Central Board of Excise and Customs (CBEC) on 8/8/2017 has notified vide Notification No: 21/2017-Central Tax, that the last date to file GSTR-3B return is 20th August 2017 for the month of July 2017.

In simple terms, GSTR-3B is the summary of your sales and purchase made during the tax period.

Dates of GSTR-1 and GSTR-2 have been elongated to September. GSTR-3B is an additional return, that a taxpayer has to file along with GSTR-1, GSTR-2, and GSTR-3.

Though it is just the summary of your sales and purchase, people are finding it difficult to understand it.

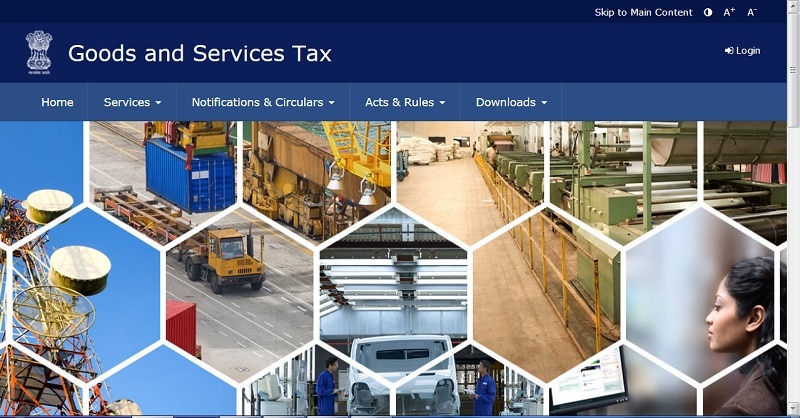

Important Note: GSTR-3B is to be filed online and there is no offline utility for this. It has to be filed manually on GST portal www.gst.gov.in.

This return is prescribed at present only for the period July-2017 and August-2017 Filing.

Important Dates of Filing GST Returns

| MONTH | GSTR-3B | GSTR-1 | GSTR-2 |

|---|---|---|---|

| JULY 2017 | 20th August-2017 | 5th September-2017 | 10th September-2017 |

| AUGUST 2017 | 20th September-2017 | 20th September-2017 | 25th September-2017 |

Let us discuss step by step, how to file GSTR-3B easily in details.

Step By Step Guide TO Easily File GSTR-3B Return

1. Go to www.gst.gov.in and click on Login button on the right-hand side as shown in the figure below:

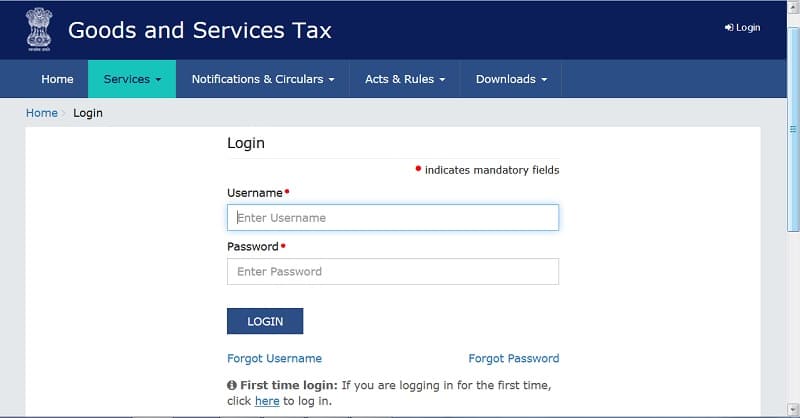

2. Enter your Username and password provided to you by the GST Council.

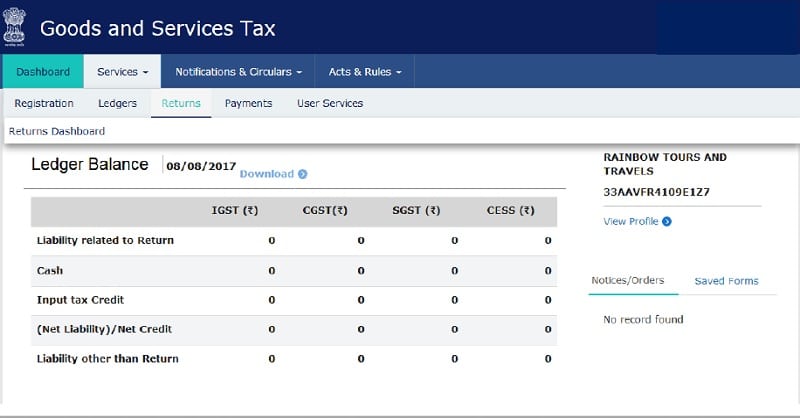

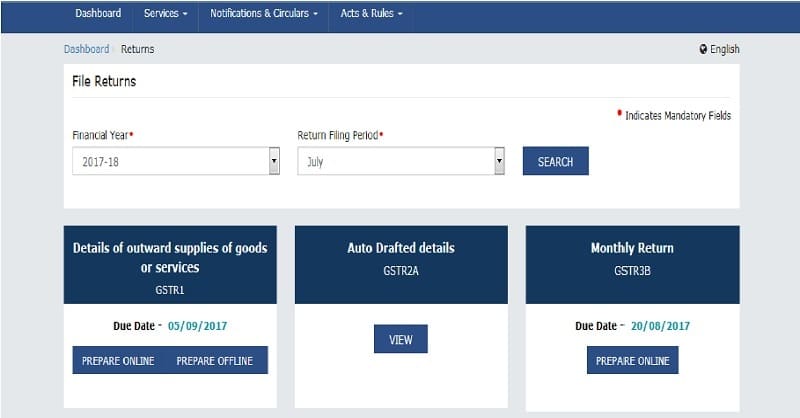

3. After login you will be at the Dashboard. Click on Returns Tab under Services menu.

4. This will open the Return dashboard. Select the assessment year and the month from the dropdown list for which your are filing the return.

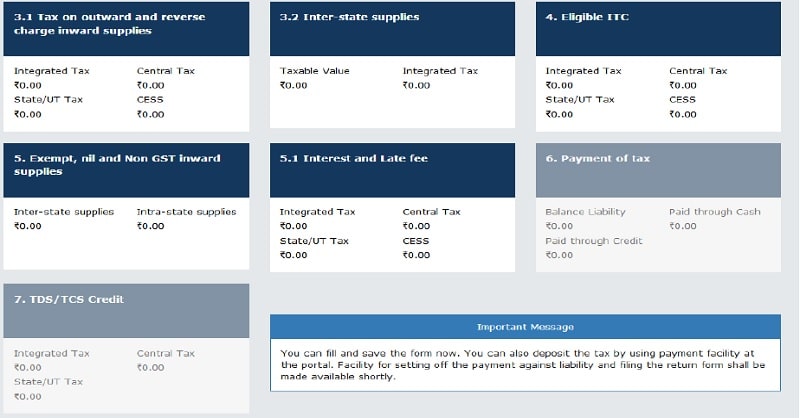

By clicking on Monthly Return – GSTR-3B below screen will appear:

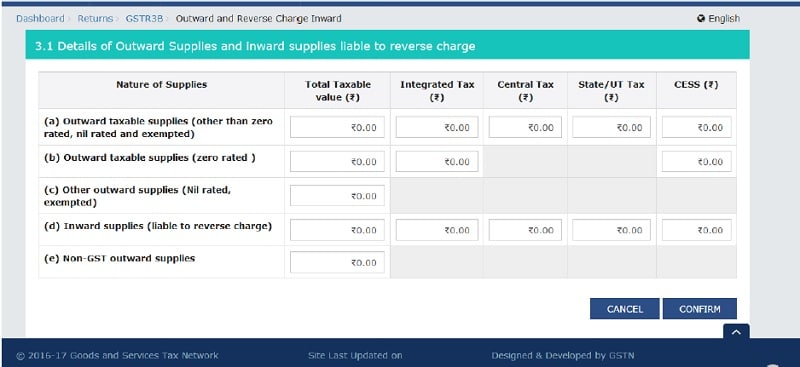

5. Click on 3.1 Tax on outward and reverse charge inward supplies.

In this section, you need to enter your summarized taxable value sales on which GST is collected along with reverse charge on purchases if you have purchased any goods or services on reverse charge.

Fill in all the details and click on Confirm button. It will take you to the next screen.

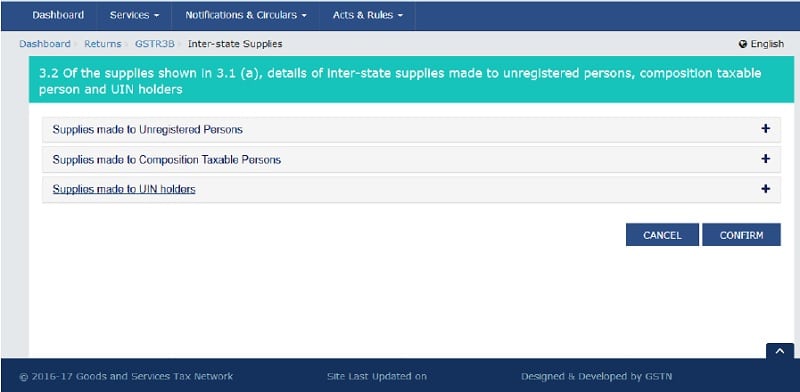

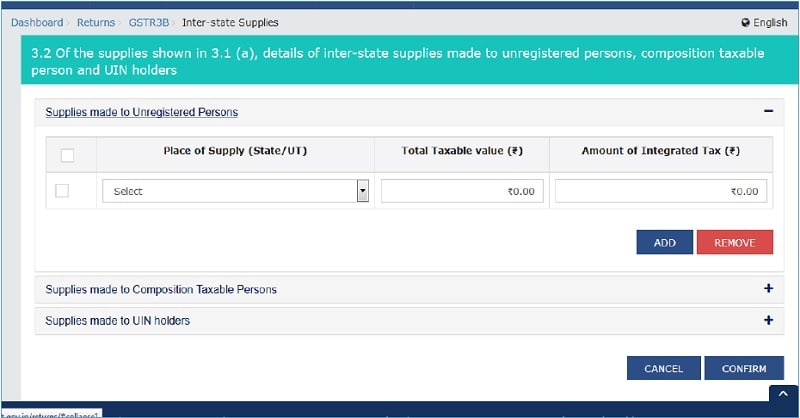

If you have any inter-state supplies made to unregistered buyers, composition taxable persons and UIN holders, you need to enter it in this section.

If you haven’t made any such supplies, you can leave it blank.

Select the Place of Supply (POS) from the drop-down, enter total taxable value and amount of Integrated Tax (IGST).

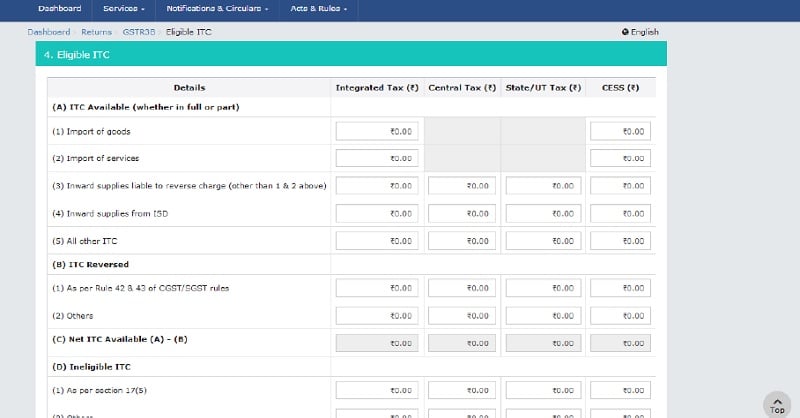

6. Enter details of Input Tax Credit (ITC)

ITC section consists of 4 sections, viz; ITC Available, ITC Reversal, Net ITC available and other non-eligible.

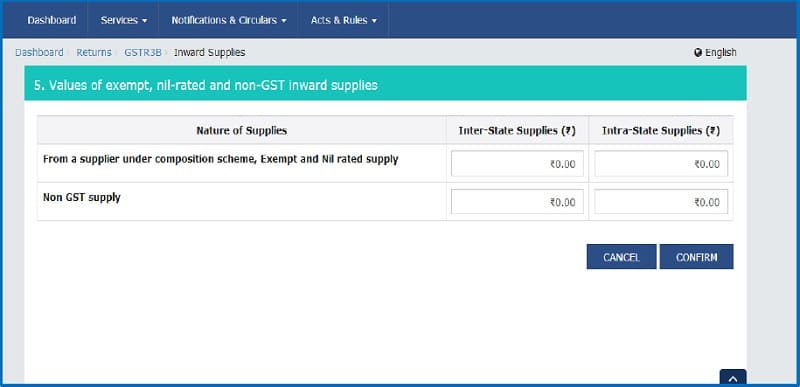

7. If you are dealing in any nil-rated supplies, then this section is for you. If it is not applicable click on confirm and proceed further.

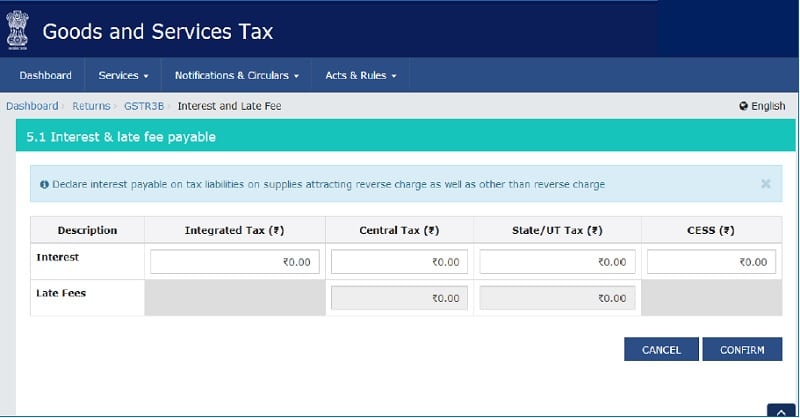

Lastly you need to enter details of tax liability on which the interest on reverse charge and other tax liability.

You can now save the GSTR-3B form. Click on Save button. Check and confirm all the details before final submission.

After submitting GSTR-3B, make the payment through various options available on GST portal.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.