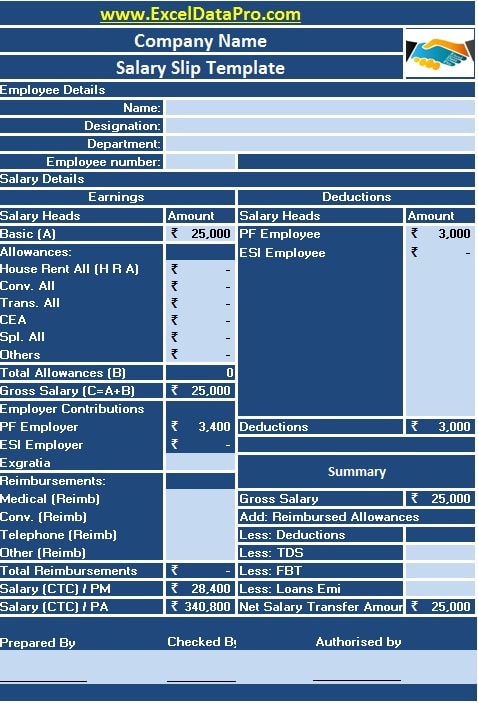

This term is used in Salary Sheet calculations and also in your salary slips. See image below for reference:

If you have any queries please share in the comment section below. I will be more than happy to assist you.