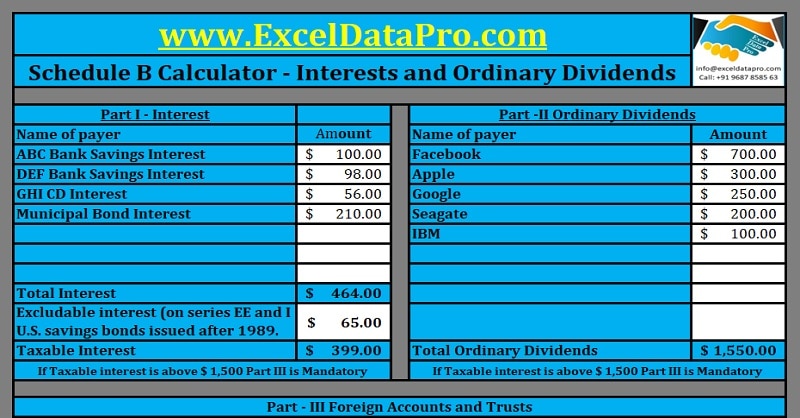

Schedule B Calculator is an excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for federal income tax. Interests and dividend incomes received during a tax year are reported in Schedule B. It is not mandatory to file Schedule B for taxpayer every year. A […]

What Is Pease Limitation On Itemized Deductions?

Pease Limitation on Itemized Deduction is a provision of Internal Revenue Code that reduces non-exempt itemized deductions for taxpayers with high AGI.

Download Itemized Deductions Calculator Excel Template

Itemized Deductions Calculator is an excel template. It helps the taxpayer to choose between Standard and Itemized Deductions. A taxpayer needs to choose between itemized or standard deduction while filing the federal tax returns. The standard deduction is a fixed dollar amount to be deducted from taxable income with no questions asked. Whereas the itemized deductions […]

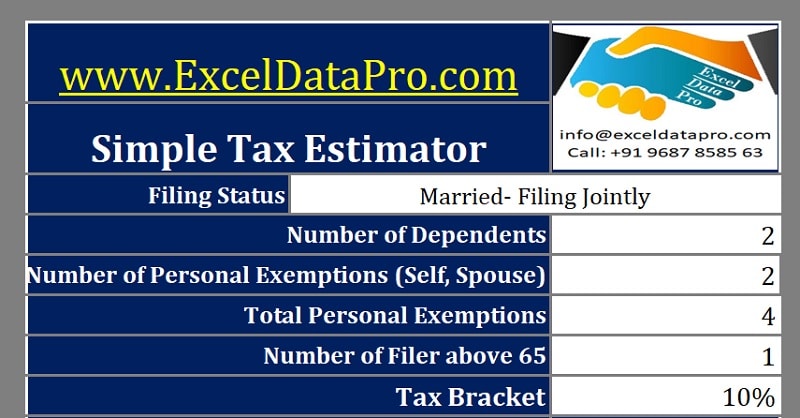

Download Simple Tax Estimator Excel Template

Simple Tax Estimator is an Excel Template to help you compute/estimate your federal income tax. This template consists of computations of your adjustments, Tax credit, itemized deductions etc. A user needs to input the in respective cells and it will automatically estimate your tax liability. Filing deadline and due date for Federal Income Tax Returns […]

What Is A Medical Savings Account or an MSA?

MSA stands for Medical Savings Account. Medical saving Account is a type of savings account in which tax-deferred deposits can be made and used only for medical expenses.