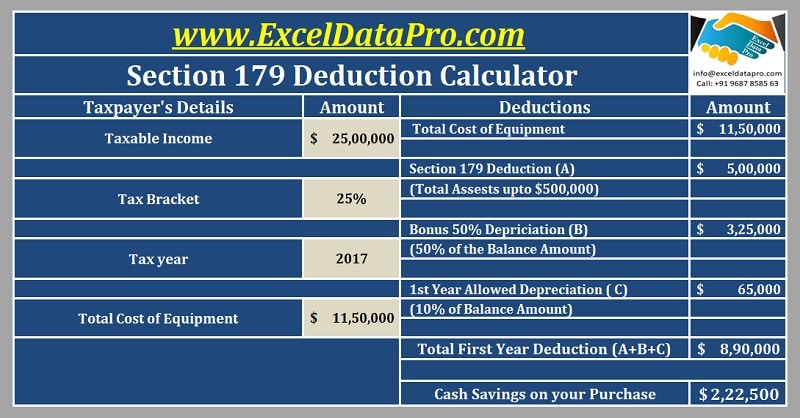

Section 179 Deduction Calculator is an excel template to help you calculate the amount you could save on your tax bill by taking the Section 179 Deduction. As we all know Section 179 deduction is an immediate expense available to business owners on the purchase of business equipment during the tax year instead of depreciating or […]

What is Section 179 Deduction? Definition, Eligibility & Limits

Section 179 deduction is the immediate expense deduction available to business owners on the purchase of business equipment during the tax year instead of depreciating or capitalizing it over the life of the equipment.

Revised GST Rates for Goods – 25th GST Council Meeting

25th GST Council meeting was held on 18th January in New Delhi. Various measures were announced to improve ease of doing business. GST Council revised GST rates for Goods and Services. To download the list in pdf format click on the link below: Revised GST Rates of Goods – 25th Council Meeting In addition to […]

Understanding UAE VAT Return Format

UAE VAT Return Format has been published to FTA site. You can find it in the menu under partners, below Tax Accounting Software Vendors in Requirements. UAE VAT Return Format is on page 48 under Appendix 8 – VAT Return Format. The VAT Return Format start from page 48 and ends at page 57. To simplify the […]

5 Legal Ways That Help You Reduce Federal Tax Liability

The only way to reduce federal tax liability is to lower your tax bracket. Tax percentage decreases as taxable income reduces. In this article, we will discuss 5 legal ways that help you reduce federal tax liability. While preparing your taxes, we usually forget to maximise the benefit given by the law to us. The reason […]