Cash Flow Statement is a ready-to-use template in Excel, Google Sheet, and OpenOffice to prepare a detailed cash flow of the company for a specific period.

Moreover, this template provides the cash flow from operating, investing, and financing activities.

Table of Contents

What Is A Cash Flow Statement?

Cash Flow Statement is a financial statement that reports the cash generated and spent during a period. It is one of the main financial statements.

In other words, this statement allows you to understand how your company operations run. It gives you an overview of where the money is coming from, and how it is spent.

You can decide the period for this statement. It can be either monthly, quarterly, half-yearly, or yearly. It can be more in some cases as per the requirement.

Reviewing this helps companies in taking crucial and big economic decisions.

Components Of A Cash Flow Statement

A Cash flow statement consists of the company’s inflow and outflow of cash. It covers 3 categories of activities: Operations, Investing, and Financial.

Operating Activities

Operating activities are the main sources of cash inflow and outflow. It depicts the cash earned and spent on regular business activities. It includes activities such as sales receipts, merchandise purchases, salaries, and other operating expenses.

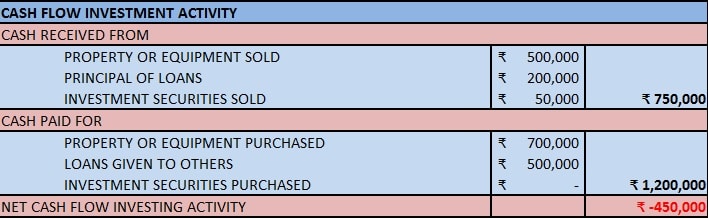

Investing Activities

Cash flow from investing activities includes inflow and outflow of cash in investing activities. It can include assets, equipment, acquisitions, and equity. Usually, they are the long-term assets of the company’s balance sheet.

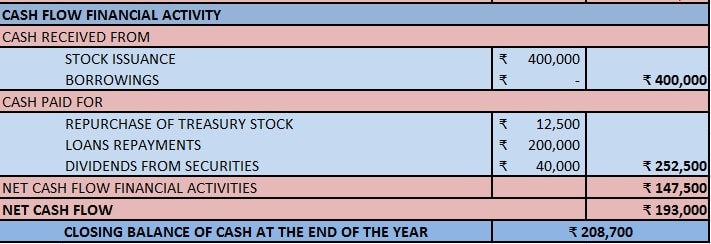

Financial Activities

The Financial activities of the cash flow statement display the inflow and outflow of cash from financing activities. These involve repayment of loans, stock issuance and dividends, equity buy-back programs. Usually, these items are the long term liabilities on a company’s Balance Sheet.

Methods Of Cash Flows

There are two types of cash flows: Direct and Indirect.

Direct Cash Flow Method

The direct cash flow method involves adding up all the cash receipts and payments of a business. These include payments to suppliers, receipts from customers, and salaries paid to employees. In this method, the opening and closing balance of various accounting heads.

Indirect Cash Flow Method

In the Indirect cash flow method, cash flow from operating activities is derived. You can find this as Net income on your income statement.

Usually, the net income on the income statement is prepared on an accrual basis. Hence, one needs to make adjustments to find the EBIT (earnings before interest and taxes).

Moreover, you need to make adjustments entries. This involves adding back the non-operating expenses that do not affect the cash flow.

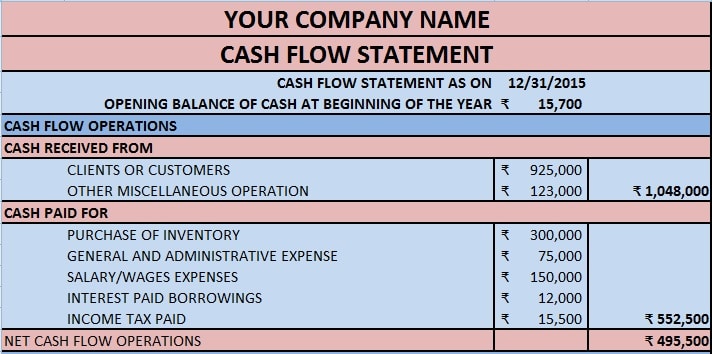

Cash Flow Statement Excel Template

We have created a simple and easy to use Cash Flow Statement with predefined formulas. Just enter the required data and get an overview of your company’s cash flows.

Excel Google Sheets Open Office Calc

Click here to Download All Financial Statement Excel Templates for ₹299.

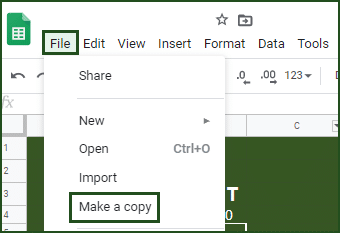

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can also download other Financial templates from our websites like Bank Reconciliation Statement and Trial Balance, Balance Sheet, etc.

Let’s discuss the Cash Flow Statement in detail.

Contents of Cash Flow Statement

This statement consists of two sections: Heading Section and Data Input Section.

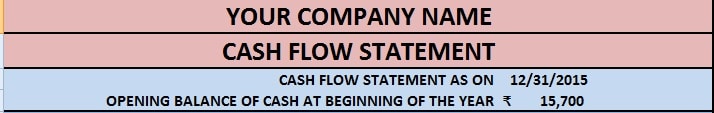

Header Section

The header section contains the details like Name of the Company, Heading “Cash Flow Statement”.

The second row contains the preparation date along with the Opening Balance of cash.

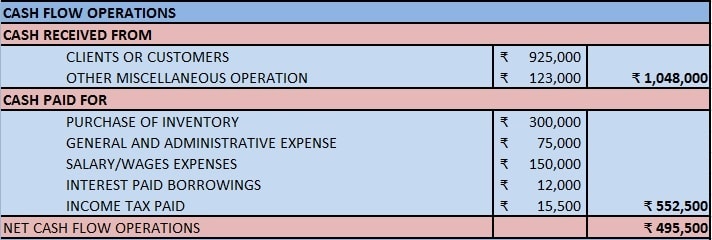

Data Input Section

This section includes cash flow from mainly 3 type activities which are as follows: Operating activities, investing activities, and financial activities.

Operating activities are the principal revenue-producing activities of our company.

You can calculate Net Cash Flow from Operating deducting Operating expenses from operating incomes.

Operating expenses are salaries, income tax, etc. Incomes include cash received from customers and other sources.

Investing activities are the acquisition and disposal of long-term assets. It also includes other investments that are not cash equivalents.

Similar to Operating activities, you can calculate Net Cash Flow from Investment by deducting Investment expenses from incomes.

Investment expenses like the purchase of property, Loans, etc. Incomes like cash received from property sold, principal amounts of loan, etc are considered.

Financing activities are activities that result in changes in the size and composition of the owner’s capital. The owner’s capital includes preference share capital and borrowings.

Net Cash Flow from Financial is calculated by deducting financial expenses from financial Income.

These expenses include the repurchase of treasury stock, repayments, etc. Incomes include cash received against share issuance and borrowings done by the company.

In the end, the Closing Balance of Cash is given.

Benefits of Cash Flow Forecasts

- Cash Flow Statements can bee used to predict the future cash flow of companies. This statement reflects the financial health of a company.

- A cash flow statement tells you if you’re running out of money even when you’re profitable. You can also see how your bank loan payments are affecting your cash. Thus, it very important for a company to prepare and review Cash Flow Statements.

- Cash Flow Statements help to the actual cash position which cannot be derived from the P&L statement. Thus, being aware of the cash liquidity, you can arrange for any cash shortfalls. Or you can use the excess cash for growth purposes.

- Furthermore, it enables the management to plan and control the financial operations properly. You can measure the profitability and financial position by doing cash flow analysis along with ratio analysis. Moreover, it is a great tool for internal financial management.

Limitations of Cash Flow Forecasts

- The cash flow cannot project the profits as it shows only the cash position of a company.

- Moreover, for any cash flow projections, we need to use the Balance Sheet as well as the P&L statement.

- The cash flow statement displays actual cash activities. Hence, it cannot be used as a substitute for the P&L account.

- By making some adjustments in purchases and other payments, the cash position can be manipulated. Thus, sometimes the cash flow statement doesn’t display the real liquidity position.

How To Analyze A Cash Flow Statement?

Operating cash flows are the heart of the cash flow statement. Thus, companies having high Operating cash flows consistently are healthy and self-sustaining.

Usually, negative investing cash flows indicate the expansion of business or replacement of old assets. Thus, it is necessary to find out whether investments can generate revenue growth in the future or not.

Often, companies having negative cash from Investing activities will have positive Financing cash flows.

Generally, it is because companies raise additional debt or equity capital to support their investments.

However, a company’s cash inflows from core operations must be enough to fund its investments. It should also cover lenders and shareholder’s obligations. Therefore, in the long run, investing and financing outflows must be almost equal to Operating cash flows.

Often we can see that some companies having low or negative cash flows from operating and a positive from Investing. In such a scenario, it means that a company funds its operations by liquidating its assets.

Such cash flows can be a wake-up call for a company. From an investor’s point of view, such a company can even be on the verge of bankruptcy.

There can be scenarios where companies need to sell their assets to maintain dividend levels. It is done to handle its investor. Because dividend cuts are a sign of poor financial health.

Thus, while selling the assets, it should be kept in mind that they aren’t core business. Moreover, they must also not be an unnecessary financial burden to the company. As an investor, you must look deep into the company if they are selling key assets.

Positive cash flows from Financing activities and a low or negative cash flows from operating activities indicates improper usage of its capital. Hence, it shows operational inefficiency and improper management of a company.

Tips To Improve Cash Flow

- To improve your cash flows, you can make adjustments to your staffing to decrease payroll expenses.

- In addition to the above, avoid unnecessary purchase of inventory.

- Furthermore, manage Accounts Payable efficiently. Make payments neither too early nor not too late.

- Create some offers to acquire more new customers and to increase sales fro the existing customers.

- Additionally, keep your accounts receivable stringent. Reach out to late-payers for speedy payments.

- Moreover, depending on market demand decreasing or increases prices can help you increase cash flows.

- Finally, if business operations suffice for managing proper cash flow, find a source of short-term working capital.

We thank our readers for following us on different social media accounts.

If you have any queries or questions, share them in the comments below. We will be more than happy to help you.

Frequently Asked Questions

Is cash flow the same as profit?

The key difference between cash flow and profit is that profit means the money left over after paying all the expenses have been paid. Whereas, the cash flow means the inflow and outflow of a business.

How do you know if a cash flow statement is correct?

To verify the accuracy of your Cash Flow Statement:

Matching the change in cash on your Cash Flow Statement with the change in cash on your balance sheets. Find the Net Increase or Net Decrease in Cash at the bottom of your Cash flow statements.

What is the formula for net cash flow?

Net Cash Flow = Total Cash Inflows – Total Cash Outflows.

What is the difference between cash flow and fund flow?

The cash flow records the inflow and outflow of actual cash and cash equivalents. Whereas, the fund flow records the categorized movement of cash in and out of the business.