After the rollout of GST since 1st of July, many queries have arisen. One such query was asked by many of our readers, which is “How to claim input tax credit under GST?”

In our previous post, we discussed “Number of Returns to be filed by Regular Taxpayer under the GST Regime?“.

These are our reader’s queries which are received by us through our contact form.

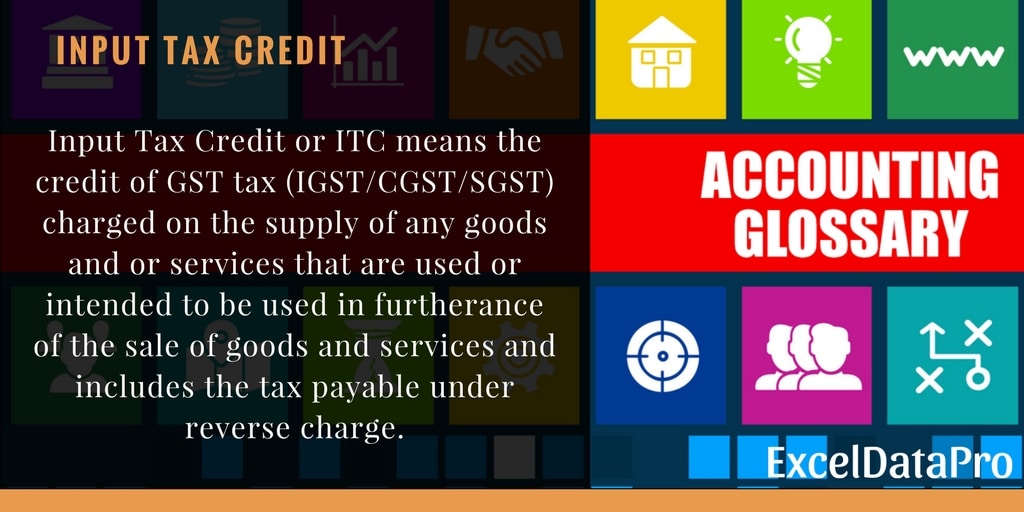

Before we proceed to our query let us under what is Input Tax Credit?

How To Claim Input Tax Credit under GST

To claim Input Tax Credit following things are necessary:

1. When you have paid GST on purchase of goods/services and have a Tax Invoice

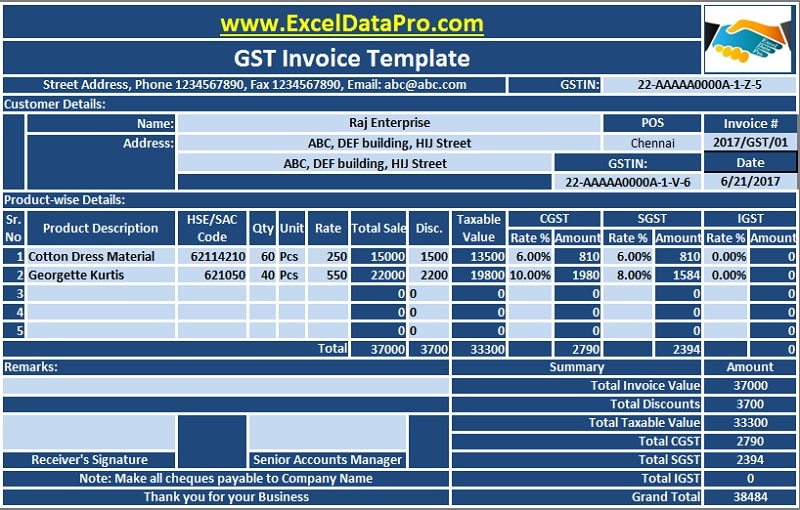

When you purchase any commodity for resale or business purpose, the supplier provides you with an invoice.

Now, instead of the general invoice, you will receive a GST Invoice. Without that, you cannot claim your Input Tax Credit.

You can download our GST Complaint Invoice Template from the link below:

GST Invoice format Excel Template

2. When Supplier File his GST Return and Pays his Tax Liability

Just Tax invoice is not enough. Your supplier needs to file his return and pay his tax liability which he has collected from you. Possibly, it one of the biggest reform under the GST Regime.

When your supplier files his GSTR-1, the invoices by which you purchased will be reflected in your GSTR-2. You need to check and approve them.

The taxes you paid on your purchases to your supplier are mandatory to be paid to the government.

Please note that when you receive goods in installments, you will be eligible for credit the tax invoice upon receipt of last lot or installment.

Input Tax Credit claimed by you needs to be matched and validated before you claim it.

Thus, to claim input tax credit, your suppliers must also be GST compliant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you

Leave a Reply