Table of Contents

Compound Interest – Definition

Compound interest is the method of calculating interest any given amount assuming that the interest earned each period is added to the principal. Hence, you receive not only interest on your principal amount but also the added interest each year.

In simple terms, this method computes interest on the sum total of the principal amount of investment and accrued interest.

It is helpful for knowing the amount of interest to be earned on the investment or the amount of interest we will pay above the principal amount for a given loan or mortgage.

In the finance industry, compound interest is often referred by the word magic interest as it is considered one of the most fundamental wealth building ways.

How To Calculate Compound Interest?

To calculate compound interest, multiply the principal amount with (1 + Interest Rate) raised to the number of years.

For this, you require the following four things:

P = Principal

i = Rate of Interest

n = Number of Years

t = Compounding Period

In case the compounding period annual then use n but if the compounding frequency is more in a year it will be multiplied by t.

Formula To Calculate Compound Interest (A)

The following formula will be applied when compounding is annual:

The following formula will be applied when compounding is more than once in a year:

(A) = P [(1+ i/t)nt– 1]

Let us understand it with a simple example

Example For Single Compounding

Principal Amount = $ 5o,000

Tenure = 10 years

Rate = 8% Annually

Applying the above-given formula:

= $ 50,000 [(1 + 0.0)^10 – 1] = $ 50,000 [2.158925 – 1) = $ 50,000 X 1.158925 = $ 57,946.25

Example For Multiple Compounding

Principal Amount = $ 5o,000

Tenure = 10 years

Rate = 8%

Compounding Frequency = Half Yearly = 2 per year

Applying the above-given formula:

= $ 50,000 [(1 + 0.04)^10X2 – 1] = $ 50,000 [(1.04)^20 – 1]

$ 50,000 [2.191123 – 1) = $ 50,000 X 1.191123 = $ 59,946.25

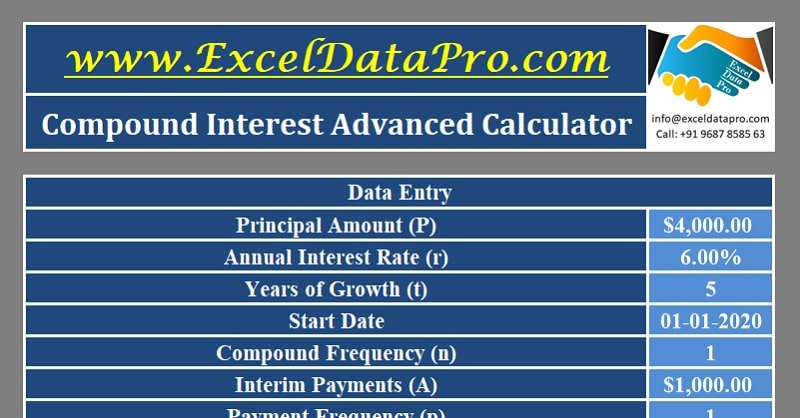

To simplify the process, we have created a simple and easy Compound Interest Calculator Excel Template with predefined formulas.

Just enter a few data and the template will calculate the compound interest for a particular investment. Additionally, the template also provides a schedule of payments and accumulated interests in each period.

Advantages

- Best way to build wealth by investing.

- Interest is earned on interest received every period.

- Higher return on investments.

- More compounding periods per year yield higher returns.

- It allows exponential growth in the long-term.

- Money making machine for lenders.

Disadvantages

- A loss for those who borrow.

- Higher interest to be paid when borrowings have multiple compounding periods.

- Borrowing washes money away in the long run.

Important Things to Know

Compounding Frequency

You can compound the interest on any given frequency from daily to annually. Usually, financial organizations use quarterly, half-yearly and annually compounding.

While calculating the compounding periods matter the most and have a significant difference. For example, compounding an investment on a 10% rate annually will be lower than 5% compounding half-yearly over the same time period.

More compounding periods are beneficial for the investors or creditors whereas bad for borrowers.

Rule Of 72

Rule of 72 estimates the approximate time over which the investment will double at a given rate. To estimate time for doubling the investment at a given rate, divide 72 by the given interest rate.

For example, an investment at the 12% annual return rate will take 72/12 = 6 years.

Difference Between Simple Interest and Compound Interest

SImple interest calculates interest only on principal amount whereas compound interest calculates interest on the sum of principal and accrued interest.

Let us check the difference in the growth of similar investment amounts with similar interest rates and the same tenure in both the scenarios.

Investment Amount: $ 5,000

Interest Rate: 10%

Simple Interest Calculation

For the year 1, 2 and 3 the calculation will be $ 5,000 X 10% = $ 500. $ 500 is added each year to the principal but interest amount. Hence the Final Value is $ 5,000 + $ 1,500 = $ 6,500.

Compound Interest Calculation

First Year: $ 5000 X 10% = $ 500. New Principal = $5,500.

Second Year: $ 5,500 X 10% = $ 550. New Principal = $ 6,050.

Third Year: $ 6,050 X 10% = $605.

Total Interest in this case is $ 500 + $ 550 + $ 605 = 1655. Thus, the final value is $ 5,000 + $ 1,655 = $ 6,655.

There is a difference of $ 155 in interest received.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply