Table of Contents

Diminishing Balance Depreciation – Definition

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value.

As it uses the reducing book value it is also known as reducing balance method. In this method, the depreciation amount decreases each year.

In the Diminishing Balance method, a company charges depreciation on diminishing book value each year. Whereas in the straight-line method the company charges depreciation on the asset purchase price.

Hence in depreciation in reducing balance method is higher in initial years and lower in later years. Businesses use this method for assets that quickly lose their value over time or are of no use in the future.

How To Calculate Depreciation Using Diminishing Balance Method?

When you purchase an asset at the beginning of the accounting year, you need to calculate the depreciation for a complete year.

Follow the below steps to calculate depreciation by Reducing Balance Method:

- Find the depreciation rate.

- Subtract Scrap Value from the Asset Cost.

- Multiply the book value by the depreciation rate.

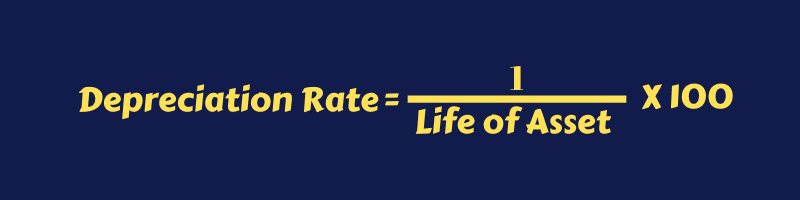

Formula to Calculate Depreciation Rate

To calculate the depreciation rate, divide the 1 by the useful life of the asset.

Formulas to Calculate Diminishing Balance Depreciation

Formula To Calculate Partial Depreciation

Companies don’t purchase the asset at the beginning of the accounting year. Hence, they need to depreciate the asset partially for that year for accounting purposes.

To calculate the depreciation for a partial year multiply the depreciation of full-year with the number of months and then divide it by 12. This formula is applicable to calculate the partial depreciation in any method.

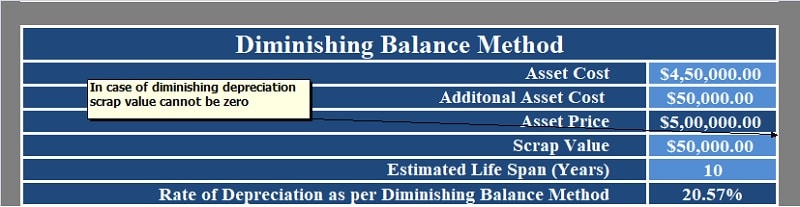

Example of Diminishing Balance Method

Let us understand with the help of some examples.

Asset Value: $ 10,000

Estimated Useful Life: 10 years

Scrap Value: $ 1,000

Depreciation Rate: 1/10 = 10%

For the first year, the book value = Asset Value – Scrap Value.

Applying the above formula:

= ($ 10,000 – $ 1,000) X 10%

= $ 9,000 X 10% = $ 900 first year.

In case the asset is purchased after 6 months of the beginning of the accounting year the partial depreciation will be calculated as follows:

= $ 900 X 6/12

= $ 450.

Partial Depreciation for that accounting year will be $ 450.

For the second year and the rest of the years until the scrap value and life of the asset, the depreciation will be calculated on book value.

Second Year Book Value: $ 8,100

Thus, the depreciation for the second year is $810 that is 10% on $ 8,100.

You can also calculate straight-line depreciation using the DB function in excel. You can also use a simple and easy Depreciation Calculator Excel Template with predefined formulas.

Accounting Entries of Diminishing Balance Method

Given-below are he journal entries for straight-line depreciation

Journal Entries in Year of Purchase:

Asset A/c Dr

To Cash/Bank/Creditor A/c Cr

Depreciation Journal Entry:

Depreciation A/c Dr

To Asset A/c Cr

Income Statement:

Profit & Loss A/c Dr.

To Depreciation A/c. Cr

Eventually, the balance sheet will reflect the decreased value of the asset from the Asset A/c at the end of the year.

Advantages of the Diminishing Balance Method

- Acceptable by Tax authorities.

- Depreciation amount reduces with the life of the asset.

- This method takes the loss of efficiency into account.

- Eliminates a major portion of the asset cost in earlier years minimizes the impact of obsolescence on the asset.

Disadvantages of the Diminishing Balance Method

- The asset cannot be written off completely and the asset value cannot be zero.

- There is a provision for the replacement of the asset.

- Interest on capital invested is not considered.

- It emphasizes too much on the historical cost.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply