Table of Contents

CAGR – Definition

CAGR stands for Compound Annual Growth Rate. It is the annual rate of return of an investment reinvesting profit of each year over the investment period.

In simple terms, it shows how much your investment grows over a specific period. It is a useful measure to find the growth of investment over periods.

Compound Annual Growth Rate takes into consideration the time value of money. It helps to compare a variety of investments over a similar investment period.

Compound Annual Growth Rate calculates returns on investments accurately. It helps to determine the rise or fall in the value of an investment over time.

As an investor, it helps you to compare the return on two different alternatives. It provides insights on how well one investment has/will perform against another.

Stock market investors, business investors, and private lenders use the Compound Annual Growth Rate to take important investment decisions. CAGR does not reflect the risk of investment.

How To Calculate CAGR?

You can calculate the Compound Annual Growth Rate in 3 easy steps. You need to have 4 data to calculate; investment made, the end value of the investment, starting year and ending year or the tenure in years.

If you don’t have the tenure, then you need to find tenure by subtracting the starting year from the ending year. For example; 2011 – 2005 = 6

Steps to Calculate:

- Divide the End Value of the investment by Initial Value of Investment.

- Multiply it with 1/period.

- Subtract the result from the result.

Formula To Calculate CAGR

Where:

Ending Balance = Investment value at the end of tenure.

Beginning Balance = Initial Investment

N = Tenure or No. of Years

Example

Company: ABC Pvt Ltd

Initial Value: $ 10,000

End Value: $ 16,500

Starting Year: 2015

Ending Year: 2018

Tenure: (Ending Year – Starting Year) = (2018 – 2015) = 3 Years

Applying the above-given formula:

= ($ 16,500 / $ 10,000) ^ (1/3) – 1

= 18.17 %

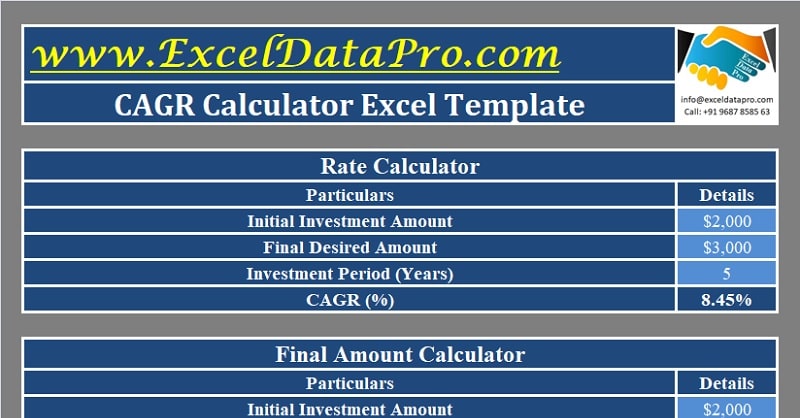

We have created a simple and easy CAGR Calculator Excel Template with predefined formulas. You can calculate the CAGR rate and calculate the final value of a given investment based on the CAGR rate and investment period. Moreover, you can the period an investment will require the given final value and the CAGR rate.

Advantages – Compound Annual Growth Rate

- One of the most accurate ways to calculate historical returns.

- You can use CAGR to compare the relative performance of the investments.

- Used to estimate or project expected future returns.

Disadvantages – Compound Annual Growth Rate

- Compound Annual Growth Rate doesn’t calculate the profitability of an investment sidelining the inflows and outflows that happen during the investment tenure.

- It doesn’t take the investment risk into consideration.

- It assumes a constant growth rate during the tenure.

CAGR and Mutual Funds

While investing in mutual funds, it is necessary for us to know whether investing in a specific fund is worth it or not. In such cases, you need to measure the performance of that particular fund over a period.

Usually, the MF fact sheet provides growth rates across different times. Thus, it becomes difficult to define the actual growth based on multiple rates.

Eventually, calculating the Compound Annual Growth Rate provides the actual annual growth rate. This makes it simpler for investors to take investment decisions. Therefore, it is the best way to measure the performance of the fund.

Things Investors Must Know About Compound Annual Growth Rate

The CAGR doesn’t indicate anything about the sales. It might have happened in the initial years or in the last year. Some companies might have higher growth in the initial year and some at the end of the tenure.

Many times it happens that two companies reflect the same CAGR. The reason behind it is that the growth for one company was faster in the initial years whereas the growth for the other happened in the last year.

CAGR can be used for investments made for 3-7 years tenure. If it more than 10 years, CAGR may hide the sub-trends in between.

You can use our Portfolio Analysis Excel Template for easy and accurate portfolio analysis and analyze appropriate analytical data of your invested securities.

Difference Between Simple Growth Rate and Compound Annual Growth Rate

Simple Growth Rate calculates the percentage of growth between the present value and future value of an investment. Whereas the Compound Annual Growth Rate calculates the compounding interest.

Let us understand it with a simple example.

The initial investment is $ 10,000 and future value after 3 years is $ 13,000.

SGR = (Future Value – Present Value) / Present Value X 100

= ($ 13,000 – $ 10,000) / $ 10,000 X 100

= 30 %

Now, applying the CAGR formula:

= ($ 13,000 / $ 10,000) ^ (1/3) – 1

= 9.14 %

Usually, when we divide the 30% return by three years it is 10% a year. But in Compound Annual Growth Rate it is 9.14% because every year the profit is reinvested and the present value is differed every year.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply