CEA means Child Education Allowance. Child Education Allowance is the allowance paid by the employer to educate the children of their employees.

Govt employees mandatorily get Child Education Allowance. Whereas this allowance is not mandatory in private sector. It depends on the employer and the companies policies.

CEA Tax Benefits

Both employer and the employee are entitled to deductions in their income tax for Eduction allowance. It is paid towards tuition fees of employee’s children.

The Child Education Allowance for an employee is tax deductible up to Rs. 100 every month for a maximum of two children.

Thus, this amount is set to no more than Rs. 2400/year/employee.

Education facility is provided to the employee by the employer is treated as a part of the employee benefits.

The amount spent by an employer to provide free education facility/training of the employee is not taxable.

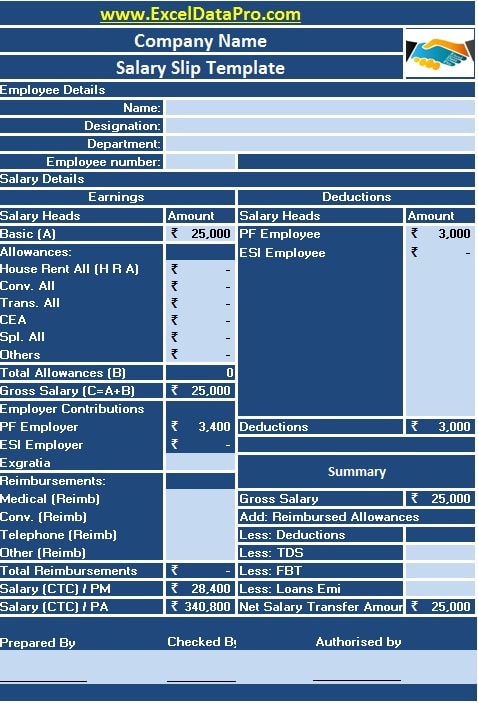

These terms are usually found in your Salary sheets and Salary slips/pay slips

If you have any queries please share in the comment section below. I will be more than happy to assist you.