Adjusted Gross Income or AGI is a benchmark used to check eligibility for most of the tax credits, deductions etc by IRS. It also helps to define your Tax Bracket. We have created AGI Calculator Apple Numbers Template for our readers who use Mac operating systems.

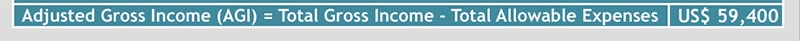

Adjusted Gross Income or AGI is the Gross Income less of Allowable Deductions. Thus, the formula for AGI is :

AGI = Gross Income – Allowable Deductions

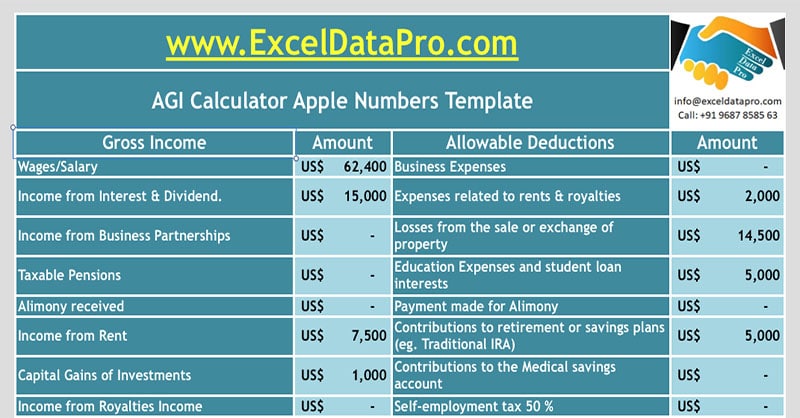

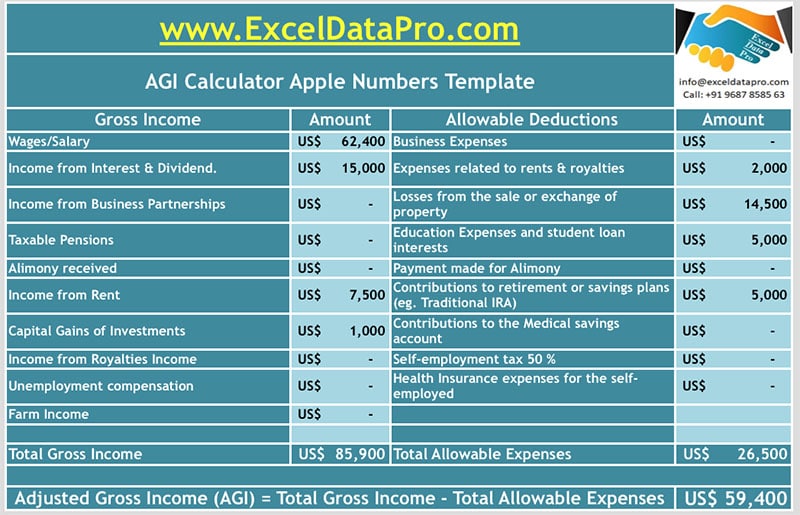

The AGI Calculator has been designed with predefined formulas. The user just needs to enter the relevant figures against the respective line item and AGI Calculator Apple Numbers Template will automatically calculate your Adjusted Gross Income.

Click here to download AGI Calculator Apple Numbers Template

To download the same calculator in Excel click the link below:

Adjusted Gross Income Calculator Excel Template

In addition to the above, you can also download other Numbers Templates like Simple Tax Estimator, Itemized Deduction Calculator, and Section 179 Deduction Calculator

Let us discuss the contents of the template in details.

Contents of AGI Calculator Apple Numbers Template

AGI Calculator consists of 2 sections:

- Gross Income

- Allowable Deductions.

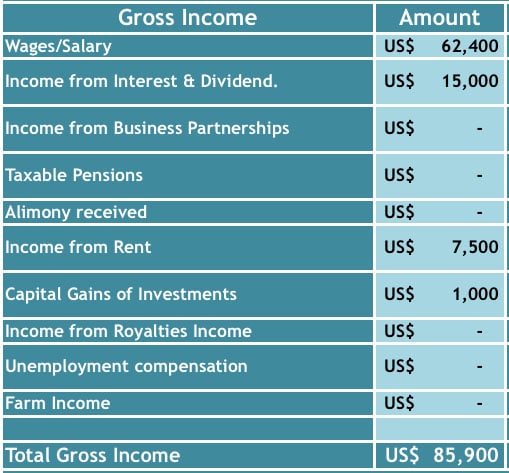

1. Gross Income

Gross income is your total income from all the sources. These sources include wages, salary, dividend income, Business income (individual and partnerships etc), pension income, receipt of alimony, Rental Income, Capital Gains on Investment, Royalty Income, Farm Income, Unemployed Compensations etc.

Gross Income doesn’t include gifts, inheritances, tax-free Social Security benefits or tax-free interest from state or local bonds.

Enter the amounts in the cell applicable to you and the template will sum up all.

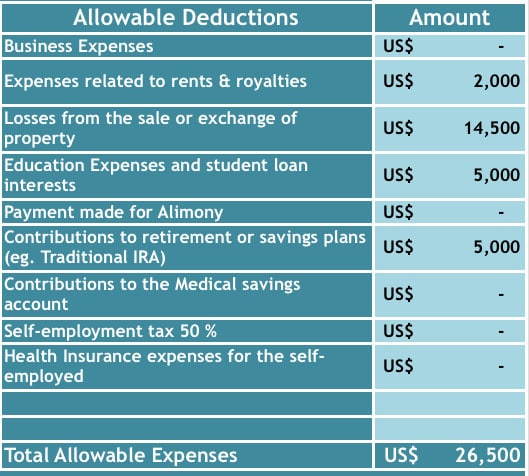

2. Allowable Deductions

Allowable Deductions are the deductions allowed by IRS on your federal income tax. These deductions include business expenses, Rent and royalty expenses, Losses on Sale or exchange of Property, Interests paid on Student Loan, payment of alimony, IRA Contributions, Medical Saving Accounts Contributions, 50% Self-employment tax and Health Insurance Expenses of self-employed etc.

Enter the amounts in the cell applicable to you and the template will sum up all.

The last row of the template is the AGI amount. applying the above-mentioned formula for AGI; Gross Income – Allowable Deductions will be displayed here.

Example of Calculating AGI

Mr. Y’s salary is $ 6,500 per month. Thus, his annual salary is $ 6,500 x 12 = $ 78,000.

Income of Mr. Y

Annual Salary Income – $ 78,000

Interests Income – $ 10,000

Rental Income – $ 5,500

Capital Gains – $ 1,500

Total Gross Income of Mr. Y = $ 95,000.

Deductions for Mr. Y

Rent and Royalty expenses – $ 3,500

Losses from Sale or Exchange of Property – $ 24,500

Education expenses and Student Loan Interests – $ 2,000

IRA Contributions – $ 3,500

Mr. Y’s allowable deduction = $ 33,500.

Adjusted Gross Income of Mr. Y

Gross Income – Allowable Deductions = $ 95,000 – $ 33,500

AGI of Mr. Y = $ 61,500

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply