Balance Sheet Template is a ready-to-use template in Excel, Google Sheets, and OpenOffice that helps you to gain insights into the financial strengths of the company.

Moreover, this Balance sheet template gives you a snapshot of your financial position at a specific time. Usually, the businesses prepare a Balance Sheet quarterly, half-yearly, or yearly.

Table of Contents

What Is Balance Sheet?

Balance Sheet is a financial statement of a company. It shows the assets, liabilities, equity capital, total debt, etc. at a given point of time.

In simple terms, a balance sheet shows:

- What your business owns. (Assets)

- What it owes. (Liabilities)

- What money is left for the owner? (Owner’s Equity)

For the balance sheet to reflect the true picture, both heads (liabilities & assets) should tally.

Thus, Assets = Liabilities + Equity.

Components of a Balance Sheet

There are two major components of a balance sheet: Assets and Liabilities.

Assets

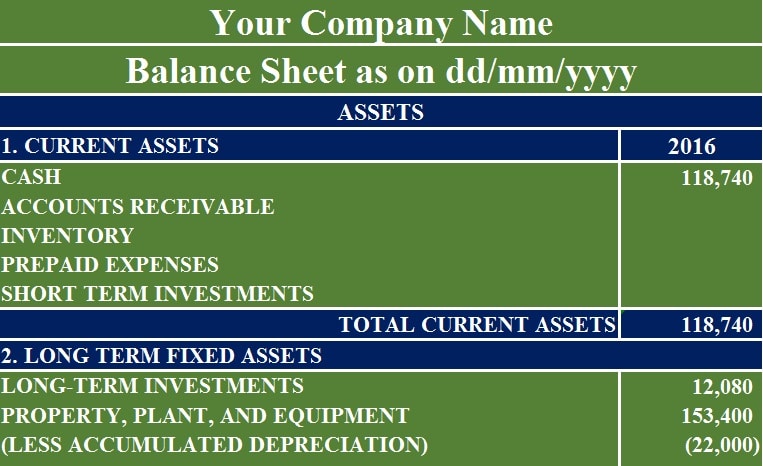

Assets are the resources or things that your company owns. It consists of two categories: Current Assets and Long-term Assets. An asset is anything tangible or intangible that you own or hold and has a positive economic value.

Current Assets include the following items:

- Cash

- Accounts Receivable

- Stock/Inventory

- Prepaid Expenses

- Short-Term Investments

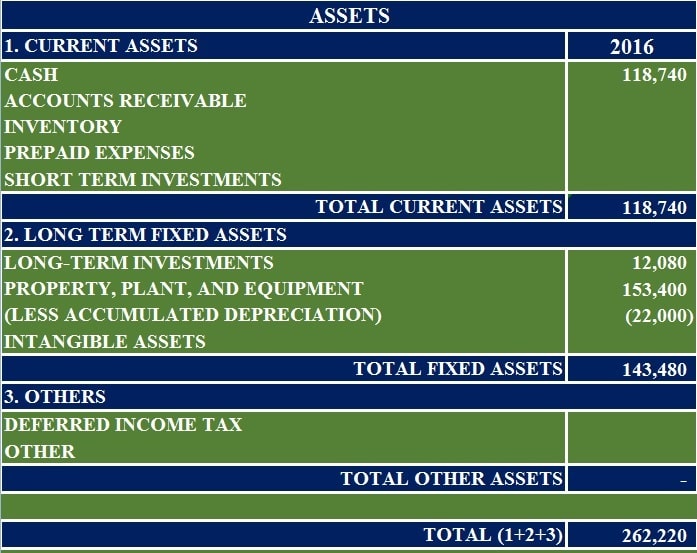

Long Term Assets include the following:

- Long-term Investments

- Property, Land, and Equipment. Accumulated Depreciation of all will be deducted from these assets.

- Intangible Assets

Other items include Deferred Income Tax.

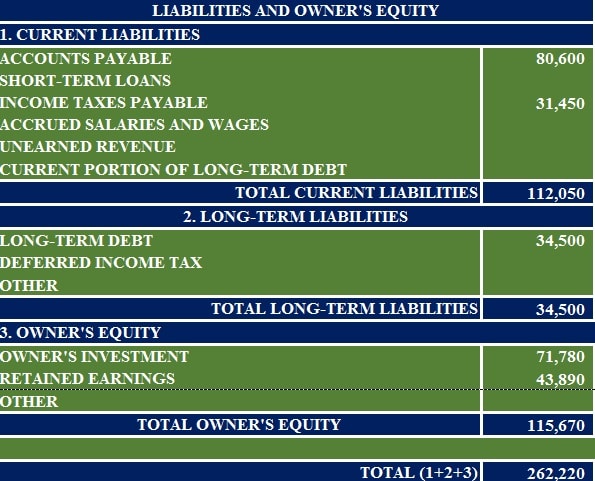

Liabilities

Liabilities on are debts or obligations to be paid by a company. It is the amount that the company owes to its creditors.

Liabilities consist of 3 parts: Current Liabilities, Long-term liabilities, and Owner’s Equity.

Current Liabilities include the following:

- Short-term Loans

- Income Taxes Payable

- Accrued Salaries and Wages

- Unearned Revenue

- Current Portion of Long-term Loans

Long-term Liabilities include:

- Long-term Debt/Loans

- Deferred Income Tax

Liabilities include all payments to be made by your company. Therefore, any payable loans, accounts payable, unpaid credit card bills, or unpaid taxes must be included.

Owner’s Equity

Another very important head in the balance sheet is the owner’s equity. Your assets should be equal to total liabilities and owners’ equity.

We use the term Owner’s equity when the company is a sole proprietorship. Shareholder’s equity is used when it is a corporation.

In simple terms, the Owner’s Equity is the claim on the assets of a business. Those Assets which remain after deducting liabilities.

Eventually, Equity includes opening investments, contributions, owner’s capital, or retained earnings.

Thus, Equity = Assets – Liabilities.

Owner’s Equity includes:

- Owner’s Investment

- Retained Earnings

Balance Sheet Template

We have created a Balance Sheet Template that summarizes the company’s assets, liabilities, and equity. This will give your lender or investors an idea of the health of the company.

This template can be helpful to Accounts Assistants, Accountants, and Auditors, etc.

Excel Google Sheets Open Office Calc

Click here to Download All Financial Statement Excel Templates for ₹299.

You can also download other templates like Cash Flow Statement, Trial Balance, and Profit and Loss Account.

Let’s discuss the contents of the Balance Sheet Template.

Contents of Balance Sheet Template

This template has 3 sections: Asset, Liabilities, and Owner’s Equity. Owner’s Equity is a part of Liabilities and hence falls under the liabilities section.

Let’s understand what items we will be included in each section.

Asset

Insert the following items:

Cash on hand: All Cash including cash in hand + money in the bank.

Accounts Receivable: Receivable includes the total of your outstanding invoices. This does not include any invoices that are still in “draft” status.

Stock Inventory: Stock Inventory that your company holds for the ultimate purpose of resale. Sold items will not include in the Inventory.

Machinery or Equipment: Any Equipment/tangible items purchased for business usage. This equipment will not be bought for reselling.

Reimbursable expenses: Any reimbursable expenses that are already paid and will be reimbursed by another party.

You can customize the Assets section according to your needs.

Liabilities

Insert the following items:

Accounts Payable: This includes money that you owe to other parties other than loans. An example of this would be any unpaid invoice for any service. It can be advertising, electricity, telephone bills, etc.

Taxes Payable: Unpaid Taxes that you owe the government.

Current Loans Payable: Loans from banks or investment from the investors that you have not paid back yet.

Long Term Loans Payable: The Long-term loans that are yet to be paid.

You can customize the Liabilities section as required.

Owner’s Equity

Insert the following items in the Owner’s Equity.

Owner’s Capital: Capital is the owner’s investment in the company. You need to add the net income earned by the company. Whereas deduct any withdrawals by the owner from it.

Note: The owner’s bank account and the business bank account two are separate entities.

Retained earnings: Net income retained by the corporation and distributed to its owners as dividends.

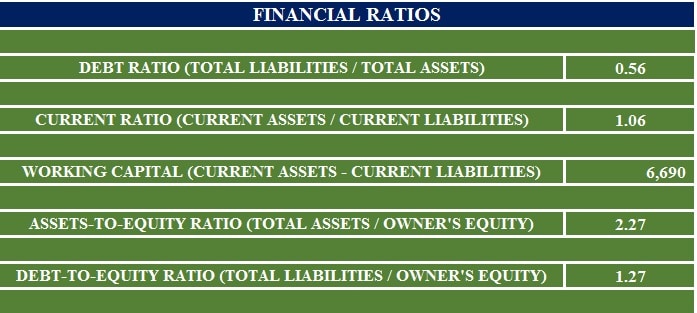

Important Financial Ratios From Balance Sheet

In the end, we have included some important financial ratios from the Balance Sheet than can be helpful for further analytics:

- Debt Ratio.

- Current Ratio.

- Working Capital.

- Assets to Equity Ratio.

- Debt to Equity Ratio.

Advantages of A Balance Sheet

As the name states, it keeps business things in balance. As per the accounting rule, the total assets must be equal to liabilities and equity. Hence, if they don’t balance there is a mistake in the accounting process.

A balance sheet helps in calculating and analyzing financial ratios. Moreover, these ratios are helpful in comparing your competitors as well as your company’s financial strengths.

A balance sheet is also helpful in getting credit from financial institutes. Furthermore, seeing a balance sheet, n investor can make a decision for investment.

Limitation Of A Balance Sheet

Long-term assets are recorded on book value. Whereas, the actual market value is less of those assets. Therefore, these overvalued/undervalued assets distort the company’s wealth.

A balance sheet often misses the internally acquired assets. Furthermore, it also doesn’t take into consideration the assets that cannot be measured in monetary terms. These assets include irreplaceable technical workforce, online sales channels, loyalty, honesty, etc.

Moreover, the balance sheet records some of the assets in estimates that again doesn’t provide the true financial picture of the company.

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below. We will be more than happy to help you.

Frequently Asked Questions

How do you create a balance sheet?

You need to follow these 5 step process to prepare a balance sheet:

- Determine the reporting date and period.

- Identify your Assets.

- Identify your Liabilities.

- Calculate Shareholders’ Equity

- Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets.

What does a strong balance sheet look like?

Simply having assets more than its liabilities cannot make a balance sheet strong. Strong balance sheets will have the following:

- Intelligent working capital.

- Positive Cash Flow.

- Proper capital structure.

- Income-generating assets.

What are the two types of balance sheets?

There are two types of balance sheets: Personal and Business. The personal Balance sheet displays an individual’s personal assets and liabilities. Whereas, the Business Balance Sheet consists of accounts payable, accounts receivables, intangible assets, etc.

Why is it called a balance sheet?

According to the balance sheet equation Asset – Liabilities = Owner’s Equity, each side of this equation must balance at the end of the period.

Who invented the balance sheet?

It is presumed that Luca Pacioli, a Franciscan Monk, presented the concept of balance sheet in the 15th Century.

What items are not presented on the balance sheet?

Off-balance sheet assets do not appear on the balance sheet. These OBS assets include leaseback agreements, operating leases, etc.

Where is TDS shown in the balance sheet?

TDS is a liability. It is the amount of tax we owe to the Government that we collect on behalf of the Government.

What is the difference between vertical and horizontal balance sheets?

Businesses that operate at lower scales will use vertical balance sheet. It consists of a single column to report the amounts.

Whereas, businesses that operate on a bigger scale, and have different branches/departments, prepare horizontal balance sheets. It is an additional balance sheet that displays the performance of each department/branch.